American Battery Factory (ABF) has partnered with KAN Battery to pilot a line of lithium iron phosphate (LFP) battery cells.

As part of this collaboration, ABF will launch its subsidiary, ABF China, where the company will work with KAN to utilise a 1GWh factory for high-capacity prismatic cells. LFP is attempting to refine its production process while preparing for the construction of its gigafactory in Arizona.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

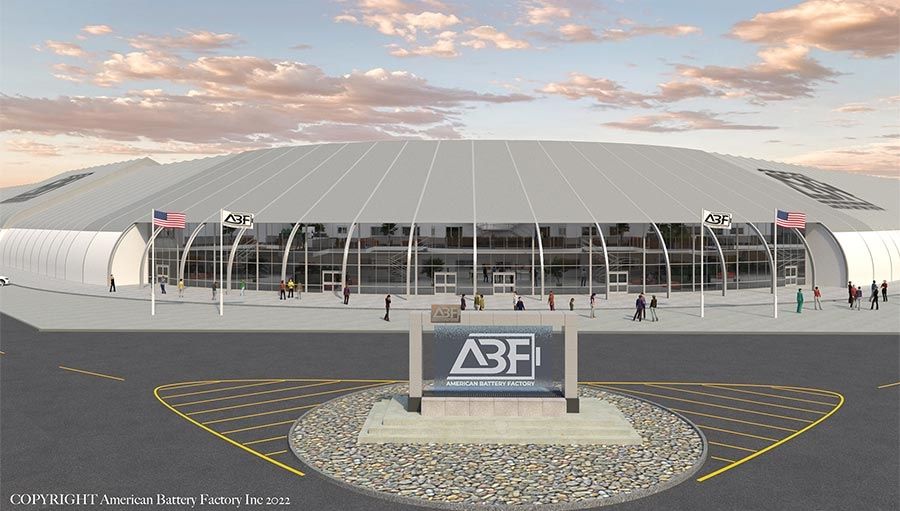

Set to be constructed in Tucson, Arizona, ABF’s gigafactory is on track to include the company’s headquarters, a research and development centre, and the initial 2GWh factory module. The company claims its cells will last up to 10,000 cycles, or 20-30 years on average.

ABF believes that by beginning its pilot line in China, it will be better positioned to enter into the production of cells in the US and assist with growing a US supply chain for LFP battery cells.

The startup is targeting offtake deals with battery pack manufacturers and system integrators in markets including utility, data centres, telecoms, commercial and agricultural equipment as well as power tools, national defense and others.

John Kem, president of ABF, expanded on this idea, adding: “In reality, the United States is 10 years behind the leaders of battery cell production. To develop a domestic supply chain, we must work together with the best in the world.”

“Working with KAN Battery gives us an opportunity to bring expertise back to the United States and train US workers with the best manufacturing and chemistry innovation available to date. This will help us leap forward, bringing our line of lithium iron phosphate prismatic cells to our US gigafactory for full-scale production.”

According to the International Energy Agency (IEA), the only countries with significant shares of cathode active material (CAM) manufacturing capacity outside of China today are Korea (9%) and Japan (3%). China is home to almost 100% of the LFP production capacity.

ABF says the launch of its subsidiary will enable the company to supply batteries to off-takers such as Lion Energy, a long-time partner with KAN.

ABF is using Sprung Structures’ “rapid-deploy factories,” constructed using a tensioned fabric membrane that the company claims will only take weeks to construct at 33%-50% lower cost than traditional construction.

Construction for the Arizona gigafactory started in October of 2023. ABF says the two million-square-foot facility will create 1,000 jobs and require US$1.2 billion of investment. The company hopes to complete the first phase of the gigafactory in the second half of 2026.

Speaking with Energy-Storage.news in March 2022, former ABF CEO, Paul Charles, said that the company expected to have its first 3GWh production facility with R&D centre and substantial pilot line up and running in Q4 2023/Q1 2024 – with 3-6GWh expansions to it every six to twelve months.

In related recent news, Lithium-sulfur battery and supermaterials firm Lyten is seeking a US$650 million loan from the US import-export bank EXIM. Financing would support a planned 10GWh gigafactory in Reno, Nevada. In other markets, ACWA Power has agreed to deploy wind energy and battery capacity to help power what is claimed will be the Middle East and Africa region’s ‘first battery gigafactory.’