The success in a recent capacity market auction of large-scale battery energy storage system (BESS) projects in Belgium is a sign of the European country’s energy storage market maturing, Energy-Storage.news has heard.

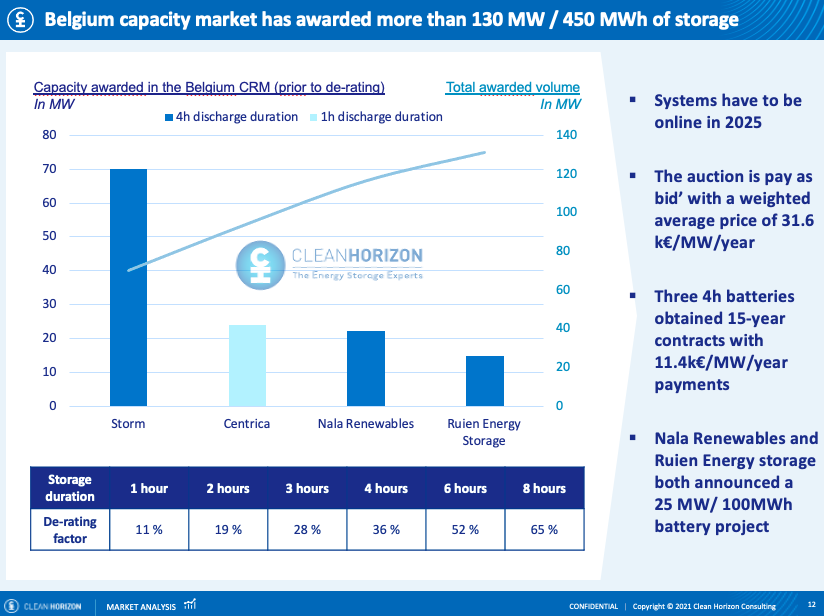

Belgian transmission system operator ELIA held an auction for the newly introduced Capacity Remuneration Mechanism (CRM) in late October. Among 40 Capacity Market Units (CMUs) that received long-term contracts for 4,447.7MW of capacity through the Y-4 Auction, at least four were BESS projects, with 130MW / 540MWh output and storage capacity.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The fact that each is a new build project is a “pretty positive sign,” Corentin Baschet, head of analysis at energy storage consultancy Clean Horizon told Energy-Storage.news. Of particular interest to note is that three of the four projects awarded contracts are four-hour discharge duration systems, Baschet said in an interview.

Belgium has been of interest to Clean Horizon as a market for some time, Baschet said. The country has some fundamental drivers that are good for storage, not least of all because its electricity grid lacks flexibility and most of its ageing nuclear fleet is set to close by 2025.

While as part of mainland Europe Belgium is “quite well interconnected,” it is also “looking — as every other country is — to have enough electricity to go through winter times,” and the peaks in electricity demand that the cold months bring.

So grid operator ELIA has been looking to roll out the new CRM for a number of years before it gained approval to go ahead from the European Commission. Combined cycle gas turbines got the most contracts, followed by combined heat and power facilities, most for a year and some for 15 years, while the three BESS projects of four-hours duration got 15 year contracts.

Fundamental drivers, stackable revenues make attractive business case

The BESS projects will earn €11,400 (US$12,820) per MW / year. This is only roughly 7% of the revenues an asset will need to break even, which according to Corentin Baschet is about €160,000 per MW / year. That might seem very low, he said, but as a guaranteed 15-year revenue stream, it could be useful to get some financing.

Energy-Storage.news reported that financial close was achieved on one of the winning projects, the 25MW / 100MW Ruien project by Nippon Koei and Yuso, a few weeks ago. Similarly, another winning project of the same size was announced as in development in January by Trafigura, set to provide a number of different grid services, before the auction was held.

That shows, Baschet said, that the CRM revenue stream isn’t going to be what triggers investment in battery storage — but it is a very useful “cherry on the cake”.

Another reason why Belgium’s energy storage market is looking increasingly attractive, he said, is because revenues are relatively stackable across different opportunities for batteries.

“Capacity market revenues are by nature meant to be stackable,” Baschet said.

“Because it’s a payment to be there. These capacity markets are created because there’s not enough revenues for power plants on the wholesale market. As a battery, it’s just a cherry on the cake. It doesn’t ask for more cycling, it’s just an additional revenue. So why not take it?”

“Belgium is one of the markets in Europe where a lot of revenue streams are opened. That means there’s a frequency control reserve (FCR) market just like in France and Germany, but there’s also secondary reserve, which is fully open to batteries with very clear pre-qualification rules,” Baschet said.

On top of that there’s now the capacity market, as well as some revenues to be made on energy trading.

“It’s a country with revenue streams [for battery storage] really looking like a stack.”

Just like other markets, like the UK, where this is the case, it took some time for the ‘stack-ability’ of revenues to emerge, but it is “really happening,” in Belgium too, making it an interesting market.

Four-hour batteries, broadly speaking, have been seen in places like California that have market mechanisms to value the extra capacity and duration. Battery storage is an increasingly important asset for energy suppliers in California to meet Resource Adequacy requirements — ensuring that daily peak energy demands can be met with a growing share of decarbonised electricity.

In Belgium, the market dynamic of having different stackable revenues is creating more and more aggressive strategies for battery asset route-to-market operators and optimisers.

“I think there’s several things at play,” Baschet said of this interest in four-hour batteries.

“It would be stupid to do less than two hours [duration] in Belgium because of the high secondary reserve prices. But the fact that there are some trading capabilities also for these projects, and a lot of revenue streams open, plus potentially aggressive cycling. When you get a longer discharge duration, the cycling is less aggressive, obviously, because you get more energy. So that’s a lot of elements that justify these these four batteries.

But indeed, it’s quite a change. In France and Germany batteries installed today are mostly one hour, some are starting to be two hours. And we’ve seen the first projects with with three, four hours storage. So that’s an interesting sign.”

More markets are opening up for energy applications around the world, necessitating longer duration storage, while battery module prices keep decreasing year-on-year while the price of balance-of-system equipment like power conversion systems (PCS) stays broadly the same. As energy gets cheaper and cheaper, the fact is that business cases for longer duration are being triggered, the analyst said.