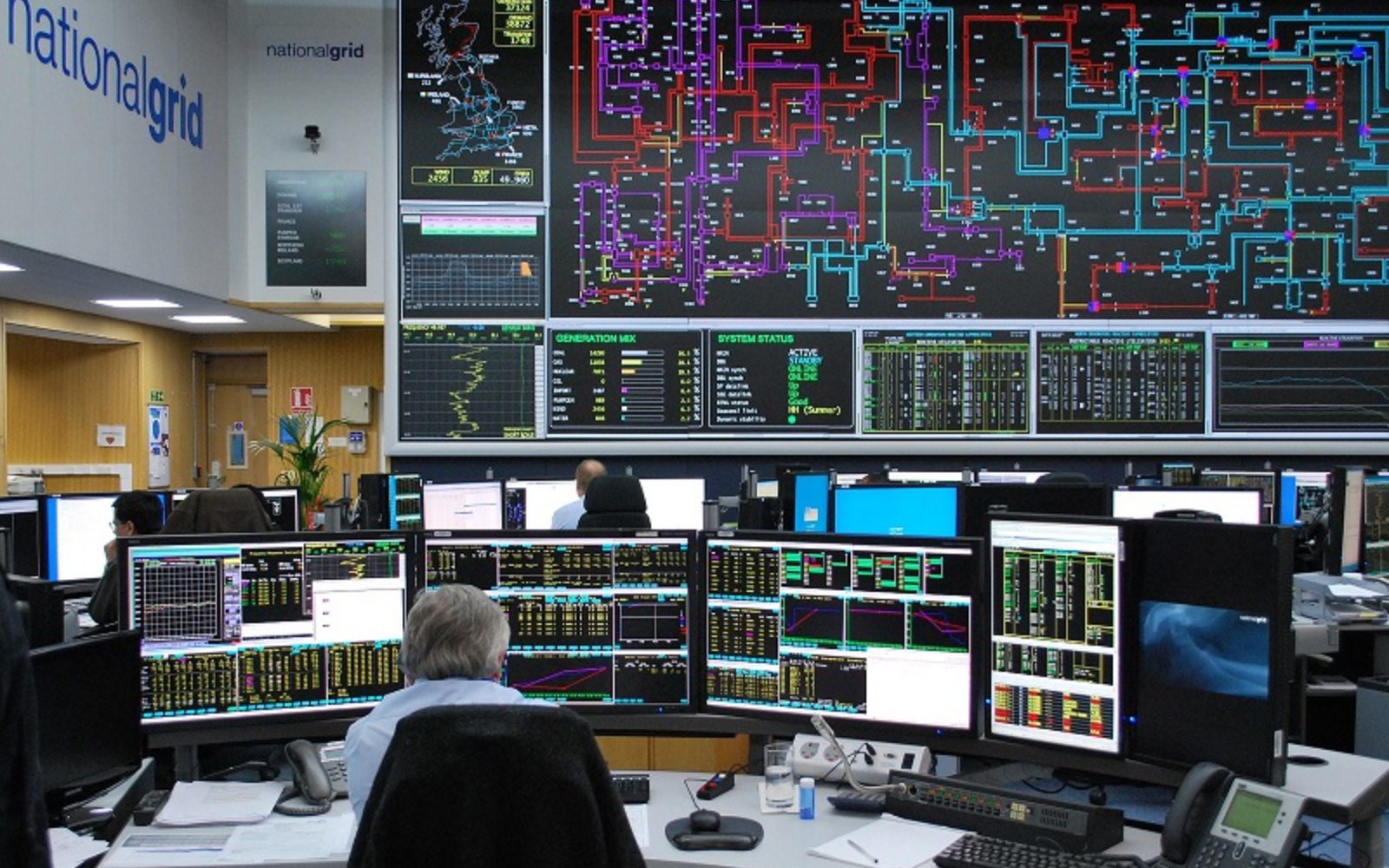

The greatest value aggregrators putting batteries and other assets in the UK’s electricity markets offer to their customers today is in providing access to the Balancing Mechanism (BM), through which the electricity system operator National Grid ESO matches supply and demand in real-time.

This was a key topic of discussion in a panel session on the role of flexibility, both large scale and at a domestic level, in energy systems across Europe during the Energy Storage Virtual Summit, hosted online by our publisher Solar Media.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Speaking as part of this session, Christopher Brown, M&A and strategy at Alexa Capital, said that moving forwards, the value for aggregators is “definitely going to be in the direction of providing Balancing Mechanism access” over access to the traditional markets, with energy storage providers now doing their own bidding into Firm Frequency Response (FFR).

This is particularly relevant as the BM was this year opened up to allow independent aggregators – dubbed Virtual Lead Parties (VLP) when trading in the BM – to access the mechanism without a supply license.

However, the players in this space “have definitely changed over the last six months”, Brown said, explaining how traditional infrastructure players “have dominated since 2013/14” but that since the BM has started to widen “there’s been a seat shift in the guys interested in this market”.

He pointed to companies like grid-scale battery asset optimiser Habitat Energy, which recently became the second company to enter the BM as a VLP, stating that he thinks “we’ll see more of those guys in the market”. Habitat said in early September that it has put 100MWh of UK battery storage assets into the BM.

This is despite the aggregator space “being pretty crowded now”, with Brown saying he thinks “we probably have enough aggregators”, with the question now being “how we build capacity out in the long term”.

The role of aggregators in the domestic market was also discussed, with the panelists unsure of whether an aggregator, supplier or in the case of vehicle-to-grid (V2G) a car company should be interacting with the consumer when it comes to domestic flexibility. However, James Sprinz, vice president, strategy at Energy Impact Partners, said that he felt it should be either car companies or suppliers as consumers are already familiar with both and in the case of car companies, have a level of brand loyalty.

Brown explained how he doesn’t see a way of monetising domestic flexibility as it stands, whether that’s using home batteries or V2G technology.

To read the full version of this story visit Current±.

Watch ‘The future is arbitrage, a deep dive into the merchant model’, presented by Habitat Energy founder Ben Irons, which aired at the Energy Storage Digital Summit earlier in the year and hear about the UK market’s move away from an emphasis on contracted revenue streams for supplying grid services, as well as some discussion on what the outlook is in Australia’s electricity markets for trading energy through batteries.