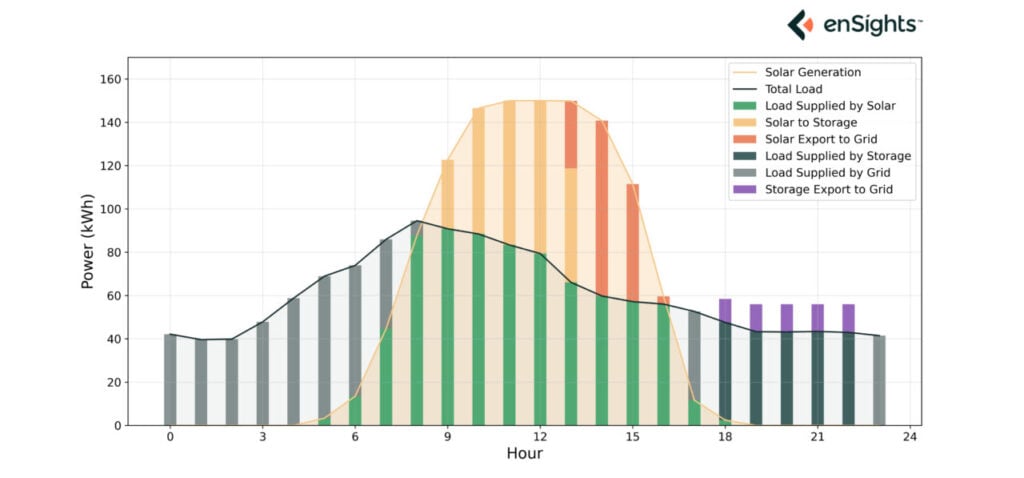

Renewable energy portfolio management software company EnSights has launched a tool for calculating the optimal sizing of battery energy storage system (BESS) projects.

Getting the sizing right for battery storage assets is central to the business case for most projects; if a system is too small, its operators won’t be able to fully capture market opportunities. If it is too large, its owners and investors will have overspent relative to the revenues they can earn.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The new calculator aims to replace some of the more cost- and labour-intensive BESS design steps that this work represents.

EnSights claimed it can generate financial projections instantaneously and recommend the ideal battery size and project operation modes. It does this by assessing the size and technical capabilities of a proposed BESS against revenue data from energy and grid services market opportunities.

EnSights co-founder and CEO Alon Mashkovich said the new tool can help decision-makers mitigate some of the risks that the energy storage market still represents despite its rapid growth and the “great deal of opportunity.”

These risks include high capital costs, energy price volatility and incentive structures that can vary from state to state, or across different transmission areas and wholesale markets.

“We developed our storage calculator to not only mitigate these risks for decision-makers but to make BESS design cost-effective so that energy stakeholders can unlock market opportunities while maximising battery lifespan.”

Responding to customer demand

The product was developed in response to enquiries from customers who said that their ability to deploy battery storage was “severely limited and slowed” by the complexity of battery optimisation, EnSights’ chief product officer and co-founder Roy Fadida, said.

Fadida claimed that customers who have beta tested the calculator have already “significantly accelerated their battery deployment to meet growing demand in one of the fastest-growing storage markets.”

The software-as-a-service (SaaS) company created its BESS calculator with a proprietary model that balances financial returns over a system’s lifetime with the optimal asset lifespan.

In other words, it takes battery specifications and degradation parameters that include round-trip efficiency (RTE), depth of discharge (DoD), and charging and discharging cycles and calculates the trade-off between earning revenues from market opportunities and the impact that might have on the asset.

To date, EnSights has provided an AI-driven, cloud-based centralised monitoring and asset management platform for renewable energy installations and portfolios ranging in scale from residential to commercial & industrial (C&I) and utility-scale.

It joins a small handful of other software-based solutions available for calculating BESS returns and modelling system size, including products from Energy Toolbase and RatedPower.

EnSights, which is launching the product at the forthcoming RE+ clean energy industry show in Anaheim, California, in September, said the calculator is suitable for both hybrid solar-plus-storage projects as well as standalone BESS installations. EnSights can also onboard BESS projects to its asset management, monitoring and control platform, the company said.