As with previous years, our year in review wrap up of 2023 includes interviews with a handful of industry players from around the sector.

This 2023 edition kicks us off with the views, recollections, insights and predictions of representatives at two leading battery storage system integrators: Wärtsilä and IHI Terrasun.

Both hardly require any introduction: Wärtsilä has a portfolio of more than 3.5GW and 7.5GWh of energy storage projects awarded, contracted or in deployment and was again this year ranked in the top five global system integrators by volumes deployed or contracted according to S&P Global. We speak to the head of Wärtsilä Energy Storage & Optimisation (ES&O), Andy Tang.

IHI Terrasun meanwhile is known for specialising in solar-plus-storage applications and its recent projects include Gemini, currently under construction in Nevada, US, and thought to be the largest single site solar PV and battery hybrid plant in the world to date, featuring 690MWac/966MWdc of PV with 1,416MWh of batteries. We speak with Ray Saka, IHI Terrasun VP of business strategy and services.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Andy Tang, head of energy storage & optimisation, Wärtsilä Energy

Energy-Storage.news: What did 2023 mean for the energy storage industry, both from your own company’s perspective and in bigger picture terms?

The energy storage industry has continued to grow in 2023 – both in terms of the number and size of projects.

Despite this growth, several important hurdles – including the rise in global interest rates – have held the US industry back. Projects are expected to be delayed into 2024 and beyond due to changes in local regulations, uncertainty around how policies like the Inflation Reduction Act/Green Deal will be implemented, and the market looking for stability in interest rates.

How are energy storage projects and different market opportunities evolving, as technologies and stakeholder understanding mature?

Across the board, energy storage projects are scaling up significantly in size. The industry is also drastically expanding geographically. Chile is a good example of a quickly emerging market, where evolving policies and regulatory frameworks are playing a pivotal role in promoting the growth and development of energy storage projects.

Australia is another market that mirrors this change with regulatory support and a surge in energy storage system deployments. We recently completed the second largest energy storage project in Australia with AGL Energy.

Finally, we see tremendous opportunity in Taiwan. We’re approaching a 1GWh+ portfolio in the region.

The last couple of years saw significant supply chain challenges for the industry, particularly around lithium battery and battery materials. Have those constraints eased in 2023 and what sort of supply chain dynamics are you seeing in the industry going forward?

Supply chain constraints have eased significantly compared to the last few years. But many storage integrators, including Wärtsilä ES&O, are pushing ahead with plans to diversify their supply chains with an emphasis on regionalisation. Companies are also taking efforts to establish new lithium mines and advance battery recycling technology to ensure there is enough raw material to meet growing demand. We’re sure to see additional investment in US battery factories as the requirements for domestic tax credits are firmed up.

Historically, storage and EV companies have had to compete for the same battery supply, but we’re beginning to see a notable shift in the landscape. We’re seeing EV and grid-scale battery R&D paths begin to diverge. Battery manufacturers are recognising that storage needs very high cycle life, but not as much power – whereas EVs are the exact opposite. This shows that grid-scale energy storage is coming into its own as an industry. Battery manufacturers are aligning and reserving battery capacity for us.

What are some major trends in energy storage technologies that readers should keep an eye out for?

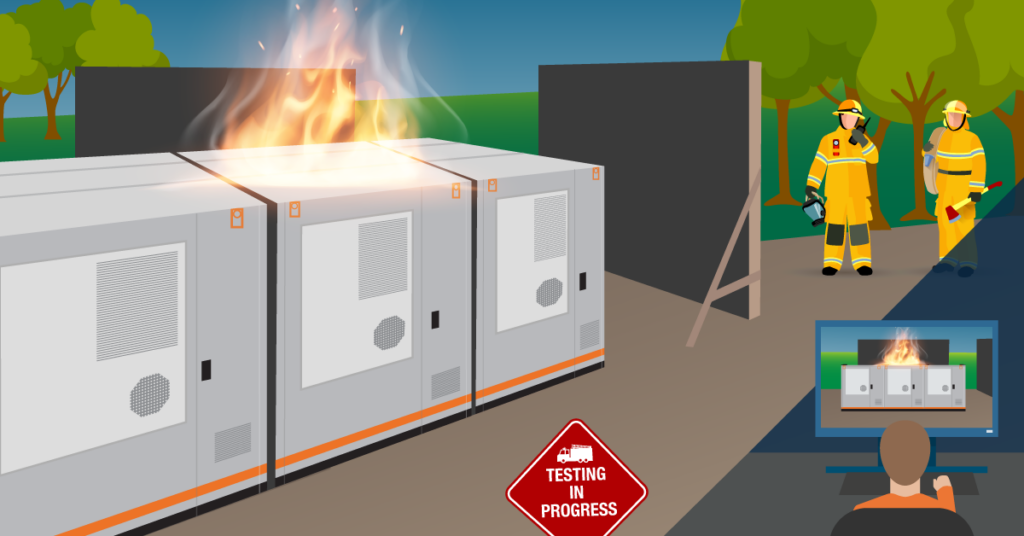

One of the key trends that readers should closely monitor is the advancements in safety within storage technologies. We are seeing a noticeable influx of inexpensive products in the market, which is coinciding with an uptick in safety incidents, such as fires.

Over the past year, our focus has been on proactively addressing these safety concerns. We have undertaken several large-scale fire safety tests to evaluate and enhance the safety of our products and continue our 100% safety record.

We recently launched our new Quantum High Energy system with advanced safety features, including active dehumidification to combat moisture and condensation and pre-fabricated fire walls to reduce the risk of unit-to-unit thermal propagation.

We will also be introducing a new predictive battery analytics software suite next year, which uses machine learning algorithms and data modeling to extend battery life, improve revenue, and reduce risk.

What should the industry’s main priorities be in 2024?

Looking ahead to 2024, safety must be the single greatest priority for energy storage companies. Fires at grid-scale storage facilities in 2023 have threatened to slow deployment. The emphasis must be on product design to reduce fires, streamline costs, and ensure smooth deployments. Any company not singularly focused on safety is holding the whole industry back.

Ray Saka, VP of business strategy & services, IHI Terrasun

What did 2023 mean for the energy storage industry, both from your own company’s perspective and in bigger picture terms?

Industry-wide, there is no question there has been great volatility in 2023. When the IRA was passed in 2022, it was clear that it would transform energy storage, but the details of how that change will come about – from the domestic manufacturing rules to the investment tax credit (ITC) guidance- weren’t defined. In 2023, both of those elements have been further clarified, speeding up the expansion of the energy storage space.

There has also been volatility in lithium carbonate pricing. 2022 ended at around RMB570,000 (US$79,785) per tonne with severe drop in price in 2023 ending at RMB96,500. While these swings are caused by availability of supply and demand for electric vehicles (EVs), which take up about 95% of available supply, the energy storage space is impacted directly by price shifts and changes in availability. This impact is substantial because the vast majority of the cost of a storage project is the cost of the battery, and the majority of the battery cost is lithium carbonate.

IHI Terrasun Solutions (IHI Terrasun) has been seeing both impacts: pricing fluctuations lead developers to delay or postpone projects in expectation of a better price and the IRA incentives push up projects in their timeline and bring in more players into the energy storage field. This makes for a great deal of volatility in project development and battery procurement.

How are energy storage projects and different market opportunities evolving, as technologies and stakeholder understanding mature?

The United States looks at a massive deployment of energy storage projects over the next few years because delays and disruptions due to COVID are subsiding and there is an available supply of batteries, with additional manufacturing expansion coming due to the provisions in the IRA.

Projects that were put on hold in 2021-22, are coming back all at once for commissioning in 2024-25. Now the industry will face bottlenecks in financing, availability of independent engineering firms, and trained integration and commissioning teams that know how to deploy battery energy storage. IHI Terrasun has been expanding our Field Engineering and commissioning teams and expanding our procurement consulting services to speed up project contracting and direct-to-developer battery purchase cycles to address these upcoming challenges.

As new players enter the market and established developers look to take on larger numbers of projects, we believe that there will need to be an increase in flexibility in the battery and integration procurement process, along with flexible contracting timelines to support the massive project deployment in 2024/2025.

In addition to new markets opening to energy storage, we’re starting to see ISOs and utilities look strategically at energy storage as a transmission asset. Energy storage is an ideal solution for a lot of the needed functions: congestion relief, peak shaving, blackout prevention, frequency and voltage regulation. It’s a clear benefit to place medium-sized energy storage projects in strategic locations that provide resilience and reliability to the electricity grid.

The last couple of years saw significant supply chain challenges for the industry, particularly around lithium battery and battery materials. Have those constraints eased in 2023 and what sort of supply chain dynamics are you seeing in the industry going forward?

The supply chain disruptions caused by the COVID-19 pandemic have been mostly resolved, and their resolution is coinciding with an ease in demand for electric vehicles, which means there is more lithium carbonate available to devote to energy storage projects.

On the battery front, more manufacturers are coming into large scale battery production, first spurned by the EV market and now into the energy storage space. That is a good thing for the energy storage projects: there is physically more supply coming off production lines and there is more innovation in energy density and safety features as manufacturers work to keep up and exceed each other.

What are some major trends in energy storage technologies that readers should keep an eye out for?

An interesting evolution that we’re following carefully is the increase in energy cell density: 100Ah to 200 Ah now to 300 Ah cells. An increase in energy density means lower cost to achieve the same energy and power or more compact projects for those more urban environments. Like the evolution in computing and solar panels, battery manufacturers are charging ahead with adding more capacity into each container. We’ll see this continue to evolve as manufacturers incorporate more functions – such as fire suppression and more evolved monitoring.

Long-term storage is now starting to sprout in the industry. Grid operators are looking at seasonal storage to keep continuous power supply as we integrate more and more solar and wind. This is a continuation of the duration evolution we’ve seen develop over the last decade: first, PJM was looking for 15–30-minute batteries for frequency regulation, then ERCOT started with 1-hour but is now shifting to 2 hours, CAISO is solidly at 4 hours and even starting to dip into 6-hour and longer options.

As more batteries are integrated into the electricity grid, they can decrease sharp peaks as California saw in September’s heat waves. But utilities want a flat line of generation, which means that while storage right now is able to address peaks and valleys, deployment of longer-term storage will begin to address the ramps up and down that come from renewable energy intermittency.

Some battery vendors have started announcing sodium-based battery technology. That brings even lower costs with potentially similar energy density. Technology innovation will drive down the cost, which is the goal: be most effective as an energy balancing asset.

What should the industry’s main priorities be in 2024?

- Staff up: Addressing trained resources that will be needed for massive deployment. The US is currently not training enough power engineers to manage the work at utilities to transition our grid nor enough electricians to install those assets.

- Prep for a large pool of projects that is coming – IEs and financiers need to be better staffed and resources to be able to provide the necessary support for the marketspace for the developer side of the fence.

- PUC level and the interconnection approvers and authorities need to be more efficient in their approval of projects.

- Continue the investment into standardisation. IEEE2800 is being developed right now to specify grid operation and testing requirements for inverter-based resources (IBR). With more deployment of large-scale energy storage systems, it’s important for the standards to be well defined so the projects can operate in the most efficient way with the electricity grids. OEMs and hardware providers must take these standards seriously, adopt them, test to them and deploy to the requirements.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.