ESS Inc, among several companies looking to commercialise a flow battery energy storage technology, has netted US$13 million in a Series B funding round from investors that include global chemical company BASF.

Portland, Oregon-headquartered ESS Inc. said on Tuesday that it has persuaded a mix of new and existing investors to contribute to the funding. The company makes an ‘iron flow battery’, branded Energy Warehouse, that ESS claims is “safe, low-cost and long-duration”.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

With the money, the company intends to begin scaled manufacturing of the product, adding automation to its lines. ESS believes the US$13 million could enable construction of a facility with 900MWh annual production capacity. Funding will also be used to further business development activities, working with energy storage system integrators and project partners to promote the batteries.

Participants in the round new to ESS alongside BASF included Cycle Capital Management, a clean tech, sustainability and infrastructure investor, Presidio Partners, which includes investing venture capital for technologies in its activities and InfraPartners Management, an asset and fund manager and advisory firm.

Chemical firm BASF has made other recent investments in or partnered with energy storage sector companies including a €400 million investment in a collaborative venture with Norilsk Nickel (Nornickel) for the supply of raw materials for lithium-ion batteries. It is also one of several companies involved in the creation of an industrial-scale pilot production plant for “automotive-grade” lithium-ion cells at Germany’s Centre for Solar Energy and Hydrogen Research Baden-Württemberg (ZSW).

“BASF is committed to supporting new energy technologies that can transform businesses and communities by adding flexibility, expanding use of renewable sources, and building a sustainable future. After conducting extensive research across a range of battery technologies, designs and developers, we’ve concluded that ESS offers a superior combination of low-cost, clean, safe and long-life chemistry; scalable architecture, and management experience,” BASF Venture Capital managing director Markus Solibieda said.

“Based on an in-depth review of a wide variety of existing solutions, we invested in ESS because they have the cleanest and the best low-cost energy storage solution on the market,” Cycle Capital founder and managing partner Andrée-Lise Méthot said.

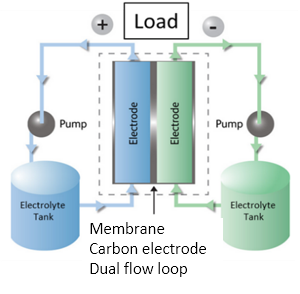

Energy Warehouse typically has an energy storage duration of four hours to eight hours, for use both in-front-of and behind-the-meter. The turnkey system is housed in a 40ft shipping container, as are solutions by many rival energy storage system providers. As with Primus Power’s zinc bromine battery, the flow system uses a single tank design for its energy storage and managing the system’s electrolytes. Electrolytes are a mix of iron, salt and water, according to ESS. The system can be shipped ‘dry’ and then hydrated in-situ, which ESS claims shaves off further costs.