Hydrostor, a Canadian company with projects under development in North America and Australia using its advanced compressed air energy storage (A-CAES) technology, has secured CA$10 million (US$7.99 million) growth capital.

The investment has come from BDC Capital, the investment arm of BDC, a bank which aims to support Canadian entrepreneurs. The Canadian government is BDC’s sole shareholder, although the financial institution is operated at “arm’s length” as a Crown corporation company.

Canada’s government has also more directly supported Hydrostor: Natural Resources Canada, a government department, pledged about CA$4 million of financing to the company through an Energy Innovation Program, while government-created foundation Sustainable Development Technology Canada also offered an undisclosed sum of funding. Those investments were reported by Energy-Storage.news in April.

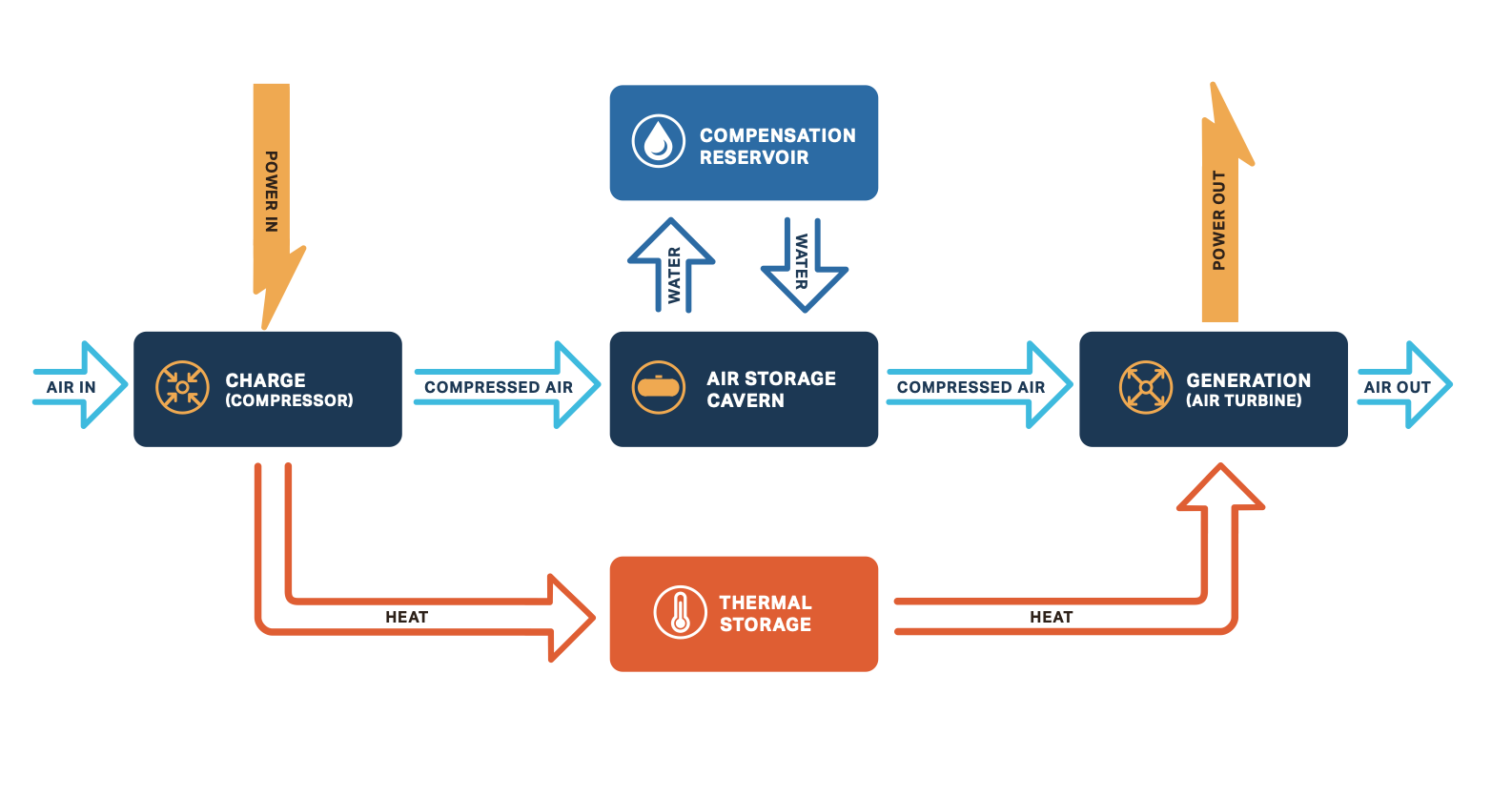

Hydrostor aims to build massive, long-duration energy storage systems, using electricity to compress air during charging which is then stored in sealed underground salt caverns, also storing heat created by the compression process. Water reservoirs then provide hydrostatic compression to maintain the air at constant pressures for storage. Then, when the system is discharged, the compressed air is forced to the surface by hydrostatic pressure and combined with heat, passing through turbines to generate electricity as needed.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The systems — which can store and discharge bulk energy for several hours — could have an operational lifetime of 50 years and create economic benefit by employing people with experience in more traditional energy sectors like oil and gas. While it has to date built just one commercially operating plant, in its home province of Ontario, with Canadian energy storage project developer NRStor, which has 1.75MW peak power output and 10MWh+ of storage capacity, Hydrostor believes the solution could be scaled up significantly.

These include a 200MW / 1,600MWh project proposed at a remote site in New South Wales, Australia and as much as 15GWh of projects at several sites in California, including one of 500MW / 4,000MWh. In all, Hydrostor claims to have a pipeline of more than 6GW / 65GWh of storage projects at various stages of development, with over 1,200MWh of that “under active and development stages”.

The new investment will help the company to advance that pipeline of projects, including accelerating development on projects for which final investment decisions are expected within the next year-and-a-half.

“Hydrostor is a world-leading developer of reliable and emissions-free long-duration energy storage systems. Hydrostor is unique in its ability to cost-effectively store vast amounts of otherwise curtailed renewable energy, such as wind and solar, and in doing so, addresses one of the key barriers to realising a net-zero energy grid,” BDC Capital Cleantech Practice director Zoltan Tompa said.