Research firm Wood Mackenzie has held onto its forecast that the US will deploy around 7GW of energy storage annually by 2025 and found that 97.5MW / 208MWh of storage was installed during the first quarter of this year.

COVID-19 caused some near-term downside in the market during Q1 2020, particularly in the behind-the-meter segment, Wood Mackenzie Power & Renewables notes in the latest edition of its quarterly US Energy Storage Monitor report, but acknowledged that the impacts of the pandemic did not begin to really hit the sector until March and April, meaning that its effect on installations overall was limited.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

From conversations with industry participants, Wood Mackenzie found that the market downside was mainly to be found “as a result of challenges relating to customer acquisition, installation and interconnection”. Brett Simon, senior analyst for energy storage at the company tweeted yesterday that the first quarter was “the calm before the storm,” and that the “economy-wide slowdown will bleed into market opportunities” in 2021 as well as during this year.

Although Brett Simon said that forecasts for this year and next have therefore been revised downward to reflect this, overall his firm still believes the annual market in the US will reach 7GW annually by the middle of this decade, having predicted earlier this year pre-pandemic that it expected that figure to be closer to 7.3GW.

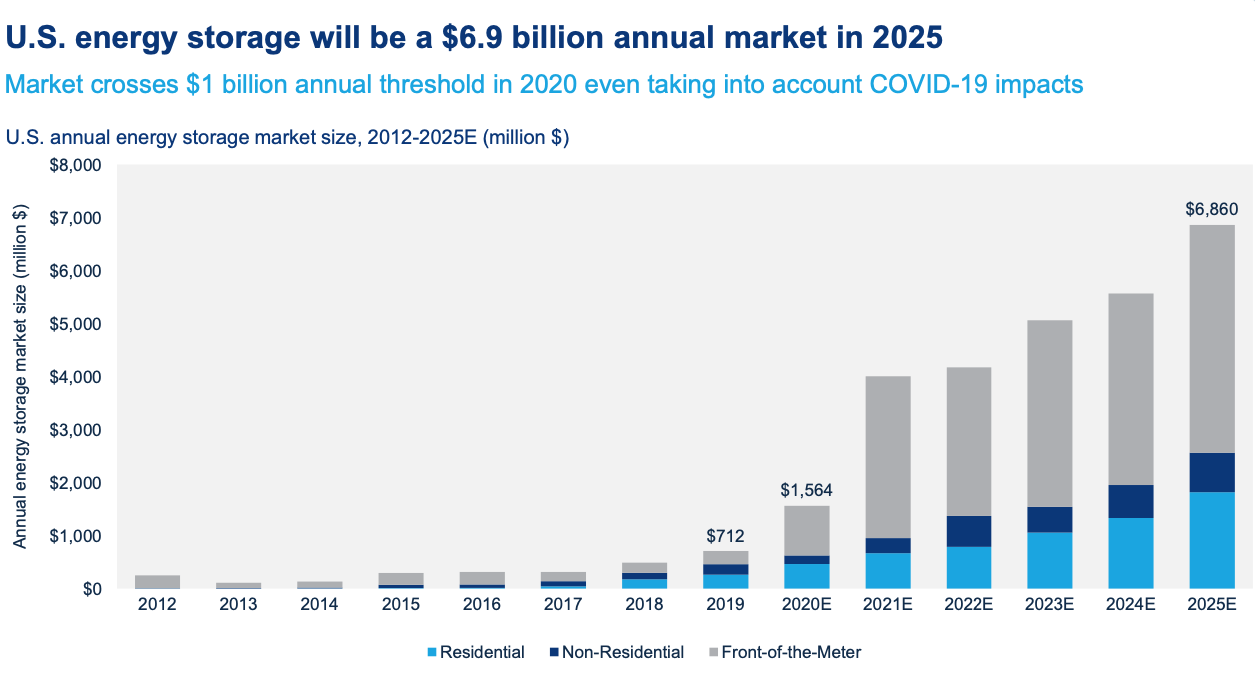

The amount of annual deployment expected in 2020 is around 1.2GW, and the market will still exceed the US$1 billion mark in value for this year. By 2025 that figure will be closer to US$6.9 billion annually, according to the Monitor report. The company expects significant growth in residential, non-residential and front-of-the-meter segments, with front-of-meter becoming the biggest segment by far this year and continuing to grow.

The Q1 2020 figures in megawatts were a decrease of 48% from the previous quarter and a decrease of 48% from the same period in 2019. However, residential deployments (44.4MW) broke its previous record for quarterly deployment by 10%, Brett Simon tweeted, adding that non-residential had its third most successful quarter to date. Meanwhile front-of-meter deployments were “down substantially quarter-on-quarter,” but the analyst also noted that this was not a “cause for concern,” as the majority of installations in that segment had already been anticipated to happen later this year.

The overall deployments were also down in megawatt-hour terms: 208MWh in total was a 43% decrease quarter-on-quarter and down 34% year-on-year. Wood Mackenzie found that this was due to a majority of front-of-the-meter projects coming online being short duration energy storage. This meant that FTM storage accounted for 13% of Q1 2020 deployments in megawatt-hours but for 22% of the total megawatts deployed.

Kelly Speakes-Backman, CEO at the US national Energy Storage Association, which partners with Wood Mackenzie in the publication of the Monitor report, said that the first quarter’s figures were an indication that “despite dampening effects of the coronavirus crisis, energy storage will ultimately experience a positive growth trajectory in 2020”.

“This is evidenced by increases in both capacity and deployments of the residential and non-residential sectors. While the ongoing pandemic will more seriously affect Q2, we anticipate year-over-year growth as states have continued to pass regulations and legislation to encourage energy storage deployments”.

“The energy storage market, like most industries, is going through struggles. But long-term this is a healthy, growing space,” Brett Simon wrote on Twitter, noting that during the quarter utility Southern California Edison announced a 770MW procurement.

Europe to turn to energy storage as main flexibility asset for renewables integration

In a separate piece of analysis produced by Wood Mackenzie Power & Renewables and published in the past few days, Europe’s energy storage capacity has been forecasted to surge to 89GW by 2040.

Wood Mackenzie said that energy storage looked likely to be the grid flexibility technology class of choice on the continent, where wind and solar generation continues to enjoy rapid growth.

Across the five major European markets – Great Britain, Germany, France, Italy and Spain – variable renewable energy (VRE) generation is expected to grow to become the largest share of capacity as early as 2023. By 2040, an additional 172GW of solar power is expected to be connected to the grid, along with 169GW of wind.

With flexibility assets the key to balancing the grid in the face of this growth, interconnectors, gas peakers and energy storage capacity collectively are expected to increase from 122GW in 2020 to 202GW by 2030, and then to 260GW by 2040.

Of this capacity, energy storage systems look set to win out as the flexibility asset of choice. Due to decreasing costs and the compatibility with VREs, capacity is expected to grow from 3GW in 2020 to 26GW in 2030, and then to 89GW by 2040.

This would mean that by 2040, there could be 320GWh of energy storage available to balance the grid across the five markets. System duration is also likely to increase over this period, in line with battery cost reductions.

Rory McCarthy, principal analyst at Wood Mackenzie said that “by 2030, energy storage will beat gas peakers on cost across all our target markets, resulting in a cloudy outlook for any new future peaking turbines. Fuel and carbon prices are on the up, technology costs are not set for any major decreases and net zero policies will eventually target the decarbonisation of all power market services. Unabated gas is likely to be the EU’s next target after coal, although market forces are already pushing it out.

“For storage and solar-plus-storage, technology costs will continue to decline. The levelised cost for a standalone 3-hour system will reduce by 33% through 2030. Its ability to take advantage of peaks alongside gas plants and capitalise on low and negative prices, which gas plants cannot, pushes it into preferred flexible asset territory,” added McCarthy.

The majority of the growth in battery storage capacity is likely to be front of the meter, however there will also be a jump for behind the meter. Hybrid renewable systems and electricity bill management are both set to make it attractive over the next two decades, along with the resilience proposition it offers.

Europe piece by Molly Lempriere. Read the full version of that story on our sister site Solar Power Portal where it was first published yesterday.