Financial close was achieved on a 270MWh battery storage project in Belgium by removing as much asset and revenue risk as possible, Energy-Storage.news has heard.

Developer BStor, the majority equity owner of the 100MW/270MWh ESTOR-LUX II battery energy storage system (BESS), announced the project’s financial close at the beginning of this month (1 April).

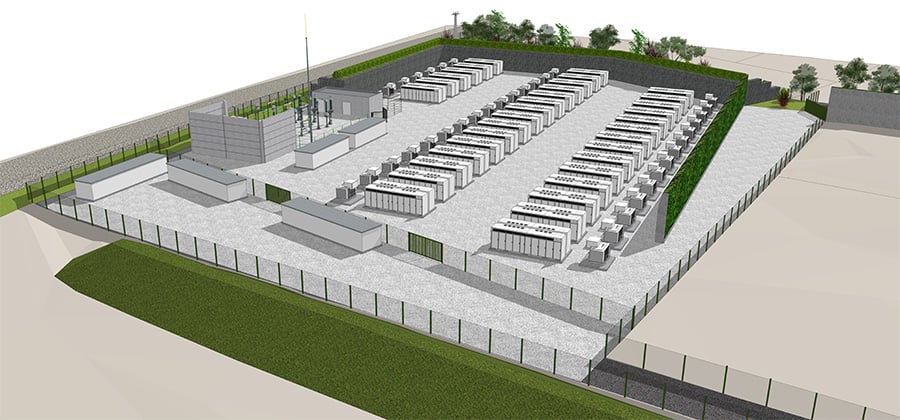

The project is located close to a high-voltage substation owned by grid operator Elia in an industrial zone in Aubange, Luxembourg (the southern region of Belgium bordering the microstate of the same name), in the Wallonia region.

BStor owns 75% of the project equity, with SOCOFE, an investment arm of local authorities in Wallonia, and SOPAER, investing for the province of Luxembourg, holding 15% and 10% respectively.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

A total of €124 million (US$136.3 million) investment was required, with 65% non-recourse debt financing from KBC, Belfius, and Triodos and the balance covered by the partners’ equity.

Speaking exclusively with Energy-Storage.news, BStor managing director Pierre Bayart said that ESTOR-LUX II, together with two other projects in the consortium’s portfolio, will be fully exposed to merchant markets.

Energy supplier and trader Eneco will create value from the dispatch of the asset’s stored energy once it goes into commercial operation, scheduled for autumn 2026.

The trio’s consortium has previously worked on ESTOR-LUX (10MW/20MWh), Belgium’s first high-voltage grid-connected BESS, which went online at the end of 2021. It is currently also working on D-STOR, a 50MW/140MWh project for which financial close was achieved in Q3 2024, and construction began earlier this year.

“Together, the projects [ESTOR-LUX and D-STOR] represent a total capacity of 150MW/410 MWh and a total investment of €194 million,” Pierre Bayart told Energy-Storage.news.

“This is a landmark deal, not only for BSTOR as it shows our ability to scale up the model we demonstrated on our first project ESTOR-LUX I, but also for BESS development in Belgium since we managed to source around €120 million (>60% gearing) through fully non-recourse senior debt from a consortium of three Belgian banks, on these projects while they are fully exposed to merchant risk.”

Long-term purchase agreement with full merchant exposure

Belgium and its neighbour, the Netherlands, have been talked about by industry and analysts as being ripe for battery storage development.

In a recent interview, Anna Darmani, energy storage analyst at Wood Mackenzie, told ESN Premium that the market fundamentals are in place in the Benelux countries for BESS development, and the audience to a panel discussion moderated by Darmani heard similar things from investors, developers and technology providers at February’s Energy Storage Summit EU 2025.

However, announcements of large-scale BESS projects in financial close, construction or commercial operation have been noticeably fewer in Belgium than within its neighbour’s borders.

A quick look at the European Energy Storage Inventory public database hosted by the European Commission (EC) JRC Smart Electricity Systems initiative using data from Wood Mackenzie highlights 21 operational energy storage projects in the Netherlands and only 12 in Belgium.

“We have seen similar or even much bigger merchant-exposed projects sourcing a large share of their financing through project finance in the Netherlands recently, but Belgium is a bit more complex market,” BStor’s Pierre Bayart said.

“The share of wind and solar electricity in the mix is much lower here in Belgium, meaning that you need to go for more sophisticated revenue generation than arbitrage on spot [prices], with more focus on intraday and balancing markets.”

Achieving financial close required focus on the blend of total risk exposure by derisking both the asset side and revenue side of the financing as much as possible, Bayart said.

On the asset side, the BESS vendor—which was Tesla in the case of both ESTOR-LUX II and D-STOR—had to be convinced of the need for what Bayart called “better-balanced terms and conditions”. These made the projects bankable, and helped the development consortium persuade Tesla that it was “the right party to guide them toward the lenders’ ‘sweet spot’.”

On the revenue side, the BStor-led consortium signed so-called ‘flexibility purchase agreement’ long-term offtake contracts with trader Eneco that outsourced volume risk. These have the look and feel of the type of long-term power purchase agreement (PPA) Eneco has dealt with for many years.

“We get guaranteed availability-based remuneration, irrespective from the usage by the offtaker,” Bayart said.

“But such remuneration is fully merchant-exposed.”

ESTOR-LUX II will feature 70 Tesla Megapack 3.8MWh lithium-ion (Li-ion) BESS enclosures. Construction is underway, and Pierre Bayart said the consortium has secured around 1.5GW of transmission system operator (TSO) grid connection agreements.

With the business model “now demonstrated at full scale,” Bstor and its partners intend to build out that pipeline of large-scale battery projects, the managing director said.