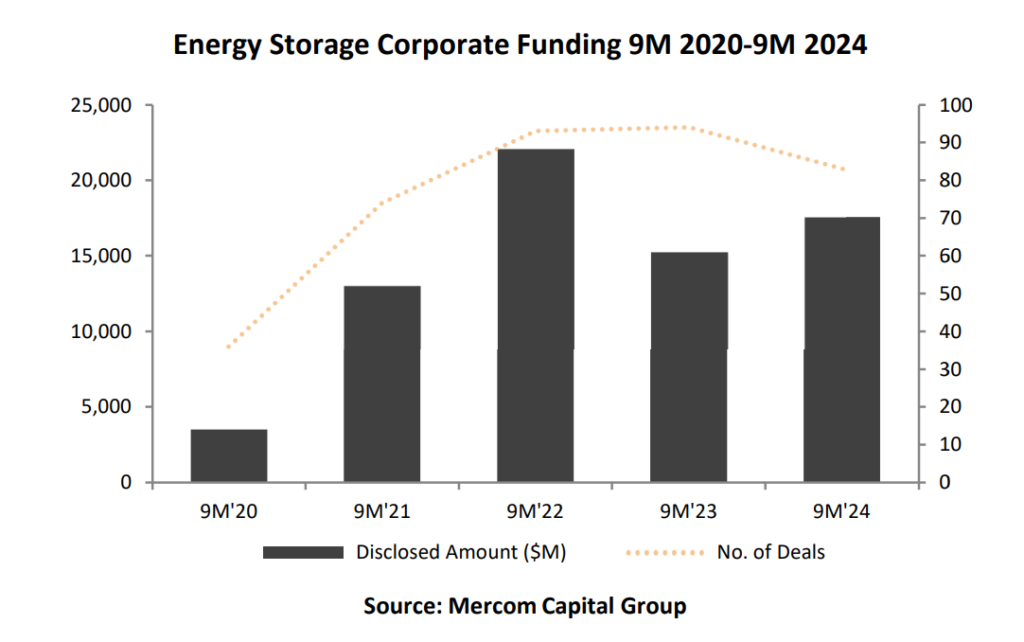

A total of US$17.6 billion was invested in the energy storage industry across 83 announced deals in the first nine months of the year, according to comms and market intelligence firm Mercom.

The majority of the funding came from debt and public market financing as opposed to venture capital (VC) funding, the inverse of the same period last year, Mercom’s latest quarterly report on financing in the energy storage and smart grid industries shows.

Venture capital (VC) funding for energy storage companies fell 69% to US$2.7 billion across 61 deals in the first nine months of 2024, versus US$8.6 billion across 68 deals in the same period in 2023. Debt and public market financing meanwhile soared 125% to US$15 billion across 22 deals, compared to US$6.6 billion across 26 deals in the the first nine months of 2023.

Meanwhile, a total of 18 M&A transactions were announced in the first nine months of 2024, up from 11 in the same period last year, though Mercom didn’t provide any financial figure for this as the transaction values are typically not disclosed unless involving a publicly listed company.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Notable M&A deals seen this year include oil and gas major TotalEnergies’ acquisition of German battery energy storage system (BESS) project developer Kyon Energy in January, which was followed five months later by investor Brookfield’s acquisition of independent power producer (IPP) Neoen.

The report also covers corporate funding for ‘smart grid’ companies. and showed that deal-making fell 33% to US$2 billion across 53 deals.

See Mercom’s chart showing how the most recent nine-month figure for investments in energy storage stacks up against previous ones below.