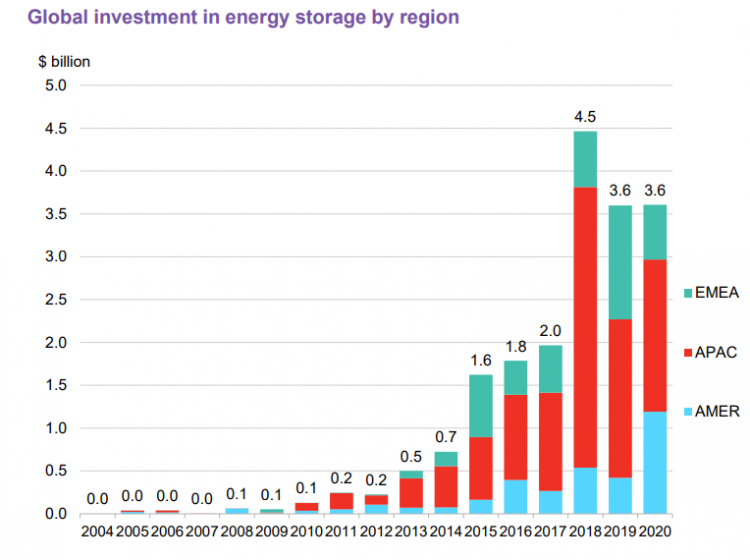

Despite the fall in unit prices for energy storage, a total of US$3.6 billion of investment was committed to energy storage projects in 2020, around the same amount as in 2019.

A new report from BloombergNEF looking at investment trends in the global energy transition found that solar PV lead a jump in energy transition investments throughout 2020. Investments in solar rose by 12% year-on-year to US$148.6 billion despite the economic slowdown induced by COVID-19. As much as 194GW of solar PV could be deployed this year, the firm predicted.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The report goes on to claim that roughly half a trillion US dollars were pumped into renewables developer projects, systems and businesses last year as governments set out new targets to decarbonise energy systems. This was the first time investment into the energy transition has hit $500 billion, BloombergNEF said, with investment in renewables in particular rising by 2% year-on-year, it said, with the sector attracting US$303.5 billion in funding.

Governments and households spent a further US$139 billion on EVs and charging ports, representing a 28% rise compared with 2019. At the same time, investment in wind projects declined 6% to $142.7 billion, although this is largely due to a fall in onshore wind commitments, according to the report.

The Americas region saw “record investment” in energy storage last year at a rate of US$1.2 billion, although the report found a marked slowdown in investment in Europe, the Middle East and Africa, where funding stood at US$600 million. The Asia-Pacific region invested highest, with China, South Korea and Japan leading the way for investments to reach US$1.8 billion for that region. Recently published research by rival firm Wood Mackenzie Power & Renewables forecast that the cost of front-of-meter utility-scale energy storage systems in the APAC region will fall by around 30% over the next five years. Another firm, Guidehouse Insights, predicted last year that the region could overtake North America as the world's biggest market for utility-scale energy storage as early as 2023.

Among regional markets noted to have enjoyed rapid growth during the year, China deployed 533.3MW of new electrochemical energy storage projects in the first nine months of 2020, an increase of 157% compared to the previous year. BloombergNEF said however that 2018 still remains the record year for energy storage, when US$4.5 billion of investment was made worldwide.

Some notable developments highlighted by the analysis company during 2020 included California switching on the world’s two largest battery storage systems in quick succession, the 250MW / 250MWh Gateway project by LS Power followed shortly by the start of operations at the 300MW / 1,200MWh Moss Landing project by Vistra.

Meanwhile the 200MW/200MWh SPIC Huanghe New Energy Base project in Qinghai Province, China, was also completed last year, helping to offset a slowdown in the wider energy storage sector’s growth last year, the report said. BloombergNEF’s reporting of energy storage investment focused only on stationary storage projects and excluded pumped hydro, compressed air energy storage and hydrogen projects, with the latter accounted for elsewhere in the company’s Energy Transition Investment Trends report.

Additional reporting for Energy-Storage.news by Andy Colthorpe.

This story was adapted from PV Tech. Read the original, which includes further detail on BloombergNEF's findings, here.

Our publisher Solar Media is hosting the Energy Storage Summit 2021 in a new and exciting format, on 23-24 February and 2-3 March. See the website for more details.