An estimated 21GWh of planned energy storage system (ESS) cell production capacity for 2028 has been cancelled so far this year due to new tariffs and duties, according to a report from market intelligence firm Clean Energy Associates (CEA).

CEA has recently released two battery energy storage system (BESS) reports for Q2 2025, the Energy Storage System Price Forecasting Report and the ESS Supply, Technology, and Policy Report.

The two reports describe how the ‘One Big Beautiful Bill Act’ and recent tariffs are significantly transforming global supply chains for batteries and ESS.

The ESS Price Forecasting Report provides a five-year outlook on costs and pricing for lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) systems.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

CEA’s ESS Supply, Technology, and Policy Report provides analysis of global and regional supply chains, technology developments, and regional policies. This report specifically emphasises non-lithium-ion technologies and the prospects for long-duration energy storage (LDES).

ESS Supply, Technology, and Policy Report

CEA observes that in the EU, even without subsidies comparable to the Inflation Reduction Act (IRA), regions such as Eastern Europe and Scandinavia remain appealing to investors due to lower labour costs and cheaper electricity, respectively.

The firm also states that broader geopolitical factors encouraging supply diversification, US investment restrictions, and initiatives to streamline EU regulations support increased investment in EU onshoring.

Overall, the likelihood of import tariffs in the EU is low. Demand for storage in the EU is increasing to aid decarbonisation and enhance grid flexibility. Without a robust domestic industry, import tariffs could obstruct development initiatives.

BESS cells, container bill of materials (BOM) and power plant components are subject to up to five new US tariffs: International Emergency Economic Powers Act (IEEPA) on imports from China, Canada and Mexico, IEEPA on imports from countries including China, Malaysia, Singapore, and Vietnam, IEEPA on Global imports, and IEEPA on anode active material from China.

The tariff likely to have the biggest impact is the IEEPA tariff on global imports, which is 10%-50% globally, 34% on China, and effective at different times depending on the country.

CEA states that because of the high reliance on Chinese BESS cells and limited alternative sourcing options, this tariff will disproportionately impact BESS.

Recently, the US Department of Commerce has tentatively decided to implement anti-dumping (AD) tariffs of 93.5% on imports of active anode material (AAM) from China, increasing the total tariff to 160%.

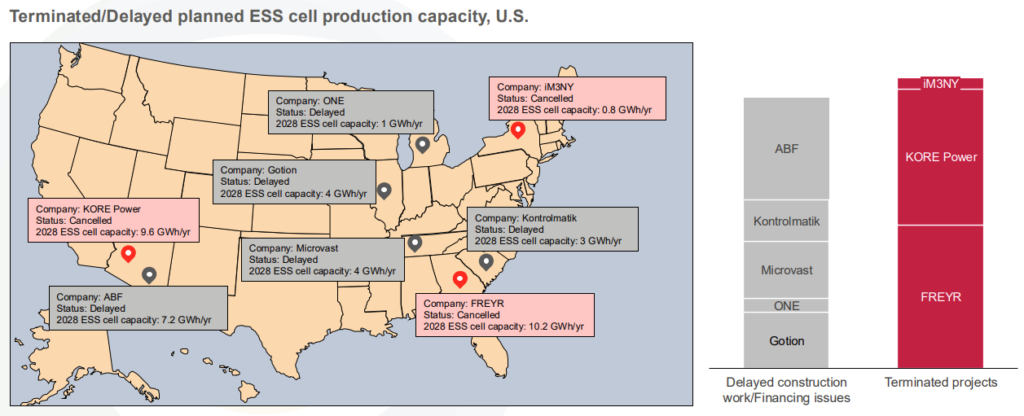

As noted above, CEA’s report found that approximately 21GWh of planned ESS cell capacity for 2028 has been cancelled this year in the US due to new tariffs and duties.

Three companies, which would have totalled 20.6GWh a year of production capability in 2028, have cancelled manufacturing facilities. FREYR cancelled its 10.2GWh facility, KORE Power cancelled its 9.6GWh facility and iM3NY cancelled its 800MWh facility.

Five other companies have delayed production facilities. These include American Battery Factory’s (ABF’s) 7.2GWh facility, Gotion’s 4GWh facility, Microvast’s 4GWh facility, Kontrolmatik’s 3GWh facility and ONE’s fittingly 1GWh facility — these total 19.2GWh.

Outside the US, Northvolt closed its only operational manufacturing plant in Sweden and other suppliers are struggling to meet their planned capacity.

Dependence on foreign battery manufacturers for both domestic production and imports is likely to grow.

Southeast Asia’s planned capacity is likely to ramp up quickly. The region is currently electric vehicle (EV) battery focused, but CEA says ESS capacity may follow the path of solar.

Also highlighted in the ESS Supply, Technology, and Policy Report is the growth of non-Chinese flow and iron-air battery manufacturing.

Four US companies are either in the early stages or have announced intentions of manufacturing flow or iron-air batteries. These include Form Energy, Stryten Energy, ESS Inc. and Zinc8.

ESS Price Forecasting Report

Due to the decline in demand for EVs in the US and China, lithium prices are expected to remain below US$10 per kg until at least 2030.

The report states that, based on industry observers, accurate cost data for lithium extraction is hard to access. As a result, many lithium projects, which were reportedly financially struggling as recently as the second half of last year, might still be marginally profitable.

Current forecasts indicate that supply and demand are expected to nearly balance by 2029. Low lithium prices benefit BESS developers in countries without trade barriers but will present substantial challenges for the adoption of non-lithium technologies and lithium-ion battery recycling.

Some system integrators site manufacturing capacity in lower-cost countries; more are choosing to co-locate capacity within the target end market. For example, CEA mentions a supplier that announced it finished a 10GWh BESS manufacturing facility in Texas, with other integrators and original equipment manufacturers (OEMs) following suit.

The firm also observes that the prices of locally integrated energy storage in the US and EU are quite reasonable when considering only manufacturing costs, with the premium over an OEM system made in China ranging from 15% to 20%.

Locally integrated US systems reduce Chinese content, reducing tariff exposure. Despite higher costs, CEA says siting ESS manufacturing in the US is the best choice for minimising tariff risk.

Notably, however, domestic cell manufacturing can still expose buyers to tariffs. The supply chains for anode and cathode active materials are primarily located in China, so the standard method for procuring these materials involves using these established supply networks.

Though these materials can be sourced via North American supply chains, the system would still be subject to price effects from Section 232 tariffs on steel and aluminium. Overall, CEA notes that tariffs on inputs are driving domestic costs up.

Tariff increases also create opportunities for alternative BESS supply from South Korea or Southeast Asia, with CEA saying that domestic hardware integrators are best positioned to mix and match sources of supply for the lowest cost.

Join CEA experts Dan Finn-Foley (director of energy storage market intelligence) and Christian Roselund (senior policy analyst) for an Energy-Storage.news webinar, ‘The US Budget Bill: Implications for Energy Storage Markets & Manufacturing,’ next week, 7 July 2025 at 12:00 Eastern, 9:00 Pacific. Registration is free.