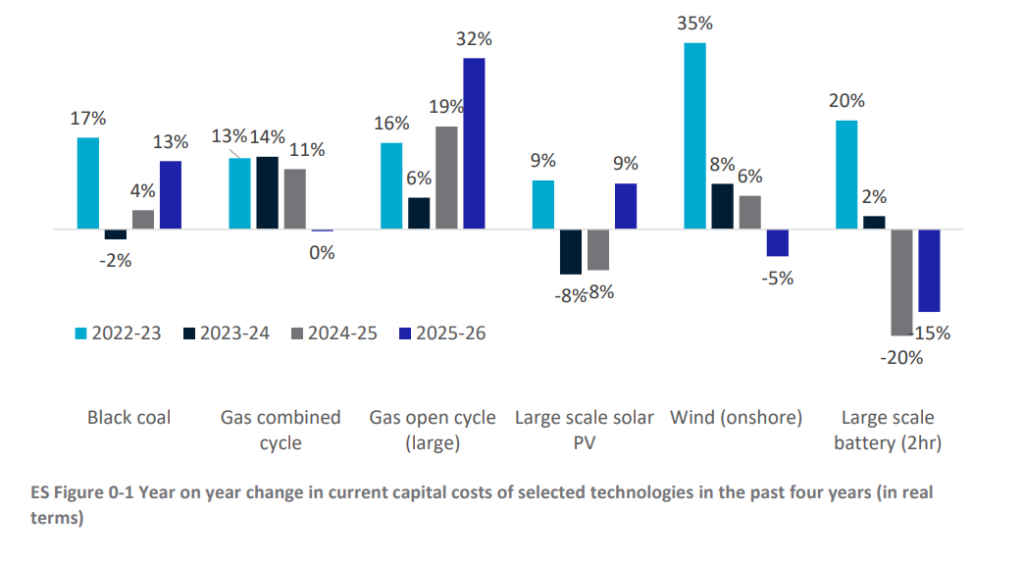

While coal and gas power plants grappled with cost increases of up to 32% between 2024 and 2025, Australia’s battery storage sector delivered a different story, with costs plummeting across all durations.

This is according to the seventh annual GenCost report from CSIRO, Australia’s national science agency, and the Australian Energy Market Operator (AEMO), an economic publication that aims to support business leaders and decision-makers in cutting emissions.

The report reveals that large-scale battery storage systems achieved cost reductions of between 11% and 16%, depending on the duration, in 2024-25, marking the technology’s consistent performance in driving down capital costs over multiple years.

This stands in stark contrast to fossil fuel technologies, with large gas open-cycle plants experiencing a 32% cost increase and black coal plants rising by 13% over the same period.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The findings align with global trends documented in BloombergNEF’s Energy Storage Systems Cost Survey 2025, which found the global average price of a turnkey battery energy storage system (BESS) reached US$117/kWh in 2025, representing a 31% decline from 2024 numbers.

Although the annual survey last year found a global average of US$165/kWh, which would imply a 29% difference, BNEF adjusted figures for inflation and revised its 2024 number to US$169/kWh.

Prices are now at their lowest since the market research and analysis group began its survey in 2017, although an even sharper 40% drop was recorded from 2023 to 2024.

CSIRO’s GenCost report positions energy storage as a critical component of Australia’s pathway to net zero emissions by 2050, with battery storage systems forming part of the least-cost technology mix alongside solar PV, onshore wind and either natural gas or hydrogen.

The analysis found that achieving the electricity sector’s efficient role in whole-of-economy net zero abatement would result in electricity costs between AU$135/MWh (US$90/MWh) to AU$148/MWh in the National Electricity Market (NEM) by 2050, inclusive of new transmission costs.

CSIRO’s modelling indicates that reaching the 2030 target of 82% renewables would produce an average electricity cost of AU$91/MWh, including transmission, or AU$81/MWh for wholesale generation costs alone.

These projections assume continued deployment of storage technologies to manage the integration challenges associated with high renewable energy penetration.

Battery storage costs fall across all durations, while pumped hydro sees major reassessment

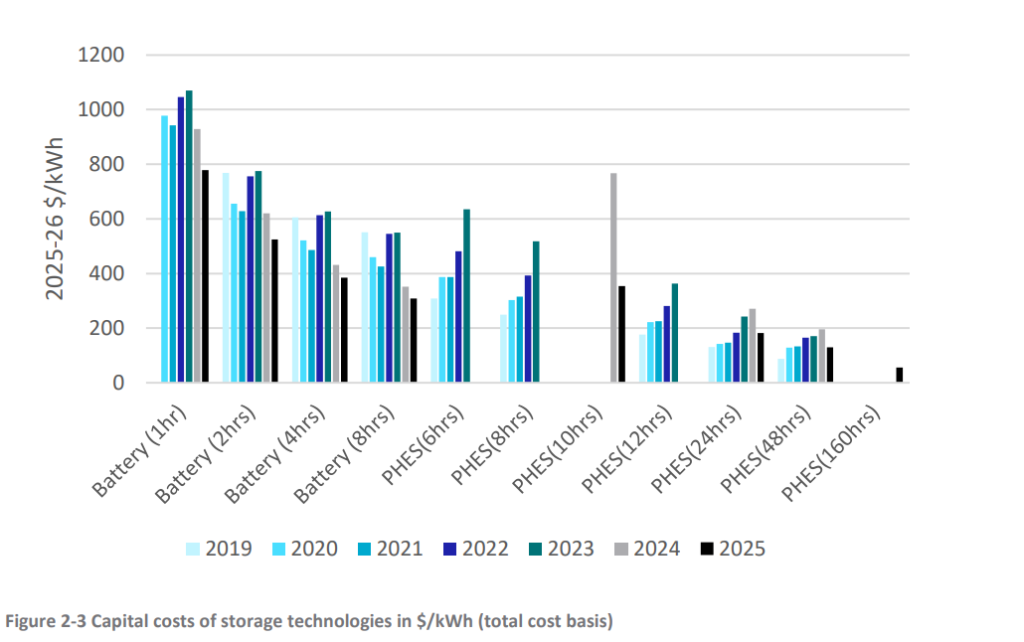

The report presents updated capital cost estimates, revealing significant cost reductions across various storage technologies and durations.

Battery costs decreased by 11% to 16%, depending on the storage duration, with the technology demonstrating consistent cost improvements across both short- and long-duration applications.

Pumped hydro energy storage (PHES) current cost estimates have decreased dramatically by 34% to 55%, although CSIRO notes that these decreases represent a reassessment of costs rather than technological change.

The report emphasises that PHES carries a wider range of uncertainty due to the greater influence of site-specific issues, while batteries are more modular with costs relatively independent of location.

The cost structure analysis reveals important deployment patterns for different storage technologies. Battery capital costs in AU$/kW increase as storage duration increases because additional storage duration adds costs without adding power capacity. This trend explains why battery storage tends to be deployed in applications with short storage durations, while PHES is deployed in applications with longer durations.

Conversely, AU$/kWh costs tend to fall with increasing storage duration as more battery storage systems or larger reservoirs are included in projects while power components remain constant.

The report notes these AU$/kWh costs represent storage capacity rather than energy delivered, with levelised costs of storage available separately in CSIRO’s Renewable Energy Storage Roadmap.

The new methodology for calculating System Levelised Cost of Electricity (SLCOE) provides greater transparency in how integration costs are assessed.

This approach directly incorporates electricity costs into system models by dividing all system costs from multiple technology deployments by total useful electricity supply, providing a comprehensive view of how storage contributes to overall system efficiency.

CSIRO’s analysis suggests that combinations including storage consistently delivered lower system costs than alternatives relying solely on dispatchable thermal generation.

The modelling found that achieving weak or no progress in reducing electricity sector emissions between 2030 and 2050 would not be efficient for reaching net zero, as the costs of reducing electricity sector emissions are substantially less than those of abatement elsewhere in the economy.

Market dynamics favour flexible storage deployment strategies

The cost trajectory divergence between storage and conventional generation technologies has accelerated over the past year.

While battery storage achieved its cost reductions across all durations, onshore wind showed tentative signs of stabilising after experiencing increases in 2022-23.

Large-scale solar PV costs declined 5% in 2024-25, continuing the technology’s downward trend despite previous inflationary pressures.

Gas combined cycle plants experienced a 9% cost increase, adding to concerns about the economic viability of gas-fired generation as a long-term solution for grid stability.

The report attributes these increases to general rises in gas turbine and steam turbine costs, reflecting ongoing supply chain pressures that have disproportionately affected fossil fuel technologies.

The COVID-19 pandemic’s impact on global supply chains initially affected all technologies, but recovery patterns have varied significantly.

Battery storage technologies have demonstrated supply chain resilience and manufacturing process improvements, enabling continued cost reductions despite other sectors struggling with persistent inflationary pressures.

The report also reveals additional cost advantages for battery integration, with systems integrated within existing power plants achieving around 5% lower costs for 1-hour duration battery storage systems through shared power conversion technology.

This advantage translates to a 1% cost reduction for 8-hour duration systems, whereas PHES faces greater co-location challenges.

The cost performance of battery storage technologies positions them as increasingly competitive against traditional peaking and intermediate generation sources. With global BESS prices continuing their downward trajectory, Australian projects can expect to benefit from ongoing technological improvements and manufacturing scale efficiencies.

For context, generation prices currently account for approximately 33% of retail electricity prices, with transmission accounting for 7% and distribution for 34%.

As storage costs continue declining while transmission and distribution costs remain relatively stable, the technology’s contribution to overall electricity affordability becomes increasingly significant.

The Energy Storage Summit Australia 2026 will be returning to Sydney on 18-19 March 2026. To secure your tickets and learn more about the event, please visit the official website.