Energy trader Danske Commodities will optimise a BESS for parent company Equinor, while optimisation specialist Habitat Energy will manage a large fleet for investor Gresham House.

Danske Commodities to optimise Blandford Road BESS for parent company Equinor

The Denmark-based commodities trader Danske will provide market access, balancing and optimisation services for the Blandford Road battery energy storage system (BESS) for Norwegian oil and gas giant Equinor, which acquired the Danske last year.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

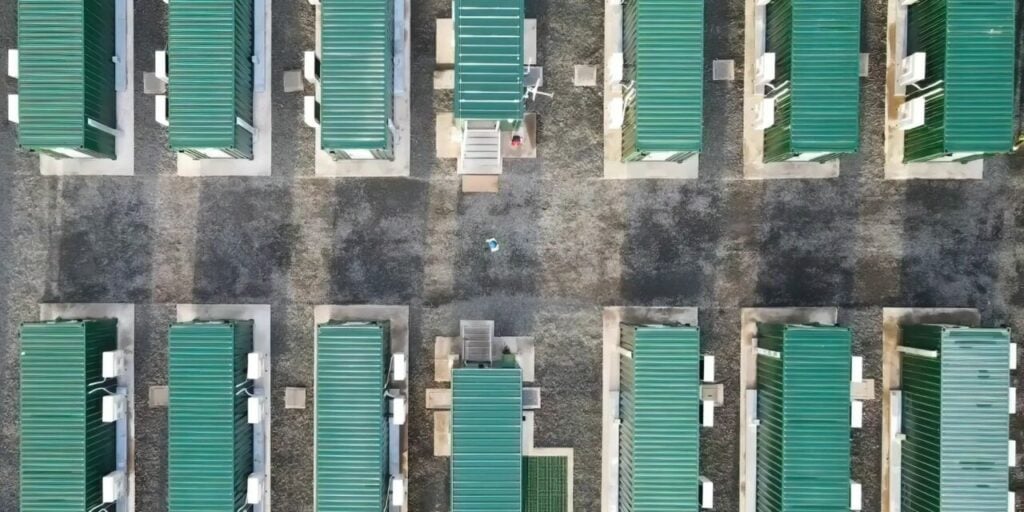

The 25MW/50MWh project is owned by Equinor but developed and operated by Noriker Power, a UK developer in which Equinor acquired a 45% stake in late 2021. The project is set to enter commercial operation in autumn 2023.

It marks Danske Commodities’ first optimisation deal in the UK.

“We are proud to announce Danske Commodities’ first optimisation agreement with a battery storage asset in the UK. With 15 years of experience from UK power markets, we will apply our trading expertise to optimise battery storage assets and help provide much needed flexibility to intermittent power generation.

“We currently manage the biggest portfolio of batteries in Denmark, and we look forward to building on this experience as we take on our first battery in the UK,” said Anders Kring, VP, Head of European Power Trading at Danske Commodities.

Habitat Energy to optimise over 500MW of projects for Gresham House

Meanwhile, optimiser Habitat Energy has signed an agreement with Gresham House Energy Storage Fund that will see over 500MW of UK battery energy storage optimised. The Fund is the largest owner of BESS assets in the UK, and recently expanded outside for the first time with an acquisition in California.

The agreement makes Habitat Energy the single largest optimiser of batteries on the Fund’s behalf, with 337MW of new battery storage assets expected to come online within the next 12 months.

Via the agreement, Habitat will utilise its AI-powered optimisation software to maximise value for the long-term, working as a strategic partner to asset owners and developers.

The two companies first started working together in 2019, which saw Habitat optimise 74MW of Gresham’s UK energy storage projects spread over three sites.

This includes the 49WM Red Scar battery, which was acquired by the storage fund in December 2018, is to be optimised, along with a 20MW project in Wiltshire and a 5WM site in Wolverhampton.

Interestingly, Gresham House itself has previously been an minority investor in Noriker Power but exited the company in December 2021. During its shareholding, it acquired BESS projects from Noriker, like this one reported by our sister site Solar Power Portal.

Habitat Energy is owned by Quinbrook Infrastructure Partners, which also owns another UK BESS optimisation firm Flexitricity, a peculiarity that was discussed during a session at the Energy Storage Summit in London earlier this year.

Part of this article was first published on Solar Power Portal.