A community-owned battery energy storage system (BESS) in Australia could earn up to AU$250,000 (US$162,610) per year, writes GridBeyond Australia’s solar, storage and EV regional director Stace Tzamtzidis.

A community battery is a shared energy storage system that stores excess electricity, typically from renewable sources, and makes it available to a local community or grid. It allows multiple households or businesses to store energy collectively, improving energy efficiency, reducing costs, and enhancing grid stability by balancing supply and demand.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In addition, a community battery can generate valuable income by providing grid services such as frequency regulation, demand response, and energy arbitrage.

Australia has set ambitious decarbonisation goals, aiming to significantly reduce its carbon emissions over the coming decades. Energy storage systems, that include utility scale and community batteries, are seen as a critical tool to achieve these goals.

In Australia, over 3.5 million households have installed solar PV systems, leading to significant excess solar generation during peak sunlight hours. This surplus energy is often fed back into the grid, creating instability and challenges in grid operation.

To address this, there is a growing opportunity to deploy community batteries that can store this excess solar energy and return it to the grid during periods of high demand, helping to stabilise the grid and improve overall energy management.

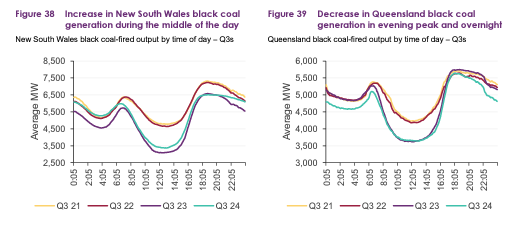

Excess solar generation in the middle of the day contributes to what’s known as the “duck curve.” This occurs because energy consumption in households is typically lowest during daylight hours, when solar production is at its peak. As a result, large amounts of solar energy are fed back into the grid, causing a surplus.

The duck curve highlights the challenge of balancing supply and demand, particularly during the transition from solar to non-solar generation, and underscores the need for storage solutions like community batteries to smooth out these fluctuations.

The ‘duck curve‘

The duck curve illustrates the variation in electricity demand throughout the day, driven by the abundance of renewable energy, particularly solar, during daylight hours.

Traditional fossil-fuel plants operate at a consistent, pre-determined output, providing a reliable and predictable source of electricity. In contrast, renewable energy sources like solar are variable, dependent on weather conditions and time of day.

Solar and battery storage, however, complement each other perfectly. By combining them, we can transform low-cost, intermittent solar energy into a flexible, on-demand resource. This creates a win-win model for future energy grids, reducing reliance on fossil fuels and lowering the carbon footprint of electricity generation.

Moreover, integrating solar with battery storage improves grid resilience, enabling better management of supply and demand fluctuations—especially in the face of more frequent extreme weather events driven by climate change.

In Australia, one of the earliest community-scale batteries was installed in June 2022 in Victoria. Since then, the government has ramped up support for such projects. In mid-2024, the Australian Renewable Energy Agency (ARENA) announced the roll-out of the AU$200 million (US$130 million) Community Batteries for Household Solar Program. This initiative aims to install more than 420 community batteries across Australia, providing shared storage capacity for up to 100,000 households.

Bowen: ‘Community batteries vital to sharing benefits of renewables’

It was recently announced that the first non-network owned battery to be delivered under the ARENA Community Batteries for Household Solar Program has been launched. The 120kW/360kWh battery is fully owned by the Mornington Peninsula Shire Council, which received AU$500,000 in funding from ARENA for the project.

In a media release, Chris Bowen, Australia’s minister for climate change and energy, said: “The rollout of community batteries is vital to making sure that everyone can share the benefits of renewable energy by storing rooftop solar energy during the day and dispatching it at night when it’s needed. The rain isn’t constantly falling, yet we always have water on tap because it’s stored for when we need it – and batteries like the one in Flinders will do the same thing for reliable renewable energy.”

Many states also have additional policies and programmes to encourage community energy projects, including grants, rebates, and feed-in tariffs.

A key point highlighted by the Australian Energy Market Operator (AEMO) is that if consumer batteries are efficiently coordinated, they can help reduce overall system costs.

In fact, AEMO estimates that such coordination could avoid AU$4.1 billion in grid-scale investments by offsetting the need for additional infrastructure development. But in addition, a 1MW community-owned battery enrolled in the Frequency Control Ancillary Services (FCAS) programme could generate AU$250,000/year revenues for its community owners, according to the latest GridBeyond White Paper.

FCAS refers to the services used to maintain the stability of the electricity grid by controlling and balancing frequency fluctuations, ensuring supply and demand are matched in real-time. Community-scale storage could provide significant net value by stacking multiple value streams while also achieving economies of scale. This finding depends on being able to accurately locate community-scale storage projects in high-value locations on the grid and monetise the value they bring.

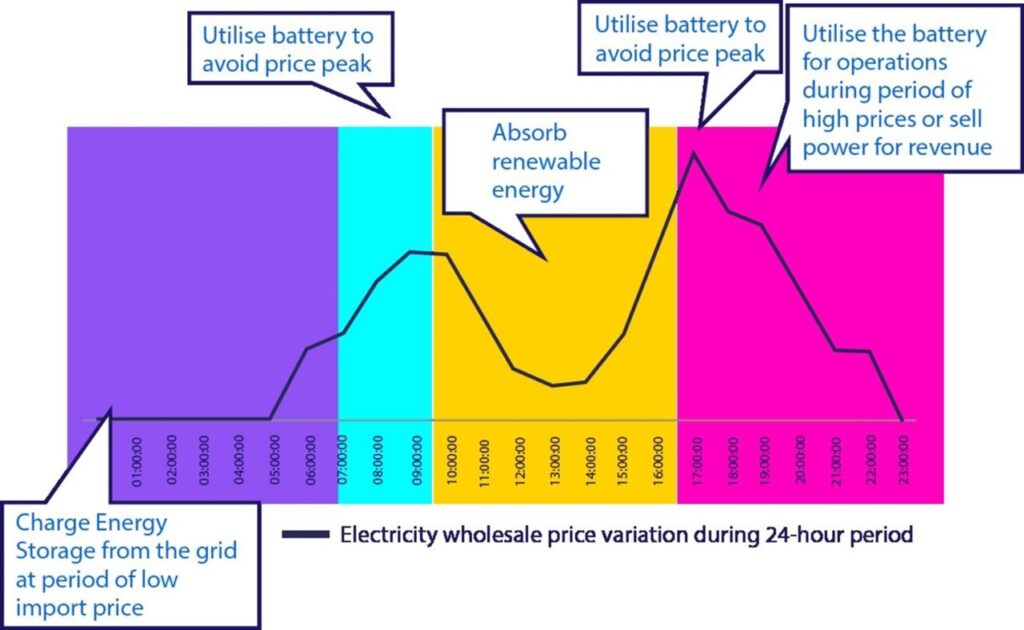

Energy is the single largest source of value. It represents the value of charging during lower-cost hours and discharging during higher-cost hours. However, significant values can also be realised from the FCAS programme with a 1MW battery able to earn revenues of AU$250,000/ year. A community battery may participate in the FCAS and Arbitrage markets, earning the operators a valuable income stream and realising attractive payback and return on investment opportunities.

But for community batteries to achieve their full potential, they must be supported by intelligent Energy Storage Management Systems (ESMS). These platforms play a crucial role in ensuring that batteries are used optimally and that they can participate in multiple revenue-generating activities. A key challenge is the need to coordinate between various stakeholders, including grid operators, market participants, and local energy users.

An effective ESMS must be able to integrate with grid operators’ systems and energy market interfaces, co-optimising across multiple value streams to deliver benefits to all stakeholders.

For example, an ESMS can ensure that the battery is used for both energy arbitrage (buying and storing energy when it’s cheap, and selling it when it’s expensive) and FCAS services simultaneously, maximising the revenue potential of the asset. It can also help to ensure that the battery is always available to support the grid during periods of high demand or unexpected outages, providing further value to the community and the broader electricity system.

By pairing sophisticated battery hardware with predictive energy storage and flexibility management software, asset operators can optimise value in real time as they respond to changing community and market energy needs.

Watch our recent Energy-Storage.news webinar with GridBeyond ‘Empowering Australia’s battery energy storage assets through market participation’.