New analysis from Clean Energy Associates (CEA) and Wood Mackenzie highlights the challenges facing the US battery storage market due to trade tariffs.

According to research firm Wood Mackenzie’s new report, ‘All aboard the tariff coaster: implications for the US power industry,’ tariffs on imports will affect battery storage more badly than the solar PV or wind sectors.

This is due to the reliance of the battery energy storage system (BESS) market on imported products from China, with “nearly all” battery cells used in US utility-scale projects in 2024 coming from there.

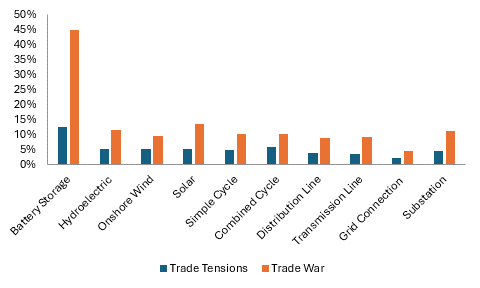

Depending on the severity of potential tariff increases, the cost of utility-scale BESS could rise between 12% and 50% across three tariff scenarios modelled by Wood Mackenzie analysts.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Wood Mackenzie vice-chairman of power and renewables Chris Seiple said that while US battery cell manufacturing capacity is expanding, this is not happening fast enough “to meet even a small fraction of battery projects in the US.”

“In 2025, we estimate there is sufficient domestic manufacturing capacity to only meet about 6% of demand and, by 2030, domestic manufacturing could potentially meet 40% of demand,” Seiple said.

While battery storage might be the most exposed to tariff risk among power sectors, as reported by our colleagues at PV Tech today in their coverage of the Wood Mackenzie report, solar PV is also vulnerable.

“The tariffs that have been in place on solar modules along with an inefficient transmission policy that exacerbates interconnection costs have made construction costs for solar higher in the US than in most other markets,” Chris Seiple said.

“An increase in tariff levels will only worsen this premium US energy consumers need to pay to access renewable energy. While the full impact remains uncertain, it’s clear that [solar] industry participants need to prepare for increased costs and potential disruptions to their supply chains.”

CEA: AD/CVD risk for active anode materials, sources beyond China impacted post-tariff pause

Clean Energy Associates this week published an interim update to its quarterly ‘Energy Storage System Price Forecasting Report’, which notes that even under the current 90-day pause on US-China tariffs, total duties on Chinese battery imports remain over 40%.

Once the paused arrangement—which itself has driven uncertainty for battery storage developers and investors—expires, CEA says that if the highest tariffs announced by US president Donald Trump under the International Emergency Economic Powers Act (IEEPA), duties could exceed 150%.

It’s not just battery cells that the US BESS industry relies on importing. CEA said prices for imported DC blocks or AC blocks would also see steep price increases, along with locally integrated systems only using cells from abroad.

With the 2 April announcement of Trump’s ‘Liberation Day’ tariffs, China was targeted with a 34% tariff rate, which was then hiked to 84% and finally to 125%. Added onto the first IEEPA blanket tariff of 20% on all imported goods from overseas, this put tariffs over and above existing tariffs at 145%, CEA said.

A deal agreed 12 May then saw the China-specific IEEPA tariffs dropped to 10% for 90 days, meaning that for now, 30% tariffs apply on all goods with China as the country of origin.

There are also existing Section 301 tariffs on Chinese lithium-ion (Li-ion) batteries at 7.5%, which are due to go up to 25% from the beginning of 2026 on all Li-ion batteries, battery parts and materials. On top of this is a 3.4% baseline ad valorem tariff.

CEA calculated that as of the end of May, tariffs on Chinese Li-ion batteries will be at 40.9% until the 90-day pause ends 12 August. From then until the end of this year, they will be at 64.9% and 82.4% from January 2026 once the Section 301 tariff goes up.

CEA said BESS cells, container bill of materials (BOM) and power plant components could be subject to up to five tariffs. These include tariffs on steel imported from anywhere in the world and the impact of Trump’s ‘reciprocal tariffs’ on other countries that play a role in the supply chain, like Canada and Mexico, plus separate active anode tariffs which could yet be imposed on companies importing from China under anti-dumping and countervailing duties (AD/CVD),

While US companies are seeking alternative supply sources, other BESS DC block- and cell-producing countries like South Korea, Indonesia, Malaysia and latterly Poland will also face relatively steep tariffs.

At the current tariff rate during the three-month standoff, CEA said Chinese OEMs would likely be willing to absorb some of the extra cost to maintain market share, but of course, the picture is much less certain in the longer term.