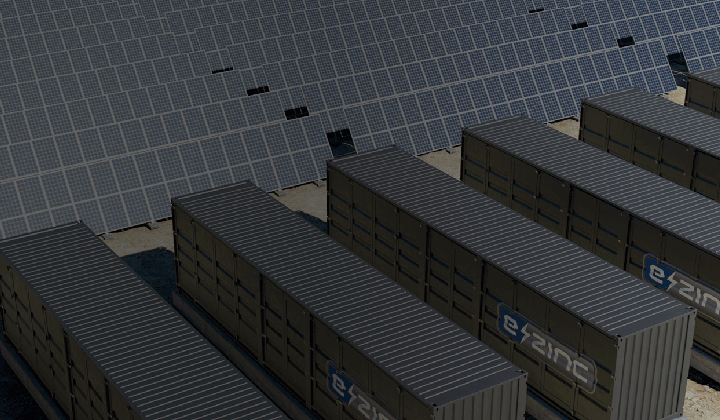

Long-duration energy storage (LDES) firm e-Zinc is targeting a gigafactory in the US by 2025 and is considering adjusting its planned project with Toyota Tsusho, it told Energy-Storage.news.

Newly-appointed CCO and US country manager Balki Iyer discussed e-Zinc’s technology, go-to-market strategy, projects and more during an interview at Energy Storage Summit USA last week. Iyer, who joined after two years as CCO for another zinc battery firm Eos, also commented on the collapse of Silicon Valley Bank, with which e-Zinc had recently raised a debt facility.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Technology and cost comparison with lithium-ion

The company’s battery technology uses zinc and offers a duration of 12-100 hours which Iyer said provides a lot of flexibility to grid operators, utilities and IPPs.

“This is important because energy market needs are ever-evolving. Because things are moving faster than what we all anticipated. You’re in an environment which is changing so rapidly, yet we have this whole industry making investments for the next 15 to 20 years. This makes flexibility even more important: we need to invest in solutions today that can solve the challenges of a grid two decades from now.”

Asked about how the cost of e-Zinc’s technology compares to industry incumbent technology lithium-ion, he said it was inaccurate and inappropriate to compare the two.

“A system that has the flexibility to stack multiple revenues will provide massive value versus a solution that can only tackle one or two. e-Zinc’s technology focuses on the 12-100 hour range, with Li-ion unable to touch that duration. I think at the end of the day, the product will be cost competitive, because all of the raw materials that we have are actually very, very low cost compared to those in lithium batteries.”

Scaling up first large-scale projects and manufacturing capacity

But he nonetheless agreed that this would only be achieved once the company scaled up. E-Zinc is targeting a US factory with a gigawatt-hour of annual production capacity operational by 2025. The company is currently scouting for the right state and site for the facility.

We then asked Iyer about a project in partnership with Toyota Tsusho to deploy a 24-hour system at Eurus Energy America Corporation’s (EEAC) Bull Creek wind facility in Texas, announced in June last year and slated for Spring 2023. He and a company spokesperson indicated the project may be changed or pushed back slightly.

“We are building a project with Toyota Tsusho, one of our investors but also a go-to-market partner with whom we’ve established a strategic partnership. We are evaluating what the project is going to be, whether it’s going to be in a wind farm or if it’s going to be an industrial setting. So that’s something that’s still open.”

A spokesperson added: “We are in constant discussion with Toyota Tsusho as we decide a site for the project, which may trail a few months as we select it, but largely we are on track with the project timeline.”

Toyota Tsusho is the trading arm of the large Japanese conglomerate while Toyota Ventures, its venture capital investment arm, participated in a US$25 million fundraise e-Zinc raised in April 2022. EEAC’s parent company Eurus Energy is owned by Toyota Tsusho, which in August last year bought out Japanese utility Tokyo Electric Power Company’s 40% stake in the company the two had formed as a joint venture.

Elaborating on why e-Zinc might take longer to firm up the project than initially planned, Iyer said: “We are in discussions to address the right use case that we want to establish. E-Zinc’s technology is suited for a variety of use cases, including both industrial microgrids and renewable time shifting.”

“Either project (wind farm or industrial setting) would be an excellent fit for our battery, but right now we’re weighing which site we want to prioritise with the client.”

Iyer provided an update on another of the company’s announced projects, one with the California Energy Commission. The firm will deploy a system to help the grid during public safety power shutoffs (PSPS), which is when utilities turn off parts of the grid during increased risk of wildfires caused by electrical infrastructure.

“For that project we’ve actually chosen an industrial site where we’re going to show how these energy storage assets can support customer bill management and resilience during a PSPS event. And that’s a big use case in California to be able to not only support grid management, renewable shifting, but you can still have enough juice in the tank to be able to support any sort of resilience event.”

Broader challenges for LDES companies like e-Zinc

“I think the main challenge for all of us in the LDES space is that we’re all in the pilot/early commercial stage. And I think all of us are facing the same challenge, which is how do you mature the product very, very fast, and how do you build a manufacturing scale that makes sense.”

“There’s some positive stuff that we have going for us, which is basically, the tech is a relatively simple tech. It’s well-established processes, well-established technology, well-established methods of how we’re going to plate zinc.”

“The use cases for LDES technology are evolving faster than the market. Which means we need to be proactive, addressing both current use cases and future needs as part of the next evolution of the grid.”

Silicon Valley Bank (SVB) collapse

As Energy-Storage.news recently reported, e-Zinc raised a US$7 million debt facility with SVB shortly before its rapid demise. The Federal Deposit Insurance Corporation stepped in and ensured continuity of business for all the bank’s customers.

“It’s unfortunate what’s happened. And I know a lot of the people in the industry who have probably suffered some of the impacts because of that. But I’d say from an e-Zinc perspective, it’s been a minimal-to-no impact for us.”

“There’s been a lot of damage control put in place and this is borne out by the fact that there have not been any downstream effects.”

This article has been amended to reflect that Toyota Tsusho is the owner of Eurus Energy, having bought out JV partner Tokyo Electric Power’s stake.