Energy storage including short duration and seasonal technologies ranging from lithium batteries to hydrogen could help mitigate the impacts of negative power prices in Europe, an analyst has said.

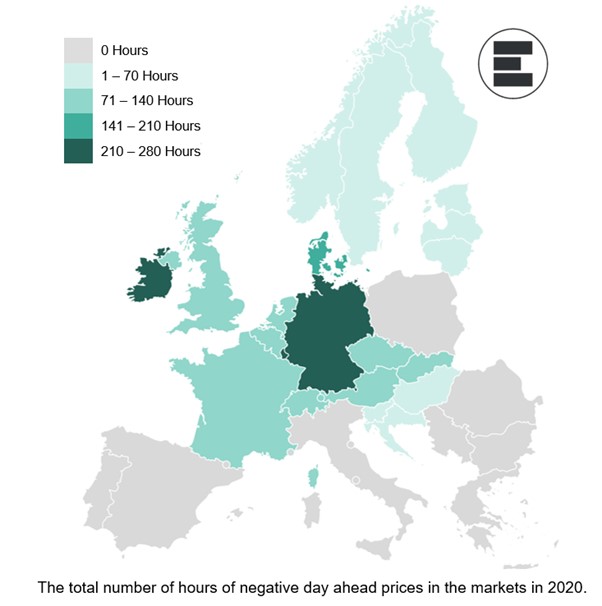

The day ahead price of power in Europe went below zero for an increasing amount of time in the first nine months of 2020, more than doubling from 2019. On average, power prices in Europe went negative 0.8% of the period studied by power market data analysis company EnAppSys.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

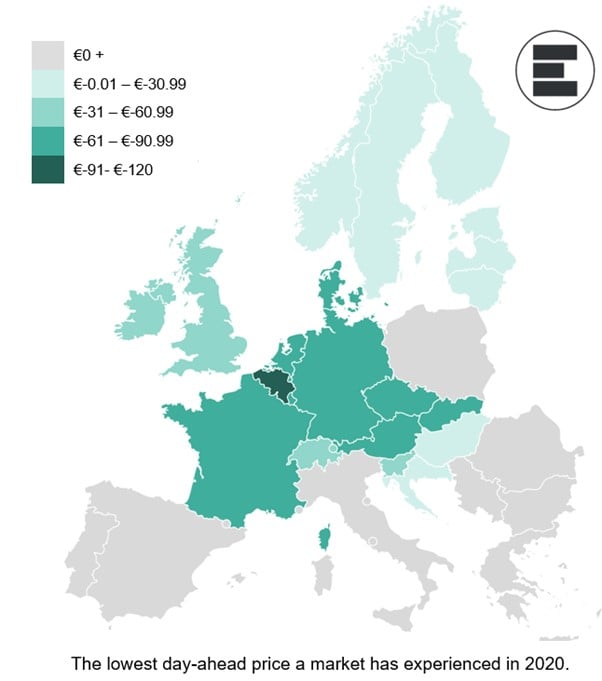

Belgium saw prices of €-115.31/MWh on 13 April and Germany saw prices of €-83.94/MWh for eight hours on 21 April. Countries with high wind demand were particularly affected, with EnAppSys pointing to Ireland, Germany and Denmark as examples.

Ireland – which includes both the Republic of Ireland and Northern Ireland – saw 36% of its overall energy demand covered by wind generation and negative prices for 4.2% of the time, significantly higher than the European average.

Markets became “much more volatile” in 2020, according to Alena Nispel, business analyst at EnAppSys, due to the lower demand during COVID-19 lockdowns, higher volumes of renewables and increasing interconnection between markets.

Nispel said that battery storage could “reduce these impacts – at least as far as it is economically sensible to do so”. Colleague Rob Lalor, a senior analyst with EnAppSys, said that as as more renewables come onto the grid, increasing volatility, battery storage can shift “large volumes” of wind or solar away from peak output into other periods of the day by charging during peak periods and discharging later on.

“There are economic limits imposed upon storage based on economic return per storage cycle and number of cycles/usages per year,” Lalor said.

“The target is to pay off capital at a reasonable return whilst accounting for any costs of running or general operation. If the market allows multiple cycles/uses a day, this return can be achieved on smaller spreads than in a market that only allows a few cycles/uses per year.”

High-renewables markets without energy storage could see ‘very extreme negative pricing for very long periods of time’

In the long term, we should see a lot of growth in storage and the reason we’ll see a lot of growth is that as you get a lot more renewables you inevitably have periods of oversupply,” Rob Lalor told Energy-Storage.news.

“Let’s say you’ve built 30GW of solar, the demand during that time would be well below 30GW – so you’d have to move that power generation either to the morning or afternoon peaks, and ideally to both. With wind, we’re already at the point where during the windiest periods the demand overnight can be fairly low that nuclear plus wind exceed demand and so as you build more wind on these extreme points, you’re going to have too much power,” Lalor said.

“Storage basically helps you to shift it into times when it’s more useful. It can be batteries, but potentially longer term it could be hydrogen as well”.

Lalor said in an interview that lithium is effective and perhaps the best option in providing fast response, following grid frequency and “correcting the differences between supply and demand in the market,” whereas seasonal storage will entail a much smaller number of charge and discharge cycles through the year and longer time between import and export of electricity.

Hydrogen is “probably not going to come into the market cost-effectively” without some sort of policy support or investment in R&D, the analyst said, and perhaps needed subsidies to get started. However, once if large amounts of renewables are built out on the electricity grid in the UK and mainland Europe without “the storage to absorb the excess,” Lalor said, “then the market would see very extreme negative pricing for very long periods of time”.

“So the economics would be there to build storage and that would be necessary to correct the markets.”

Additional reporting by Alice Grundy.