“The one word that is most important here is aggregation,” SolarEdge’s Lior Handelsman says, as we discuss the launch of his company’s first commercially available virtual power plant (VPP) solution this summer.

On a hot sunny day in Germany, Europe’s biggest market for home energy storage, we were discussing the situation back in the UK and where the VPP concept is starting to take root.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“It is a software platform that starts in the cloud. To take one example: you are a network operator, a DNO, tasked with stabilising the grid and keeping the grid stable. There are so many different distributed generation resources on the grid making your task more and more complex.”

Some of the tools to deal with such situations are now becoming outdated, Handelsman argues, and they include investing in grid upgrades such as substations, wires and cabling that can give the network operator a “a little bit of the ability to control the large generators on the grid to stabilise frequency”.

Instead, network operators could actually take advantage of the increasing numbers of distributed energy resources (DERs), including solar, wind, EVs – resources that are traditionally considered to add more balancing work for the network operators to perform, including integrating the variable output of generators and accommodating spikes in demand from EV charging.

“If you had a way where you could actually use these systems for you instead of against you – that would be amazing.

“For example if you have a peak in a specific suburb, all you need to do is tell the storage systems in that suburbs to feed energy just for a few minutes into the grid to support that peak. Or if you have a peak you ask all the EV chargers in that area to stop charging or throttle down their charging for a few minutes,” Handelsman says.

The VPP as an alternative to this requirement for big investments is not a new idea. I wrote about the ‘Rise of the virtual power plant’ back in 2015 for this journal. While it was an exciting concept then, it’s an even more exciting reality today. As we can see from the three case studies accompanying this article however, the technology lies mostly at the trial stages and numbers aren’t yet huge, but the VPPs that already exist could be vital in informing the future direction of travel for the market.

While we find that providers are not yet at the volumes of aggregated systems performing VPP tasks that they would like, work is well underway to create that value of which the SolarEdge VP for marketing and product strategy speaks.

Defining the VPP

As with a lot of the newer concepts introduced to our industry, the definition of a VPP varies. In theory a VPP could include both front-of-meter utility-controlled assets such as large generators or grid-scale batteries as well as customer-sited behind-the-meter systems like rooftop PV and household lithium battery systems. The key is that all of the aggregated DERs in a VPP network are controllable centrally, through an appropriate software platform.

For the purposes of this article we will look mainly at residential systems. And there’s another caveat: when Sonnen launched SonnenCommunity, its ‘energy sharing’ solution that allows customers to trade the surplus energy in their home batteries with one another a couple of years ago, CEO Christoph Osterman was at pains to point out that at the time, less broad definitions of virtual power plants only covered those instances where aggregated systems would perform the same tasks as peaking gas plants, i.e. to deliver grid services on a big scale.

“When you talk about the VPP in Germany, a lot of the players who are trying to aggregate smaller assets, or decentralised and distributed assets, don’t like the [term] VPP, because there’s this association with the ‘power plant’ side of the ‘VPP’,” Valts Grintals, energy storage analyst at Delta-EE explains.

While the definition has changed as the market has developed, Grintals argues, his research team look at a VPP as aggregated assets – small or large – that are “not just generating the power and feeding it into the grid, [but] also managing demand.”

Sonnen has not rolled out SonnenCommunity into the UK market yet. Grintals says this is partly to do with a greater economic sensitivity and the lower appeal of energy independence for individual households, something which has captured the public imagination in Germany (and Austria and Switzerland) by comparison.

However, a couple of dozen Sonnen battery units were recently deployed in the UK in the remote islands of Orkney, linked and aggregated together to perform many of the expected VPP tasks. That said, those systems will be run on software by the project’s lead, Solo Energy, and not Sonnen’s own platforms. Solo Energy claims that the humble trial could show how “no money down” financing could be possible for residential PV-plus-storage in Britain. So why has the VPP reached the UK in this particular form?

Driven by you

“Really the key driver for something like that in the UK, to make business models that work, will be local network operators’ flexibility,” Grintals says.

This is something that can be seen from the case studies accompanying this piece. Beneath the level of the transmission system operator (TSO), National Grid, sit the DNOs – distribution network operators. Responsible for delivering power to homes and businesses, the increasing amounts of DERs on their networks are – as Handelsman illustrated with the opening example – creating challenges for the six major DNOs. England is – or was – installing solar at pace before the cliff-edge degression of the feed-in tariff (FiT) and the introduction of Open Utility’s Piclo Flex is one attempt to introduce control, flexibility and balance through a VPP-style aggregation. Case study #1 looks at Piclo Flex in more detail.

Proving the case for the VPP

So, the early business models based around flexibility offer the UK, a leading market but still a less prolific adopter of home solar-plus-storage (and by extension aggregated VPPs) than Germany, a chance to properly value the network benefits of cloud-controlled DERs.

Moixa’s government-backed trial from a few years ago (see Case Study #2), will have informed some of the decisions we’ve seen taken as well as what we might see going forward. You can see that there was an immediate financial benefit for participating homeowners, while a modest amount of installed storage capacity had a big effect on peak demand for the local DNO.

Both the technological scope of the VPP concept in the UK and the ability to commercialise it have moved on rapidly since the government-backed Moixa trial, which ran between 2015 and 2017. Case Study #3 looks at the Local Energy Marketplace (LEM), a project from utility Centrica which could be a solution ripe for scaling up across the UK.

Harking back to Valts Grintal’s view that the proliferation of VPPs could be driven by network needs, the LEM project centres around DNO Western Power Distribution’s need to purchase flexibility services. The marketplace idea has been backed by National Grid and could be a model for rollout across the country.

Opening up technical requirements

Now that several years of successful operation have passed and lessons learned based on hard economic realities, the VPP space is evolving so rapidly that even as this edition was going to press, we had another game changer in the UK to talk about.

National Grid’s Balancing Mechanism (BM), worth an estimated £350 million (US$444.2 million) a year to participants, rewards those able to increase or decrease generation or consumption. This flexibility is bid in to half hourly settlements periods with National Grid paying out what is needed in order to keep the system balanced. Under the proposals to widen access to the Balancing Mechanism (BM) by April 2019, aggregators will also be able to play into the market for the first time without needing a supplier licence. One aggregator, Limejump has already entered its virtual power plant into the BM. Another, Flexitricity, said that on rare occasions, prices can reach £2,500/MWh (US$3,167), compared to around £50/MWh (US$63.35) in wholesale markets.

Indeed one of the historical barriers to adoption in ancillary services markets has been the minimum technical requirements which have required several megawatts of capacity to be available. Primary Control Reserve (PCR) in Germany historically required 5MW or more for eligibility which perhaps explains the reluctance of battery system providers to roll with the term ‘virtual power plant’ from the very beginning.

So we have VPPs commercially available for solar rooftops from the likes of SolarEdge, VPPs that could allow the low-cost financing to make more of those solar (and storage) rooftops a reality from Solo Energy’s trial on Orkney and increasingly as we’ve just seen with the Balancing Mechanism, ever expanding opportunities for virtual power plants to make their mark in the real world from behind the meter to the front.

CASE STUDY #1: A software platform enabling VPP aggregation

As the low carbon transition takes hold in the UK, DNOs are taking action accordingly, making changes to their own practices to keep pace with the change.

With record levels of distributed energy resources connected at the distribution level rather than at transmission, the country’s network companies are moving towards an active neutral facilitation system operation role, seeking out new forms of flexibility to account for and make use of the DERs on their systems.

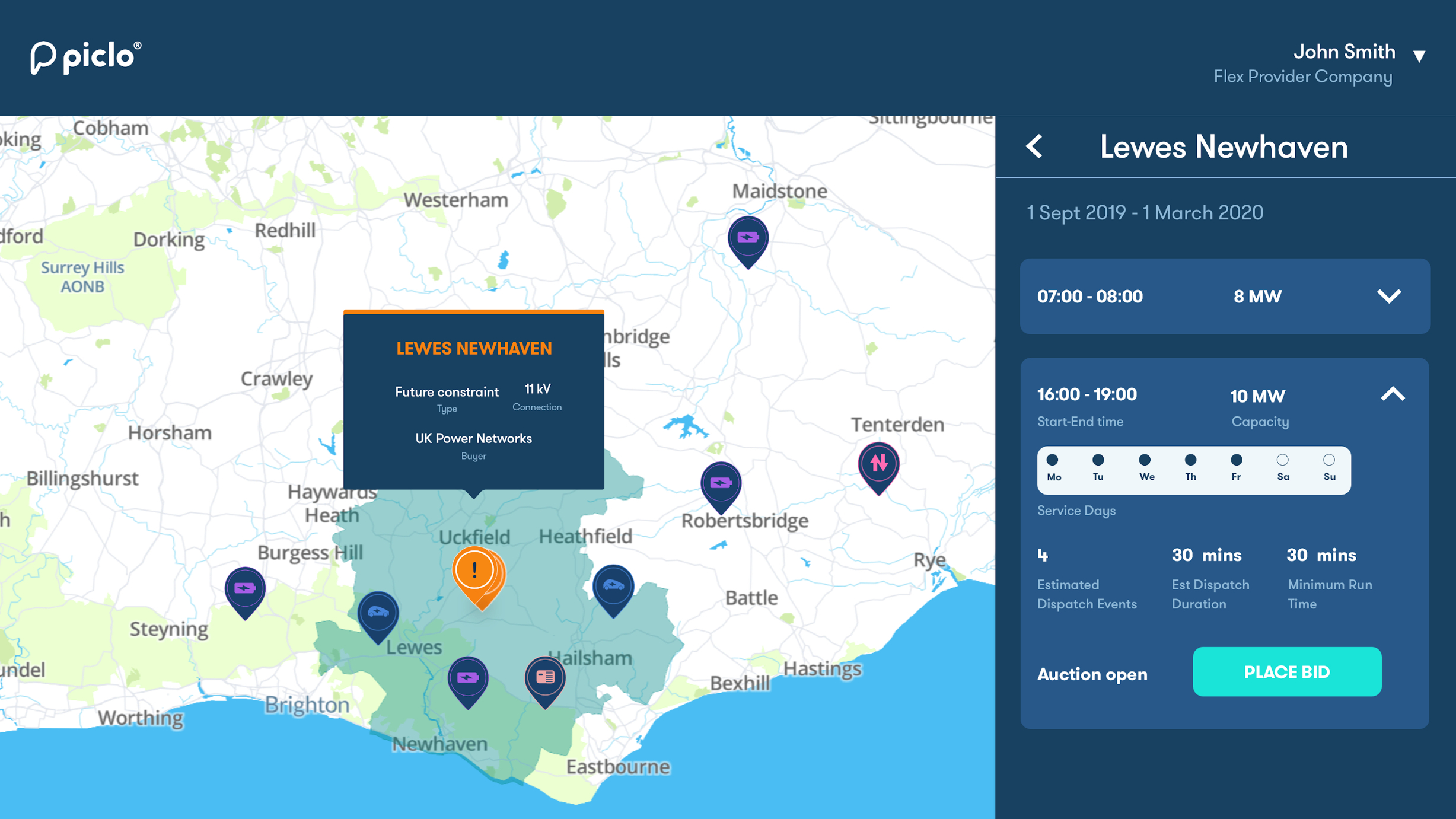

Enter Piclo Flex, the proprietary software from Open Utility, which enables distribution system operators (DSOs), as they are becoming known, to launch auctions for flexible capacity from a range of providers who have uploaded their capabilities to a VPP-style platform.

The possibilities of carrying out auctions on a national scale using Piclo’s virtual power plant stands to revolutionise how networks procure flexibility, a fact that has already attracted half of the UK’s network companies.

UK Power Networks is furthest progressed, with plans to run its next flexibility tender on the Piclo Flex platform.

Dubbed “an online dating” service for DNOs and DERs by Sotiris Georgiopoulos, head of smart grid development at UKPN, Piclo Flex gives network operators visibility over what is available in their regions, from energy storage to generation and turndown-capable resources.

James Johnston, chief executive and co-founder of Piclo, explains: “This is a place for flexibility providers, meaning anyone that operates or manages flexibility, whether they are an aggregator, a supplier or a battery operator, maybe chargepoints, an industrial customer, community groups…”

This allows them to plan how to meet their needs accordingly, while providing greater transparency to flexibility providers seeking to determine the opportunities for additional revenues.

“The DSOs have different options for where they want to launch their tenders, and what we want to do is prioritise where they are more likely to get success stories,” Johnston adds.

UKPN tried to pull together its own market VPP last year, seeking over 34MW of flexibility services across its network. But while the initial tender attracted great interest from the market, little materialised as providers called for more certainty and transparency over the flexibility procurement process.

Georgiopoulos hopes the Piclo Flex platform will offer a simplified approach to meet the concerns of providers and “unlock flexibility” at a time when the network is becoming ever more congested.

“We have a winter peak demand of 16GW, we have about 9.3GW of DER, 200MW of batteries connected on the network, a gigawatt of batteries on the pipeline and some scary numbers about electric vehicles. So the future is here…and in that context flexibility is going to be key and how we unlock flexibility is going to be key,” Georgiopoulos explains.

To this end, UKPN has already placed four of the ten locations it previously sought 14MW of flexible capacity for onto Piclo Flex for an auction to take place in Q4 2018.

A number of ‘flex sellers’ ranging from domestic battery storage firms to energy suppliers and demand-side response providers have already signed up to potentially fulfil the DNO’s needs, with Open Utility targeting several more before the auction takes place.

The possibilities of the platform have already attracted SSE and Electricity North West to plan their own flexibility procurement, with Piclo eyeing up National Grid as a potential participant in its national VPP potential.

CASE STUDY #2: Dropping bills and lopping peaks

In the UK, VPPs are being used to aggregate large-scale, front-of-the-meter storage or smaller, behind-the-meter commercial and industrial capacity to offer balancing and frequency response services to the grid.

Residential models have taken longer to emerge, with providers often coming up against consumer apathy towards managing energy use within a context of limited funding.

But domestic storage providers are nonetheless working to crack this market. One early example is Moixa, which was awarded a contract in 2013 by the government’s now defunct Department of Energy and Climate Change (DECC) to deliver a trial across 250 locations.

The system rollout was separated into multiple asset cohorts, the largest of which was Project ERIC, where Moixa worked alongside Oxford City Council to deploy 82 systems in homes alongside solar, as well as in a school and a community building.

Running between 2015-17 as the UK’s first large-scale domestic solar-and-storage project with around 500kWh of storage capacity, the project aimed to reduce the average peak grid load and increase solar consumption, with the added benefit of lowering household bills.

It enabled Moixa to test and manipulate the whole fleet together, as well as smaller collections of systems such as that in Oxford, to optimise its software, hardware and asset management services in a wide range of real world scenarios.

Meanwhile, the project also allowed household participants to see their live and historic energy data and make behavioural changes as a result to save cash. This, Moixa says, was a main aim of the project: to help social landlords and their tenants optimise their solar consumption by shifting it to peak times of day and save money.

For the Project ERIC participants, 1.8MWh of electricity was saved from grid sources thanks to 0.6MWh of solar battery consumption and 1.2MWh of solar generation. Annual household bills were reduced by over £170 (US$216.42) based on an electricity unit price of £0.14 per kWh, and consisting of up to £80 from the battery and £90 from solar.

Debbie Haynes, energy efficiency projects office for Oxford City Council, says: “It was great to learn that Moixa Smart Battery and solar package can help residents save money, particularly those who use quite a lot of electricity in the evening but are out during the daytime.”

But for Moixa, the key was to provide invaluable learning about its VPP model and how it could help balance the local, and potentially national, grid. The company told PV Tech Power that the project allowed it to “prove out” the VPP concept to show that it could deliver balancing services, while delivering what Moixa dubbed ‘local-to-meter’ value for DNOs, who were reportedly struggling with specific constraint areas on their networks.

By aggregating the batteries to reduce the exportation of solar, the local network was spared from the significant impacts caused by generation on a constrained network.

These experiences, learnings and subsequent adjustments have allowed Moixa to develop a GridShare platform that offers one of the largest domestic VPP resources for battery storage capacity at around 1,000 systems, a model being pursued in earnest by a number of other market participants. Moixa is also exporting the tech to Japan, under a programme with utility TEPCO, which has invested in the UK company.

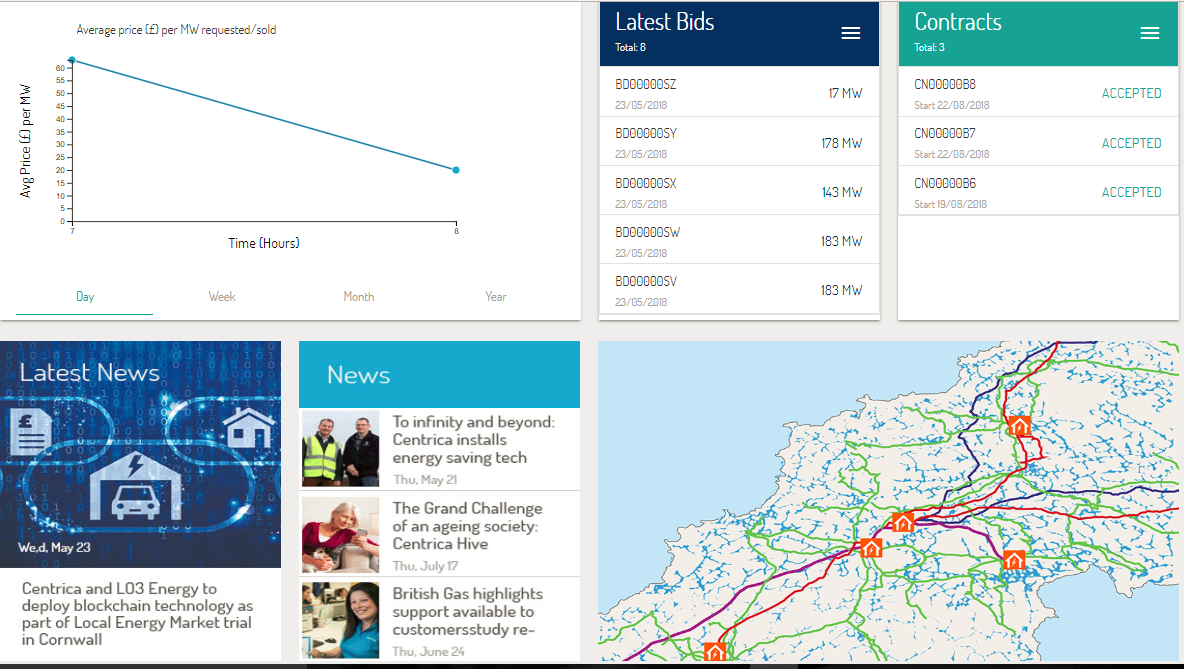

CASE STUDY #3: A local marketplace meets the blockchain

Energy services company Centrica, owner of one of the UK’s big six energy retailers British Gas, is looking to turn the south west of the UK into a virtual power plant in its own right, starting with the Cornwall peninsula.

The Local Energy Market (LEM) project will connect homes and businesses in the region, alongside local renewable generators, to an online virtual market place, allowing them to sell energy capacity to both the grid and the wholesale energy market at times of increased or decreased demand.

Solar and residential storage from around 100 homes will be utilised, as well as a range of other technologies including the UK’s largest flow machine installation – the 1.1MWh Olde House project – hundreds of blockchain-enabled smart meters, and the flexible capabilities of around 50 businesses.

The £19 million ($25.1 million) project, which takes the bulk of its cash from the European Regional Development Fund, creates an online market, whereby network company Western Power Distribution in this case will create a bid when it foresees a need for market flexibility. This could be as a result of weather forecasting showing increased output from the region’s solar and wind assets, or periods of low demand or network outage.

Posted on the LEM around 10 days prior to system requirement, it will specify the time of day, expected need across the operational window and where this need will be.

“This is one of the key differences with what National Grid currently do with flexibility and what a distribution businesses needs to do. It’s very, very localised,” says Roger Hey, future networks manager at WPD.

Business and aggregators already signed up will receive a notification of the bid and have the opportunity to take part, creating an offer in response with their own operational availability along with a price for their flexibility.

WPD will then review its received bids, comparing them on price and other metrics such as where physically on the system the asset sits, if it will solve multiple constraints, and reliability or previous performance.

Once accepted, a contract is in place between WPD and the flexibility seller whereby an arming fee is paid, similar to an availability payment in other frequency response markets. If called upon, an additional dispatch fee is also paid, however it will not be known if this is required until hours before the event.

As the transmission system operator, National Grid is already involved and backing the project with a view to integrate its own day-ahead and intraday needs as early next year.

Duncan Burt, acting director of operations at National Grid, says: “Cornwall’s Local Energy Market is at the forefront of deploying technologies and the way it is thinking about going right down to the domestic level to deliver that. The lessons that we learn here will absolutely be applicable right across the UK.”

Matt Hasting, programme director at Centrica, says: “We’re seeing this very liquid, dynamic marketplace evolving and what we’re trying to do with the local market is bring the markets up to speed with where technology is heading.

“We want to build a future energy system and we want to learn about it by doing it in practice.”

This article originally appeared in PV Tech Power, the quarterly downstream solar technology journal from the makers of PV Tech and Energy-Storage.news. Subscribe to and download every issue of PV Tech Power, featuring ESN’s ‘Storage & Smart Power’ section dedicated to technology and market advancements that go beyond generation and deployment. Free of charge – registration details are required.

You can also download this article as a PDF to keep, along with other great feature articles, white papers and more, from the ‘Resources’ section of this site.