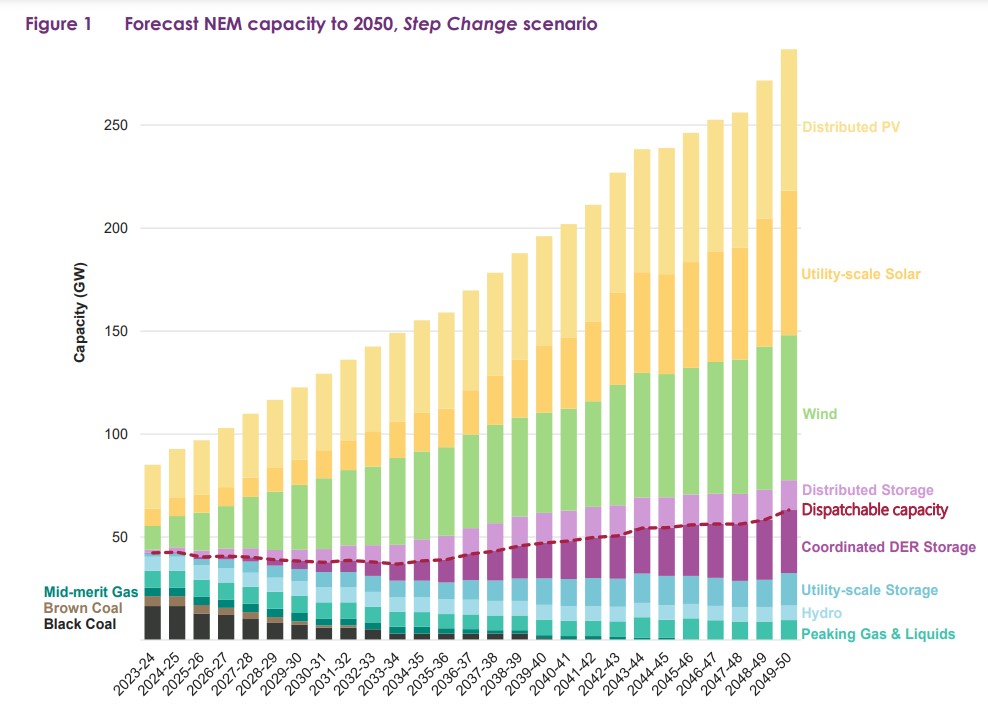

As the role of coal declines and ends in Australia’s National Electricity Market (NEM), huge growth in dispatchable energy storage capacity will be needed in the mix, along with other technologies.

The Australian Energy Market Operator (AEMO) has this week launched its Integrated System Plan (ISP) which offers a 30-year roadmap for reliable and increasingly low carbon-based operation of the NEM, which AEMO oversees and runs.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

As the share of solar PV and wind – which are both variable sources of generation – grows in the NEM’s generation mix, other resources are needed to integrate that capacity and balance the grid.

AEMO noted that as of today, about 23GW of dispatchable firm capacity comes from coal-fired generation and 11GW from gas and other liquid fuels. A further 7GW is sourced from hydroelectric excluding pumped hydro energy storage (PHES) and just 1.5GW from dispatchable energy storage, a category that includes both batteries and PHES.

By 2050, the firming capacity needed will need to be met without coal, the use of which is not only incompatible with Australia’s climate and environmental goals but is also becoming less and less economically competitive within the NEM’s structures.

That latter trend is set to continue with ongoing market reforms that favour faster-responding and clean resources like storage and inverter-based renewables, from some already implemented, like five-minute settlement (5MS) periods to others like distributed energy resource (DER) integration and congestion management measures, which are being considered.

AEMO foresees a firming capacity mix by 2050 that includes:

- 46GW/640GWh of dispatchable energy storage

- 7GW of existing non-PHES hydro

- 10GW of gas-fired peak loads

Interestingly, AEMO expects a large majority of the dispatchable storage to come from distributed-level storage resources that could include virtual power plants (VPPs), vehicle-to-grid (V2G) and other emerging technologies.

This comes largely off the back of already-high and continually increasing uptake of rooftop solar PV across most of Australia and AEMO noted that it will become more common to install home solar with battery storage than without.

Around 31GW of the forecasted need for storage would be met by distributed resources, with about 16GW of utility-scale batteries and pumped hydro.

It seems likely however that given the capacity given in MWh figures would extend storage duration to more than 10 hours on average, a higher proportion of megawatt-hour capacity would come at bulk, or utility-scale locations.

In the shorter term, the ISP also highlights some immediately actionable proposed projects. Large-scale transmission infrastructure buildout projects compromise that list.

Some of those transmission investment plans include energy storage: one is a transmission hub for New South Wales which would enable the state government’s Waratah Super Battery project and 1,500MW of interconnection capacity between Victoria and Tasmania, which would enable Tasmania’s Battery of the Nation plan to send renewable energy generated on the island state and stored with batteries and PHES into the mainland NEM.

For further details and a digested read of the plans from a solar PV and renewable energy perspective, see our colleagues’ comprehensive coverage of the ISP at PV Tech, or visit AEMO’s site to read the ISP in full.

Additional reporting by Sean Rai-Roche.