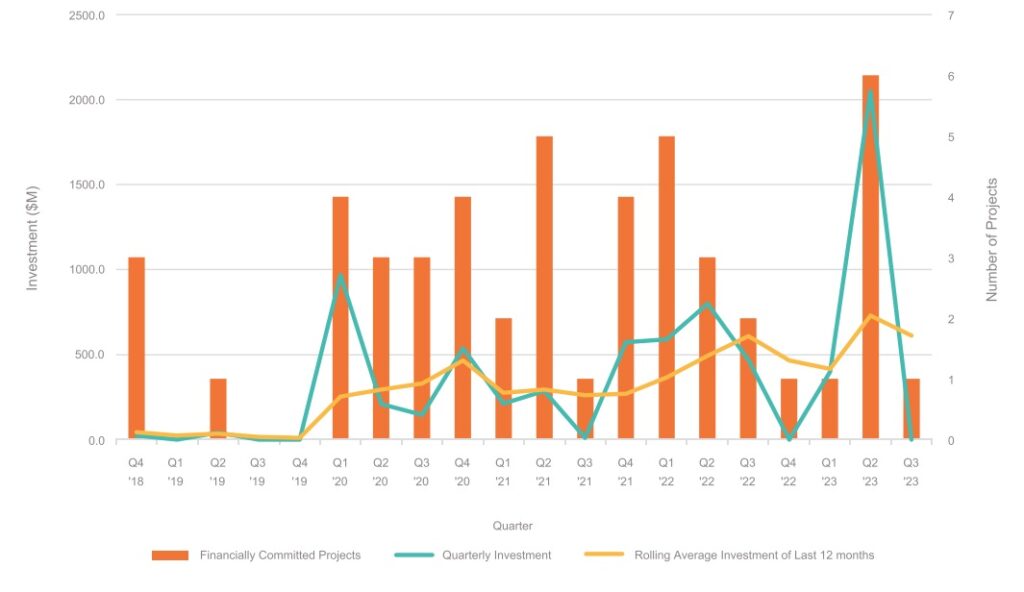

Financial commitments into utility-scale battery storage in Australia plummeted from 1,497MW in the second quarter of this year to just 13MW in Q3 2023, although roughly ten times as much large-scale storage in megawatts and seven times in megawatt-hours have been commissioned so far this year compared to last.

The financings of six large-scale battery energy storage system (BESS) projects including the Waratah Super Battery were committed to in Q2, breaking the AU$1 billion (US$6.5 million) mark within a single quarter for the first time. Just one project, a hybrid solar-plus-storage project at a mining site, reached that point in the quarter just gone.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The figures come from the Q3 2023 edition of the national Clean Energy Council’s ‘Renewable projects quarterly report’. The findings on energy storage feature alongside similarly low-key showings for the utility-scale solar PV and wind sectors, indicating that despite Q2’s success for big batteries, it has been a “challenging year” for renewable energy, according to the trade group.

During Q3, only 161MW of generation capacity from two solar PV projects was added to the country’s installed base of utility-scale renewables, while the total financial commitments added up to AU$150 million – in both cases representing the fourth-lowest quarterly totals since CEC began tracking project data in 2017.

Just one large-scale standalone battery storage asset, the 250MW/250MWh Torrens Island BESS in South Australia, reached commissioning in Q3, and just one began construction, the 200MW/800MWh Kwinana Big Battery 2 in Western Australia.

While looking at the year as a whole, commissionings of new BESS projects are at an all-time high and represent roughly ten times the amount of money invested into the technology as was seen in 2022, investment decisions on those projects will likely have been made at least a year to 18 months ago.

Indeed, across all three technologies, just 509MW of grid-scale projects had been financially committed to this year by the end of September. CEC chief executive Kane Thornton noted that this is far from being on-track to enable the 6.9GW of annual renewable energy additions Australia needs to meet the Federal government’s 82% renewables by 2030 policy target.

Thornton said investment in large-scale clean energy has been declining gradually since the Renewable Energy Target (RET) scheme ended in 2020. The RET had called for 33,000GWh of renewables generation to be added to the grid. It was met ahead of schedule in 2019, albeit this was perhaps at least partly due to the target having been lowered in 2015 from 41,000GWh.

“The rate of investment slowed more dramatically over the past year as a result of higher project costs, complex permitting processes, a congested grid and intensifying global competition in the race to net zero,” CEC’s Kane Thornton said.

“While renewable energy remains the lowest cost form of new generation, there is a clear role for government to facilitate the enormous levels of investment needed to transition our energy system, particularly in an era of significant global competition, due to incentive packages like the US Inflation Reduction Act (IRA).”

‘Strong investor interest’ looking for policy signals to match

There are clear signs the government recognises this, the ruling Labor Party having been elected in 2022 on a campaign platform strongly emphasising commitments to climate crisis mitigation through renewables.

It has just launched a contracts for difference (CfD) tender scheme for dispatchable renewable energy capacity, which will solicit investment into 32GW of clean energy, including 23GW of renewables and 9GW of storage-backed firm renewable capacity.

Based on an expansion of an existing Capacity Investment Scheme (CIS), the tender launch was described recently by energy economics expert Professor Bruce Mountain at the Victoria Energy Policy Centre as: “the biggest news in Australia’s electricity policy for as long as we can remember”.

CEC’s Thornton meanwhile said the CIS and other “strong policy settings” could “unleash the strong investor interest in Australia”.

Q4 could be better for BESS at least, if not for solar and wind

That said, while large-scale solar PV and wind are likely to continue to struggle in the final quarter of the year and perhaps do so until some of those policy moves are implemented and take effect, it does appear Q4 is already shaping up to be much stronger for battery storage.

Announcements of projects reaching financial close or on which a final investment decision (FID) was made, covered by Energy-Storage.news since the end of September include a 185MW/370MWh system by developer Edify Energy in the Murray River region of Victoria, a 150MW/300MWh project by Akaysha Energy in Queensland.

State-level commitments to battery storage look pretty healthy for Q4 as well: 2,800MWh of battery energy storage system (BESS) projects were awarded contracts through a tender for firming capacity hosted by the government of New South Wales, partly also supported with funding through the CIS; this week construction began on a 600MW/1,600MWh project in Victoria which is being invested in by the State Electricity Commission (SEC).

The contrasting fortunes of BESS with its solar and wind counterparts is likely due to the ability of battery storage to earn spot market revenues in the National Electricity Market (NEM), which has been experiencing extreme levels of price volatility, leading to an urgent need and also a strong business case for the time-shifting arbitrage applications BESS can provide. Separately to the NEM, spot market price dynamics in the Wholesale Electricity Market (WEM), which covers Western Australia, are thought to be similarly attractive for battery storage.

A table included in the CEC report, below, shows that 2023 is shaping up for the biggest year to date for large-scale batteries in terms of commissionings and the amount of money invested that represents:

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Number of projects | 1 | 3 | 4 | 2 | 5 | 4 | 6 |

| Investment (AU$ millions) | 90 | 128.9 | 71.6 | 131.6 | 373.8 | 86.9 | 780 |

| Output (MW) | 100 | 90 | 155 | 163 | 431.7 | 69 | 597 |

| Capacity (MWh) | 129 | 115 | 185 | 198 | 693 | 101 | 723 |