As society moves away from centralised fossil fuel generators to increasing shares of distributed renewable energy resources, the idea that customers’ homes could become host to virtual power plants (VPPs), joining the dots between electricity supply and demand across the grid, has gradually gathered traction.

Since our reporting on the advanced energy storage industry began in late 2014, a quick look back shows that we’ve written about efforts and offerings from technology providers like Sunverge, Tesla, Sonnen, Enel X, Moixa and many many more, in territories from Kentucky to Canada, from Japan to Australia to Italy and elsewhere.

Using an interconnected, aggregated network of residential solar-plus-storage (and other) assets to provide energy and energy services in a smart way has always resonated with the clean energy industry. It provides some of the clearest answers so far to how we can integrate rising penetration of renewables while balancing the grid, by using batteries charged with sunshine to perform many of the roles that thermal generators would be called upon.

But while there have been some high profile projects moving from the pilot stage to larger commercial deployment in territories like South Australia and California, it’s not been an easy thing to scale up residential VPP offerings into mass appeal. Customer acquisition is difficult and so is proving to local utilities that aggregated home systems can be a valuable asset.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Swell Energy is perhaps the latest player on the scene to capture media attention, and for good reason. Having secured US$450 million for deployment, CEO Suleman Khan tells us that Swell now already has 300MWh of energy storage capacity under contract over the next three years or so, to come from devices in about 14,000 homes in regions including Southern California, Hawaii and New York.

It certainly hasn’t been an overnight success, with Swell Energy working since 2015 to productise an offering designed to appeal to both utilities and their customers. So what is different about what Swell Energy has been able to do in taking the residential VPP from a niche offering into the mainstream?

A lot of utilities get why in front-of-the-meter storage makes sense, but the surgical value of behind-the-meter energy storage is extremely important to show utilities.

From the business development standpoint, we ended up approaching utilities and saying, “Look, here’s your customer base, here’s your aggregate load. If you were to add storage to this portion of the customer base, you would really take your aggregate load down in periods where you want it to be down”.

We show them precisely how certain loads can be taken down on certain circuits in a surgical manner, as opposed to just a massive battery farm in the middle of the desert. In designing the VPP programme, we think about what makes sense for the customer, what makes sense for the utility, what role are we playing.

So that’s how we’ve made it a reality. Over five years, we’ve essentially approached utilities and we now have utility contracts that require 300MWh of energy storage capacity and that’s about 14,000 homes and it costs about US$450 million dollars to build through different programmes with maturities from anywhere between 18 months to three-and-a-half years.

Our efforts and our kind of chipping away at it has finally snowballed into something where we can say: “Hey, it’s a half a billion dollars worth of virtual power plants. There’s something here now.”

What made you realise the potential value of this type of offering all the way back in 2015 and made you and your colleagues want to “chip away” at this opportunity from so early on?

Since 2008, I’ve been working from a structured finance background to bring renewable energy to market. Back then, it meant taking a US$50,000 residential PV system and turning it into US$400 a month, so people — early adopters — could afford it. Today, it’s meant associating batteries into that, and really kind of taking it to the next level with dual revenue streams, one with the customer, one with the utility, and looping all that together.

Around 2013, I joined Tesla. And the idea there was to take all the learnings that we had from the solar structured finance space and see if we can apply them to batteries. What you now know as Tesla Energy was once called the stationary storage group. The batteries don’t have wheels, hence stationary storage, so our motto was: “Going nowhere fast!”

It was remarkably interesting to see a company that realised there was value in energy storage without wheels. The first thing that we did was create a commercial and industrial lease, where a retailer or a vineyard or something could adopt Tesla batteries and get Demand Charge mitigation (peak demand cost reduction). They got bill savings and backup energy.

We were going to try to find a way to aggregate them and get them into the utilities. This is before backup became really a point of focus in California and the cost of batteries obviously was at a very different level in 2013, 2014.

One of the things that we then developed at Tesla became known as the capacity maintenance agreement. This was for large utility-scale batteries. We would talk to a utility about adopting large in front-of-the-meter batteries. A one hour conversation around what was supposed to be business development would turn into things about technology: asymptotic degradation of batteries and the price curve of batteries.

Utilities are used to thinking about power plants and annual operating costs and maybe even degradation if it’s solar degradation — they weren’t used to thinking about battery degradation, about ownership of batteries.

I was tasked to basically come up with a way where we could get rid of that. We kind of borrowed a page out of the fuel cell textbook, because fuel cells also have a degradation issue. What we ended up productising was large-scale storage in front-of-the-meter to utilities where we could say, “Hey, here’s 20MWh of energy storage, and every morning that you wake up, there’s going to be 20MWh of juice in there for the next 20 years. We’re going to oversize on the beginning, every year, we’re going to show up at night and take some out, put some in, but you don’t have to worry about that, we’re going to manage this. Your pricing is also now levelised; you pay this much up front, this much every year”.

We turned it into storage-as-a-service. Even without financing it, even if they bought it, it was storage-as-a-service. And that’s when we came up with this capacity maintenance agreement.

The energy group of Tesla started growing. We’d started with commercial, went to utility-scale, then launched the residential Powerwall. I left to join my colleagues at Swell and the focus became to really try to be early in the market in doing two things: assessing and capturing homeowner interest and demand and assessing and capturing utility interest and demand.

From the beginning, we have spent just as much time thinking about the homeowner as we have about the utility and vice versa. After multiple, multiple utility conversations and negotiations and deals, we now have several contracts in hand that are mandating us to put virtual power plants in place.

So from solar to storage and of course solar with storage, it’s been about turning something with an emotional pull, into a product, to some extent. How has the process worked for virtual power plants?

I think the VPP concept is going to be ubiquitous, and a lot of developers will do it. We may just be early, maybe exceptionally early. I think there are a lot of companies destined for success with a VPP model in mind.

But the questions that I always ask are: How bankable is your utility contract? How rich is it? Is it long-term? Are the payments financeable? Can you take those utility payments and go to the capital markets and use them to bring down the cost of capital, use them to bring down the cost of ownership for the customer?

If the answers to all of those are “yes”, then congratulations, you have a bonafide utility contract. Then the next question becomes: have you turned that into a retail financial offer back to the customer or are you just giving customers kind of you know, a US$250 gift card to participate?

Productising participation in a virtual power plant is the other thing that we’ve done. It’s going to be a challenge, but we’ve proven to the utilities that we can get there, getting the financing locked in and creating a retail version of a capacity payment. Those have been our main achievements.

I’ve heard from a lot of different people that the customer acquisition piece is, in many ways, the hardest part of creating the VPP value proposition. Either the amount of money offered to the end-customer isn’t enough to entice them, or getting their engagement in other ways has sometimes not worked. Is that side of the business model evolving quickly for you?

You’re right, the Achilles heel in the industry has been customer acquisition costs. And we have found that our battery-centric approach, where there’s resilience, VPP participation, the whole circular thing where we productise the capacity payment back to them, works. People like it, people get it.

I would also say — and this is one of the untold secrets about the virtual power plant work we’re doing — the value from the utility isn’t just the capacity payment, the value from the utility is then helping us with customer acquisition. There are certain utilities that are giving us lists of tens of thousands of customers that we can reach.

So when you think about that utility sponsorship, it comes back to another theme: these distributed energy resources (DERs) can now become a real a bonafide part of the utility’s portfolio. That’s a big deal.

When you make solar non-threatening and you make it dispatchable and you make this virtual power plant a power plant that the utility can pay for and dispatch on a 15-minute basis, then they have an interest in helping you get the customers. If it was just solar, sure, but not exactly the same. When you turn this into an asset class… you take a solar panel, you add a battery to it — all of a sudden it becomes dispatchable. You aggregate a bunch of those, that becomes a virtual power plant.

It’s very different from a solar system and the utility benefits from it. And the biggest secret in my mind, the commercial secret that I’ve loved holding on to, is that the capacity payments are interesting, but guess what, we’re getting just as much value off the customer acquisition.

So it’s a different paradigm of customer acquisition when you can frame it in a utility-centric manner. Because all of a sudden, you might have a captive base of customers to go after.

From the end-customers’ point of view, what does this look like to them? You offer equipment including the Tesla Powerwall, but what sort of sizing is optimal for the customer and the utility, and how do you ensure that it’s all co-optimised to meet the needs of both?

The equipment right now is typically any OEM. This is beautiful, because in 2021, the number of OEMs that are coming out with batteries is phenomenal. I love Tesla, used to work there and we love the folks. We’re one of their biggest customers on a wholesale basis. But it’s fantastic to see three or four new technologies coming. And [we use] our software platform.

You can think about it as roughly kind of a 5kW PV system, with 10 kWh battery, something in that range, that 5kW produces enough energy to fill that whole battery and some.

We negotiate with the utility and look at the utility’s aggregate load. We look at when the grid is most stressed, then come back to the utility and say, “Look, these are the operating parameters during which we think that you’re going to get tremendous value from our VPP fleet. And for that, we think you should pay us this much money”.

Knowing what those operating parameters are from the utility are going to be, we go to the customer side and develop a retail offer that accommodates those. And there’s some chicken and egg here. The parameters that we offer the utility are not only those that are most meaningful to the utility, but also conform to how we’re going to offer this to the customer.

So our VPP in California with Southern California Edison is at a new home development and there’s a lot of load growth associated with new home development. So it is a non-wires solution type of programme, where the utility could add batteries and defer adding more distribution equipment onto the grid for some time because of our VPP. That’s the core motivation. Well, within that core motivation, what is the time during which the utility needs it most? Roughly between 4pm to 10pm.

The customer also needs it most when energy is most expensive, around that 4pm to 10pm range. Then we need to make sure that we also have some reserved for the customer for backup.

So typically, what we say to a customer is, suppose you’re not in a virtual power plant programme, you’re going to want to do two things: dispatch the system for time-of-use arbitrage so you get bill savings, and keep some energy in case there’s an outage. Whatever ratio they’re comfortable with, putting the VPP aside, they can let us know.

What we typically recommend is to use 80% of your battery daily to save money, and leave 20% saved. If you have solar and the power goes out, 20% will get you through the night. And the next morning, the sun’s up, and you’re not going to dispatch your battery.

Whatever the customer’s preference for security versus money is, is established irrespective of the VPP. And then we roll in the VPP. We say, “Okay, you want 80% of your battery to be used to make money? Well, let us determine when that happens, let us determine how much of that happens when you’re saving money, versus when the utility needs it.” We haven’t fundamentally shifted their preference for money-making and security.

You have to have the right co-optimisation between the utility use case and the retail use case. And you can’t mess it up. And if you do, you have to make sure the utility’s paying you enough to compensate for it.

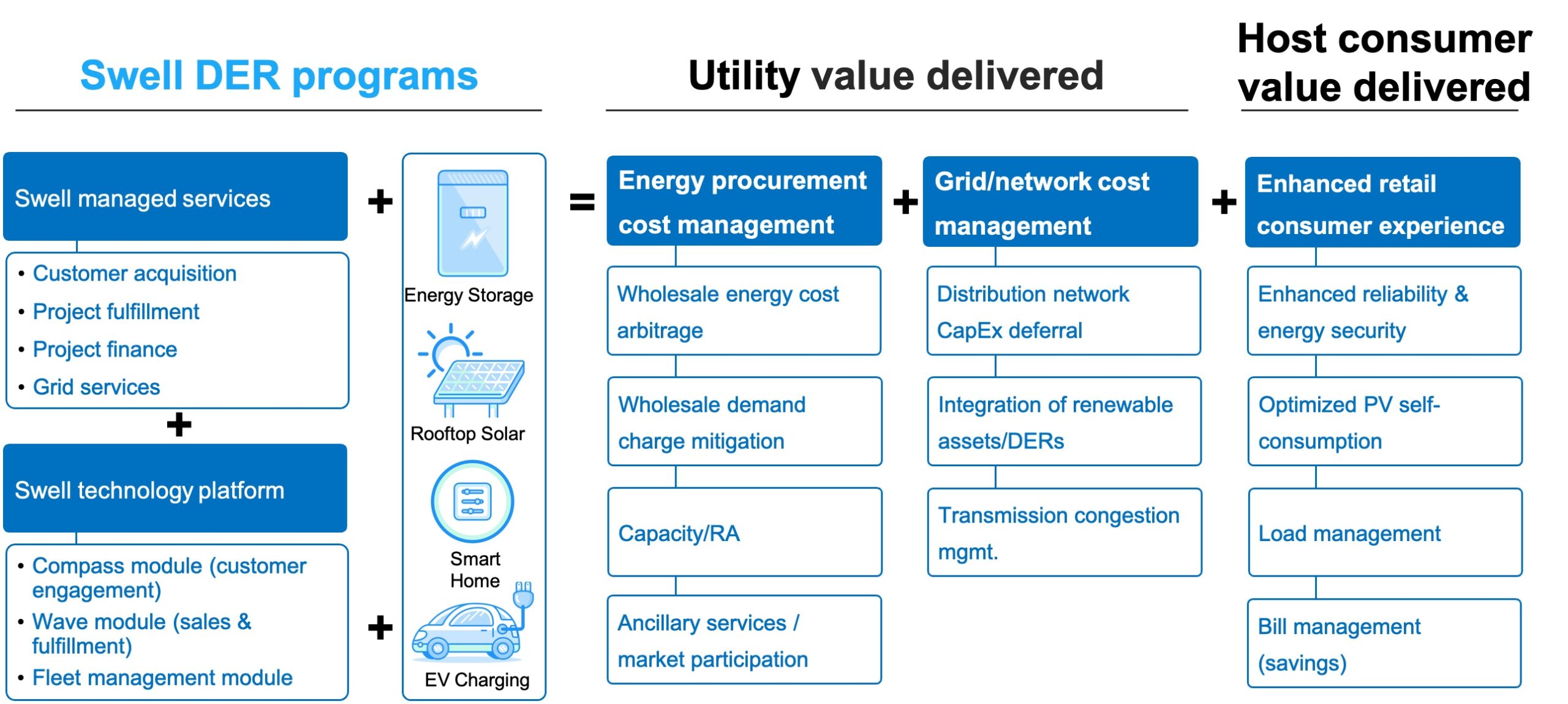

Cover image: The VPP proposition, simplified. Image: Swell Energy.

Read Part 2 of this piece, ‘From customers’ homes to utility portfolios: Inside Swell Energy’s new virtual power plant reality,’ here.