The US’ installed base of utility-scale battery energy storage systems (BESS) increased by 80% in 2022, as the industry had a record-breaking year.

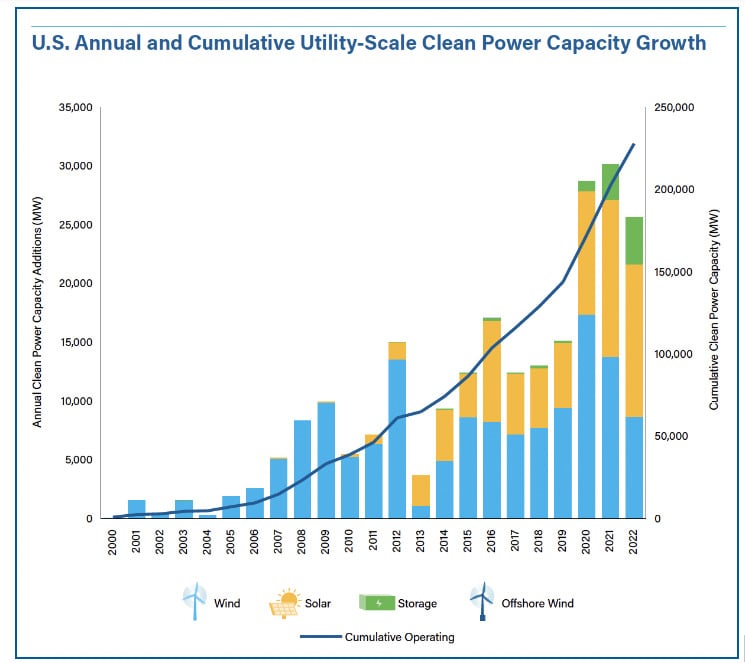

According to new figures published by the American Clean Power Association (ACP) national trade group, 4GW/12GWh of new BESS was commissioned, while the US’ total utility-scale wind, solar and storage capacity reached almost 228GW by the end of last year.

ACP publishes quarterly reports on progress in the industry, highlighting policy, regulatory, technological and other trends as well as supplying statistics and data on utility-scale clean energy.

Two of its latest reports, out this week, recap the full year for 2022 in one, while the other is an update from Q1 2023. Energy-Storage.news will cover the first quarter 2023 report tomorrow on the site, while this story will continue looking back on 2022 with ACP’s help.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The growth in energy storage deployments tallied broadly with the annual report published in March by Wood Mackenzie Power & Renewables in the research group’s US Energy Storage Monitor series.

Wood Mackenzie found that 4.8GW power output was deployed during the year along with just over 12GWh energy capacity – albeit this slightly higher megawatt number counts storage at all scales, including residential and non-residential (commercial & industrial, community and government facilities etc.).

It’s also the second time ACP has announced its 4GW/12GWh storage deployment number, as it did back in February as it tallied year-end numbers, but the comprehensive new report added more detail to the picture. At that time, the trade association said installed grid-scale BESS capacity in the country had reached 9GW/25GWh by the end of 2022.

While storage had (another) breakout year, the view from across the entire sector was a bit less positive. There was a decline in deployment volume from the previous two years, although the total 25.5GW across the three utility-scale technologies recorded nevertheless made 2022 the third highest year on record.

The reasons for a 25% decline in installations from 2021 to 2022 were varied, ACP said. They included well-documented supply chain issues and solar PV module procurement challenges, the lengthy wait and difficult process to get interconnection to the grid and the uncertainty over the various provisions in the Inflation Reduction Act (IRA), particularly the production tax credit (PTC).

This led to delays for around 53GW of projects that would otherwise have been expected to go online, according to the report.

Inflation Reduction Act already ‘supercharging’ the sector

Still, as ACP CEO Jason Grumet noted in a foreword, annual installations across all three technologies, including onshore and offshore wind, are projected to triple by 2030 in the US, with the IRA already “supercharging clean energy deployment,” Grumet said.

One key set of questions many in the industry had about the IRA went some way towards being answered recently, as the US Department of Energy (DOE) released guidance on its domestic content provisions for clean energy equipment to get the PTC and investment tax credit (ITC) earlier this month.

The industry is having a transformative impact on the economy, with 450,000 employed, investment into at least 50 new manufacturing facilities totalling more than US$150 billion announced in the past 10 months, and 80% of clean energy projects located in low-income communities.

“The clean energy revolution is underway. We have the technology, financial capital and workforce to power our economy with clean, affordable and secure energy,” Grumet said in a statement.

However, while “American energy innovation” enjoys broad bipartisan support, the industry – and country – still needs its lawmakers in Congress and Governors across the states to: “enable the siting and construction of new energy facilities and support the build out of transmission that is required to bring clean power to the people,” according to Jason Grumet.

Energy storage accounts for about 14% of a 140GW total development pipeline. While batteries represent only around 4% of the 227,852MW installed base today, the largest project that came online in 2022 in terms of energy capacity across the three technologies was Crimson, the 350MW/1,400MWh project in Riverside County, California, brought online by Recurrent Energy.

Meanwhile, ACP said that from mid-August 2022 as the IRA passed, through Q1 2023, there were 10 announcements of new, expanded, or re-opened grid-scale BESS manufacturing facilities in the country, from a total 47 announcements across the technologies.