A week of claimed first-of-their-kind advances in Germany’s BESS market, including the combination of monitoring, diagnostics and energy trading on one platform, an optimisation deal allowing multiple companies to trade one asset virtually, and a law change accelerating permitting.

In summary:

- Investor Dynamic is deploying a BESS where digital monitoring, battery analytics and diagnostics, and energy trading are combined into one single, co-ordinated system: an industry-first according to the analytics provider Volytica

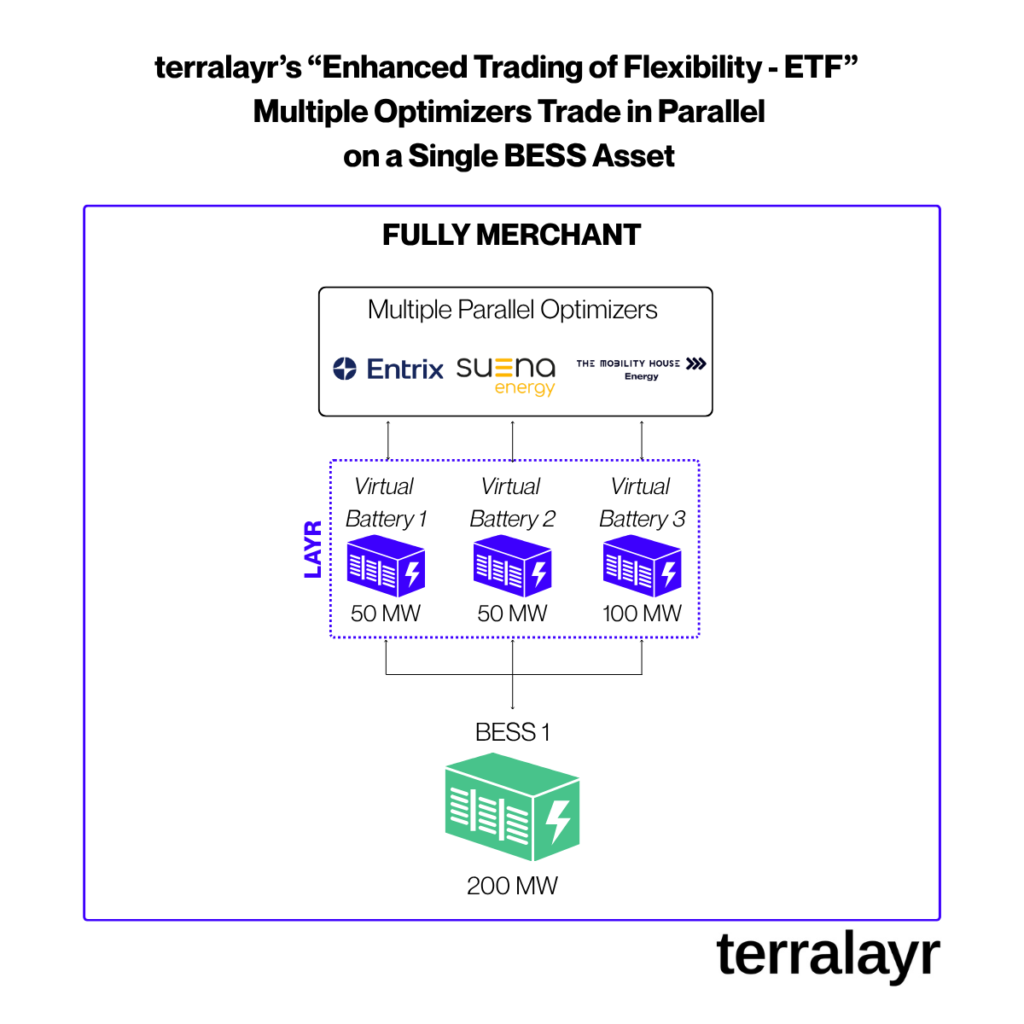

- Optimisation platform Terralayr has enabled three optimisers – Entrix, Suena and The Mobility House – to virtually trade portions of one single BESS asset

- The German Federal Parliament (Bundestag) has passed a law simplifying the development of energy storage projects, and expressly granting them privileged status

Dynamic’s Tangermünde project’s ‘first-of-its-kind’ integration

Investor Dynamic has partnered with digital monitoring and asset management solutions firm Amperecloud, battery analytics and diagnostics provider Volytica and optimiser Enspired for a 15.8MW/32MWh battery energy storage system (BESS) in Tangermünde, Saxony-Anhalt.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Volytica said it is the first project to “…combine monitoring, battery diagnostics, and energy trading into a single, coordinated system. These features are integrated to simplify operations and ensure competitiveness in today’s energy market”.

The analytics provider said the initiative addresses the common BESS industry challenge of fragmented digital tools for operational control, battery condition monitoring, and commercial optimisation. By integrating their platforms, the partners aim to enable continuous, data-driven system management, from performance monitoring to market participation, it said.

A spokesperson for Volytica said that, normally, you have individual software tools for asset management to operate and maintain the BESS, one tool for trading, one tool to access BMS data and one tool for analytics and monitoring, with no connection between providers.

Volytica CEO Claudius Jehle posted in more detail on his LinkedIn about the concept when Volytica announced the project.

The spokesperson said the integrated approach saves time and money, improves efficiency and competitiveness, and erases blind spots and increase transparency.

The project appears to already be operational, with a photo provided showing BESS units from Trina Storage, though the release did not refer to this.

Terralayr’s multi-optimiser BESS arrangement

BESS optimisation and virtual aggregation platform Terralayr has also claimed an industry-first, software-related asset management breakthrough.

It said its latest commercialisation model creates the “world’s first, risk-adjusted portfolio-effect for storage operators”.

The firm’s virtualisation set up allows multiple optimisers to trade a slice of one or multiple physical assets. The solution is live on Terralayr’s assets, will be rolled out to all future ones as well and available to asset owners in Germany.

Every asset owner has one contract per physical asset and that asset would be disaggregated into virtual batteries. Each virtual battery is then optimised by one different optimiser. As a result, one physical asset is optimised by multiple optimisers in parallel, a spokesperson explained.

A hypothetical arranagement is visualised in the infographic the firm provided below, with the BESS sliced into three virtual assets, 50MW each for Entrix and Suena and 100MW for The Mobility House (for example).

The model is called ‘Enhanced Trading of Flexibility – ETF’, and Terralayr claimed that it drives market efficiency, lowers revenue volatility, and creates a more stable risk-return profile for operators.

It also described an additional benefit called the “netting-off effects”, which regularly occurs when optimisers’ dispatch schedules offset each other, saving battery cycles and reducing degradation.

Terralayr’s platform bundles all optimiser dispatch and ancillary service signals and allocates them to the physical asset, while guaranteeing adherence to all technical restrictions and manufacturer specifications.

The firm launched in 2022, and has onboarded big-name energy firms in Germany including RWE and Vattenfall to its virtual BESS aggregation and optimisation platform as offtakers. Terralayr is deploying its own, smaller grid-scale BESS projects, at least partially to provide capacity for, and prove out, its platform.

Parliament in Germany adopts faster permitting for storage

In related BESS industry news, the German Federal Parliament (Bundestag) passed an amendment to the Energy Industry Act and the Federal Building Code which significantly simplifies the development of energy storage projects, law firm Evershed Sutherlands said in a note.

In a nutshell, the reform elevates legal certainty regarding the privileged treatment of thermal storage facilities, hydrogen storage facilities, and large-scale BESS in outside areas (Außenbereich), the firm explained: such projects are now expressly granted privileged status. The reform aims to accelerate energy storage permitting and deployment.

It creates a major simplification of future permit procedures, whereas previously energy storage was subject to considerable legal uncertainty.

Most grid-scale development in Germany is currently focused around projects that will come online before August 2028, when a three-year exemption from grid fees for charging and discharging ends. The government is discussing a more long-term solution, but whether this new change will benefit projects that can be deployed within the next three years is unclear.