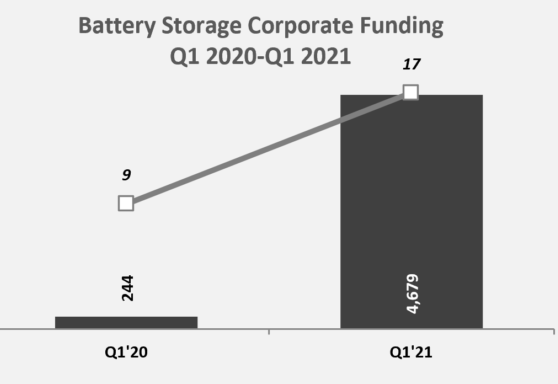

Corporate funding into the battery storage sector in the first quarter of this year totalled US$4.7 billion across 17 deals, a huge leap from the equivalent period of last year, according to a new report from Mercom Capital.

Research firm Mercom Capital’s quarterly report into the battery storage, smart grid and energy efficiency sectors tracks financial activity in corporate funding, venture capital (VC) and mergers & acquisitions.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

While last year’s first quarter saw just nine battery storage corporate funding deals go through, worth US$244 million in total, the sector appears to have gradually rebounded through 2020 and the fourth quarter saw 19 deals closed, worth US$3.1 billion, which was immediately outperformed in Q1 2021.

In fact, looking back through previous editions of the Mercom report, the US$4.7 billion corporate funding raised last quarter in battery storage was equivalent to the amount raised by total corporate funding across all three sectors covered by the report in the first nine months of 2020.

As might be expected, there was a drop in funding in the early part of last year, thought to be based largely on impacts from the COVID-19 pandemic, but investment rebounded across all three clean energy sectors covered. Nowhere was this more pronounced than in battery storage, where Mercom reported total corporate funding at the 2020 year-end of more than US$6.5 billion, more than double the previous year’s total of around US$2.8 billion.

Sector close to billion dollars in VC funding over three months

VC investor deals in battery storage almost hit the billion dollar mark in Q1 2021, with US$994 million raised from 13 deals, compared to US$164 million raised in Q1 2020. The whole of 2020 saw US$1.5 billion of VC cash go into battery storage companies, with this year’s first quarter apparently boding well for the year to beat out 2020’s performance, which itself was a slight drop from US$1.7 billion raised in 2019.

Last year — and the year before that — the success of Swedish battery manufacturing startup Northvolt in raising funding including US$600 million in equity financing announced in September 2020 contributed a large portion of the year’s total, particularly in VC funding.

In Q1 of this year, US-based advanced anode materials startup Sila Nanotechnologies was the star, raising US$590 million in a Series F round from investors including technology-focused group Coatue Management and institutional investment from the Canada Pension Plan Investment Board. Sila incidentally also won US$10 million of funding earlier this year from the Advanced Research Projects Agency – Energy (ARPA-E) of the US government Department of Energy (DOE), which in January awarded US$47 million to seven different startups and their technologies that had been identified to have the potential to make a real-world impact if they can successfully scale-up into commercialisation.

Also in the top five as reported by Mercom for VC funding in the battery storage sector were:

- Forsee Power, a French manufacturer of advanced modular lithium-ion battery systems for transport applications

- Oregon-headquartered energy storage system technology provider and integrator Powin Energy, which told Energy-Storage.news in February that it had raised “in excess of US$100 million” from investment groups Trilantic North America and Energy Impact Partners

- Enevate, a US battery fast-charging solutions for electric vehicles, which raised US$81 million in a Series E funding round

- Malta, a US-based startup working to commercialise a novel thermal energy storage technology which raised US$50 million in a Series B funding round from high profile investors including Facebook co-founder Dustin Moskovitz and Bill Gates’ Breakthrough Energy Ventures.