Clean Energy Associates (CEA) has released its latest pricing survey for the battery energy storage system (BESS) supply landscape, touching on pricing and product trends.

The consultancy’s ESS Pricing Forecast Report for Q2 2024 said that BESS suppliers are moving to +300Ah cells quicker than previously modelled. The increase is due in large part to increased competition in the market.

It also said that, as Energy-Storage.news reported recently, the industry has moved to 20-foot, 5MWh+ containers as the standard product. CEA said that that 20-foot units are much more energy dense and easier to ship, and are cheaper to the extent that the advantages of smaller modular blocks have been overshadowed.

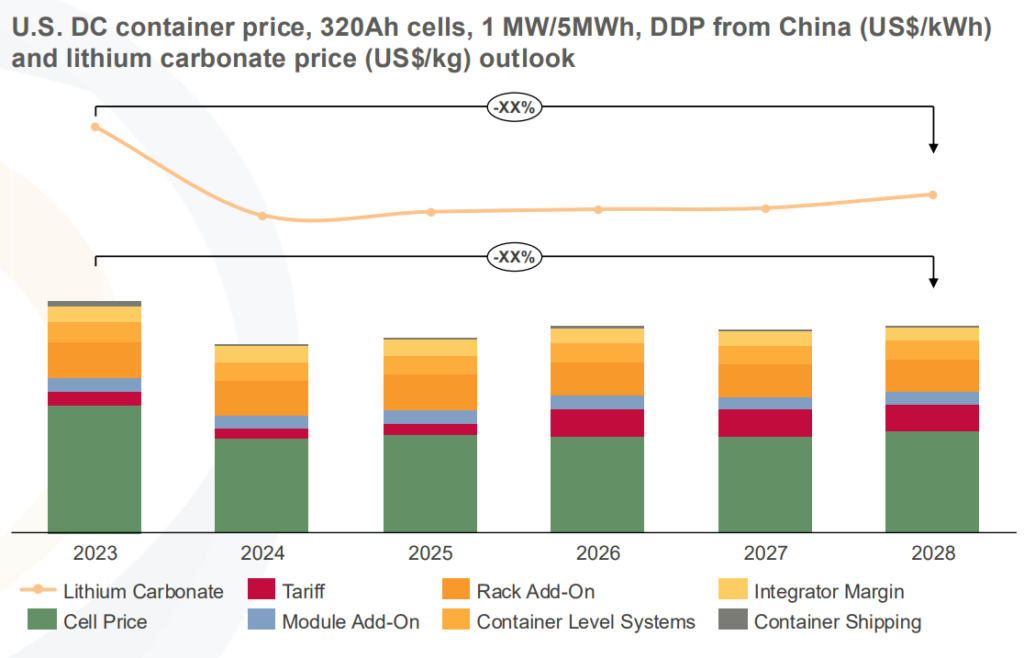

Its latest report did not, however, provide actual BESS pricing figures as previous ones did. In February, it said that the prices paid by US buyers of a 20-foot DC container from China in 2024 would fall 18% to US$148 per kWh, down from US$180 per kWh in 2023.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

That trend will reverse in the next few years, with small increases in price from 2025 onwards. Prices are expected to increase nominally in 2025, as shown in the chart above, before jumping more substantially in 2026. That larger increase is primarily down to new tariffs imposed by the US on battery products from China, which CEA previously said would increase BESS prices by 11-16%.

However, the firm’s chart implies the price will be relatively flat from 2026-2028.

In a separate paper, ‘ESS Supply, Technology and Policy Report’, CEA said that smaller lithium-ion battery OEMs and non-China companies are struggling in the current highly competitive environment and the slowdown in electric vehicle (EV) demand.

It highlighted several gigafactory projects in the US and elsewhere that have been postponed or scaled back, without naming the companies involved. One supplier’s CEO and CTO resigned and saw layoffs of 25% and 12% of employees in Q4 2023 and Q1 2024 respectively. Elsewhere, gigafactory projects have faced significant roadblocks in Clarksville, Kentucky and South Carolina.

Republican lawmakers are still pushing to impose punitive measures on major Chinese lithium original equipment manufacturers CATL and Gotion for alleged human rights abuses in their supply chains, which they deny.