The quarterly financial results of US non-lithium battery storage startups ESS Inc and Eos Energy Enterprises highlight their commercialisation strategies and progress.

Earlier this month (5 November), Eos Energy Enterprises (Eos), manufacturer and integrator of a proprietary zinc hybrid cathode battery energy storage system (BESS) technology, announced its Q3 2025 financials.

This was followed last week (13 November) by the latest quarterly figures from proprietary iron electrolyte flow battery provider ESS Tech Inc (ESS Inc.).

The companies were among a wave of new listings during the Covid-19 pandemic rush for special purpose acquisition company (SPAC) mergers, which were seen as a faster route than a traditional IPO.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

ESS Inc. is NASDAQ-listed, with shares most recently trading at the close of markets last Friday, 14 November, at US$2.76, and Eos on the New York Stock Exchange (NYSE), trading at an average US$13.80 as of that time.

For Eos, that’s a fall of 52% from a high of US$28.83 in January 2021 and for ESS Inc., a 99% decrease from its peak to date of US$281.25, recorded in November 2021.

The seeming divergence in fortunes does not end there. Zinc battery maker Eos reported record quarterly revenues of US$30.5 million for the period ended 30 September 2025, a quarter-over-quarter increase of 100%.

Flow battery provider ESS Inc., meanwhile, reported US$214,000 in revenue for the quarter, 91% less than the US$2.4 million it recorded in Q2 2025.

Eos reaffirmed previously issued guidance of US$150-160 million for the year, while ESS Inc. continued to decline from offering guidance.

Ultimately, both companies continue to operate at a loss: Eos widened its adjusted EBITDA loss from US$51.6 million in Q2 2025 to US$52.7 million. ESS Inc. reported an adjusted EBITDA loss of US$7.1 million, a slight improvement on the adjusted losses of US$7.8 million it recorded in Q2 of this year.

In both instances, company leadership was clear to the market and prospective investors when listing that profitability would potentially take some time and be largely dependent on two main factors: the coming of market demand for long-duration energy storage (LDES) technologies and the achievement of automated mass production scale.

The non-lithium market has recently seen the withdrawal of the sodium-sulfur (NAS) battery (ESN Premium article), produced by Japan’s NGK Insulators and Germany’s BASF, the world’s oldest commercialised grid-scale storage technology and the second-most-deployed after lithium-ion.

This change occurred after a shift in strategic direction led BASF to withdraw its commitment to building a gigafactory production site for the non-lithium technology, anticipated to result in significant cost reductions.

Eos claims ‘clear line of sight to profitable growth’

In a presentation for shareholders, Eos highlighted an order backlog worth around US$644.4 million, or around 2.5GWh of customer orders, and a commercial opportunities pipeline of US$22.6 billion, equivalent to approximately 91GWh. It also emphasised a relatively strong cash position with US$126.8 million on hand as of the end of Q3.

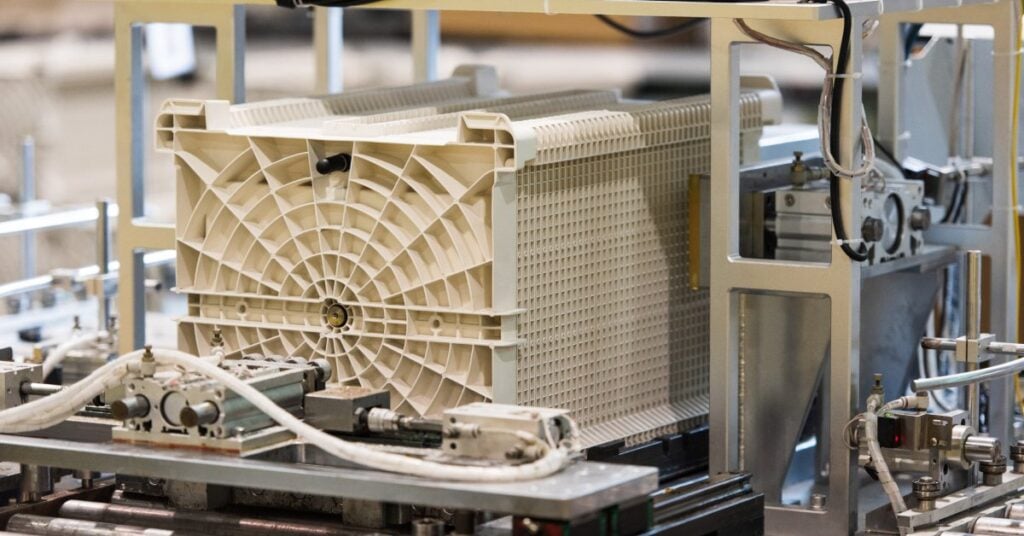

It also touted the expansion of its manufacturing footprint in Marshall Township, Pennsylvania, where it is building lines with up to 8GWh annual production capacity and the development of a software hub in Pittsburgh.

The battery maker announced a US$352.9 million planned investment in manufacturing lines and the move of its company headquarters from New Jersey to Pennsylvania a few weeks ago. Eos will also receive around US$22 million in financial support from Pennsylvania’s state government.

Eos claimed to have a “clear line of sight” to profitable growth, as production bottlenecks are removed and cost reduction drives up margins, with improvements demonstrated across both revenue and margins over the past four quarters.

It was one of the few companies able to leverage federal assistance for its plans via the US Department of Energy (DOE) Loan Programs Office (LPO) before the change of governments put an end to many of the Biden-era commitments signed before November last year.

‘Strong momentum built in 2025,’ ESS Inc. interim CEO says

Conversely, ESS Inc. ended September with unrestricted cash and cash equivalents of US$3.5 million and reiterated a warning from earlier this year that the flow battery company will need additional debt or equity financing to meet near-term operating cash flow requirements, with substantial doubts around its ability to continue as a going concern for the 12 months following its latest 10-Q quarterly report .

The company has undergone an “operational reset” in the past year, including a pivot to focus on a next-generation product, Energy Base, and changes at executive level. Energy Base is designed for very large-scale 10-hour duration LDES applications.

While the company sees that as a better revenue generator than its predecessor Energy Center and Energy Warehouse solutions for commercial and industrial (C&I) and utility-scale markets, respectively, ESS Inc. is currently facing the impacts of discontinuing those products and will wait until next year before revenue recognition from Energy Base sales.

CEO Eric Dresselhuys stepped down in February and was replaced by ESS Inc.’s VP of legal, Kelly Goodman, who is now its interim CEO.

During the quarter, ESS Inc. completed a US$40 million financing with an investment fund managed by Yorkville Advisors Global and announced a 50MWh Energy Base pilot project with Arizona utility Salt River Project (SRP).

“With key customer programs underway and new capital secured, our focus is now squarely on execution—delivering the Energy Base platform and demonstrating the performance and reliability that customers are demanding,” interim CEO Goodman said, claiming ESS Inc. had “built strong momentum over the course of 2025.”

Tailwinds in US from OBBBA, tariffs and load growth

Both non-lithium battery companies share a belief that tailwinds are on the horizon for their technologies in their home market.

Decoupled from the lithium-ion battery supply chain and using high proportions of domestic content materials in their products, representatives of Eos and ESS Inc. have said that their non-reliance on China makes their technologies viable options for developers looking to find a way around foreign entity of concern (FEOC) restrictions on investment tax credit (ITC) availability, as well as tariffs on Chinese battery components, products and materials.

The companies also expect to continue availing of production tax credit (PTC) incentives for manufacturing their batteries, again based on high domestic content inclusion and the expected ability to avoid FEOC-restricted supply chains when the new rules take effect in 2026. Eos CEO Joe Mastrangelo spelled out those potential benefits and advantages in the company’s previous earnings call in July.

Eos and ESS Inc. both also claim that, especially with Eos’ third-generation Znyth battery module and ESS Inc.’s new Energy Base, their technologies, designed to be robust with long lifecycles even through heavy cycling, are a good fit for the sort of load growth the US is experiencing with the new wave of hyperscaler data centres.