Battery storage has a big role to play in helping reduce renewable energy curtailment in California but the amount of shedded load will still grow in 2023, an analyst told Energy-Storage.news.

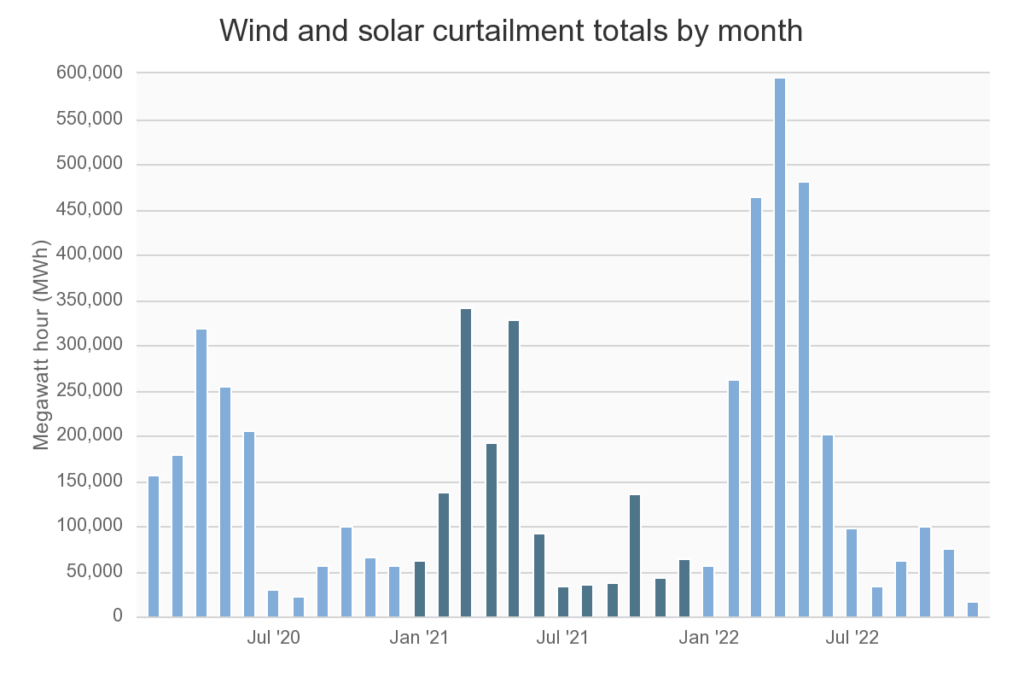

Grid operator CAISO recently revealed that a total of 2.4TWh of wind and solar production was curtailed over the course of 2022, of which roughly two-thirds occurs in March-May.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

This is because conditions become favourable to solar PV generation before peak summer demand meaning lots of excess solar in the middle of the day, said Eric Hinojosa, energy analyst for BTU Analytics. This leads to renewable power producers reducing their output, either voluntarily through price dynamics, or at CAISO’s request.

Battery storage is set to play a big role in reducing this by shifting that excess load away from the time of generation to the time of need.

“Batteries are helping by buying power when it’s cheapest and then moving that into the evening hours when it’s more expensive. It’s classic arbitrage, done on the intraday market,” Hinojosa said.

In a blog in mid-2022, he estimated that as of April that year battery storage could already be preventing as much as 2.2GWh of renewable curtailment a day in California through doing this.

Interestingly, CAISO’s storage sector manager Gabe Murtaugh told Energy-storage.news in April 2022 that battery storage was shifting up to 6GWh of energy a day from low-price to high-price periods, but that the majority of this was just moving mainly gas-generated energy across the day, rather than renewable load shifting.

By 2025, battery storage could help CAISO avoid up to 23.6GWh of renewable energy curtailment a day, Hinojosa estimated in the blog. He calculates his estimates using total battery storage connected to the grid multiplied by a 30% ‘capacity factor’ – an estimate for how much a battery is actually used for load shifting, relative to its actual nameplate capacity.

“We’re starting to see a lot more battery growth and that’s where the sizeable effect on curtailment will come from. But CAISO along with (Texas’) ERCOT are at the forefront of this so they’re still trying to figure out new mechanisms in which battery storage can effectively participate in,” he added.

The amount of battery energy storage connected to CAISO’s grid has increased by 70% since April 2022, from 2.7GW then to 4.6GW as of end-2022, as per the grid operator’s most recent figures. Hinojosa said that curtailment will nonetheless continue to rise in 2023 at least.

“I’m interested in at what point we see curtailment start to plateau, or whether it will always be rising. Will we hit a point where battery storage actually mitigates the rise of curtailment? Even if you added an infinite number of batteries today, you’d still get curtailment because it’s a transmission infrastructure problem too.”

Curtailment increased substantially in 2022 compared to the two previous years as shown in the graph below. Curtailment can either be requested by CAISO or occur voluntarily through market mechanisms, for example if prices fall below certain thresholds and producers opt to stop selling energy.

BTU Analytics is a US-focused oil, natural gas and power analysis consulting firm which was acquired by business analytics provider FactSet in 2021.

This article was amended after publication to reflect updated figures for prevented curtailment by battery storage, provided by BTUAnalytics.

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 28-29 March 2023 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.