UPDATE 24 June 2022: After publication of this story, existing project partner Mitsubishi Power Americas provided Energy-Storage.news with the following statement in response to a question about whether it would seek a new equity partner to replace Chevron:

“ACES Delta is open to hosting discussions with a variety of potential strategic partners that could be a good complement to our existing portfolio of assets, products and services.”

Oil and gas major Chevron has pulled out of plans to acquire an equity interest in Advanced Clean Energy Storage Delta (ACES Delta), the 300GWh green hydrogen energy storage project in Utah, it confirmed to Energy-Storage.news.

Chevron announced in September 2021 that it planned to acquire a stake in ACES Delta, the joint venture between Mitsibushi Power Americas and Magnum Development, which owns the project set to go online in 2025.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The project recently bagged a US$504 million loan from the Department of Energy (DOE) but will no longer receive investment from Chevron, as a statement provided by the company to Energy-Storage.news explained:

“Chevron is exploring numerous opportunities as we work to achieve our lower carbon goals and grow our lower carbon businesses, and for these opportunities to proceed, commercial agreements must meet certain thresholds. Unfortunately, our opportunity to acquire an equity interest in ACES Delta no longer meets our requirements,” it said.

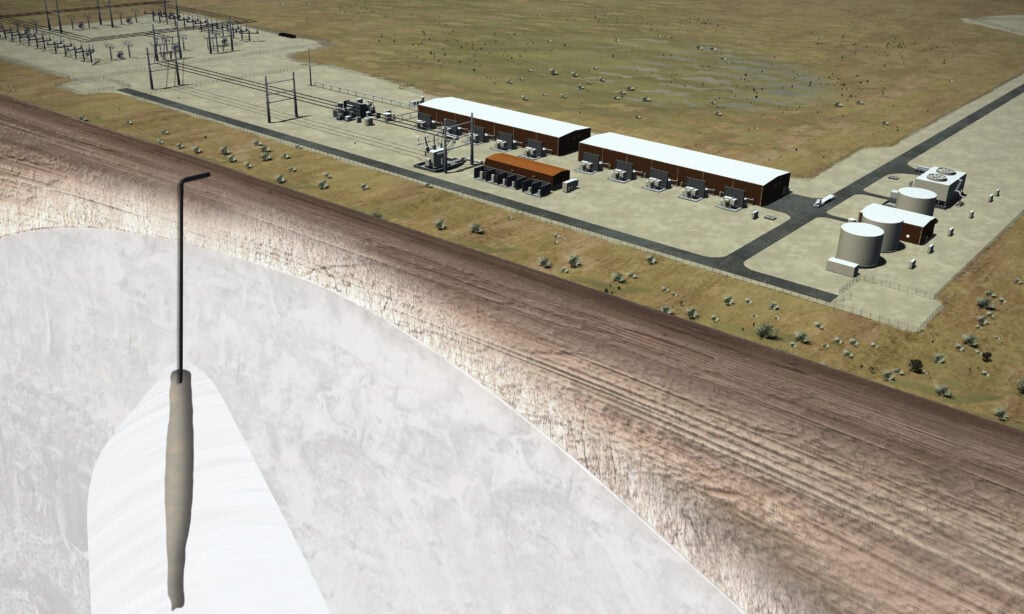

ACES Delta will feature 220MW of electrolysers that will convert renewable energy, mainly solar and wind, into up to 100 metric tonnes of green hydrogen a day. This will be stored in two huge salt caverns with a combined storage capacity of 300GWh.

It is being built to help power a new 840MW combined cycle power plant from cooperative Intermountain Power Agency, which itself is replacing a retiring coal plant. It will power 30% of Intermountain’s plant when it comes online in 2025 with plans to increase that to 100% by 2045. But that achievement could come as early as 2030 or 2035 according to Mitsubishi Power America’s Thomas Cornell in a recent interview with Energy-storage.news.

Chevron added: “We continue to explore hydrogen opportunities – including in the western United States where we have established an early and growing business – and remain committed to identifying and pursuing lower carbon solutions and providing affordable, reliable, ever-cleaner energy.”

The oil and gas company recently acquired biodiesel producer Renewable Energy Group, creating a new segment called Chevron Renewable Energy Group. It said the deal will help it grow its renewable fuels production capacity to 100,000 barrels per day by 2030.

BP invests in similar project in Australia

Chevron’s decision not to invest in a massive green hydrogen project coincides with oil and gas peer bp’s decision to do exactly that. Last week, it announced it would acquire a 40.5% stake in and become the main operator of the Asian Renewable Energy Hub (AREH), as first reported by Energy-Storage.news’ sister site PV Tech.

AREH is a project in Western Australia that is expected to produce around 1.6 million tonnes of green hydrogen a year (or nine million tonnes of green ammonia), and will also feature up to 26GW of solar and wind power. To what extent the hydrogen will be stored for conversion to electricity versus provided immediately for industrial use is not clear.

The other partner shareholders in AREH will continue to be InterContinental Energy (26.4%), CWP Global (17.8%) and Macquarie Capital and Macquarie’s Green Investment Group (15.3%).