The US Treasury and Internal Revenue Service (IRS) have finalised the rules and process for the 45X advanced manufacturing tax credit, which effectively provides a subsidy to domestic clean energy technology manufacturing, including batteries.

The final rules are largely in line with the additional guidance that the two Federal departments issued in December 2023, clarifying definitions and credit amounts for the eligible components within battery, solar, wind and inverter manufacturing.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The 45X advanced manufacturing production tax credit (PTC) is part of a swathe of tax credits, and new provisions for monetising them, brought in as part of the Inflation Reduction Act (IRA), the country’s US$369 billion package to boost its upstream and downstream clean energy industry, as well as lower consumer costs.

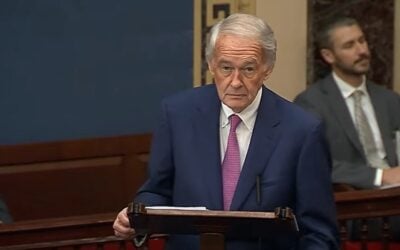

“The Biden-Harris Administration’s economic agenda is driving a manufacturing boom across the country that I’ve seen first-hand in North Carolina, Kentucky, and Georgia,” US secretary of the Treasury Janet L. Yellen said. “The final rules announced today will help companies continue to invest and innovate in the United States as we buildout our clean energy economy.”

For the energy storage system sector, the most significant aspect is the US$35 tax credit per kWh for battery manufacturing and US$10 per kWh for battery module manufacturing. Batteries, primarily lithium-ion, are used in battery energy storage systems (BESS), of which there are expected to be nearly 30GW online in the US by the end of 2024, according to the US Energy Information Administration (EIA).

One change from December 2023’s guidance highlighted by the Treasury is that now, manufacturers can include the costs of materials and extraction in their production costs for applicable critical minerals and electrode active materials, if conditions are met. This applies to the tax credits for component production, which amount to 10% of those production costs.

The other significant tax credit for energy storage is the investment tax credit (ITC) for downstream energy projects, including BESS and other technologies, which covers 30-70% of a project’s capital expenditure.

Two new ways of monetising the clean energy tax credits were also brought in under the IRA to increase the amount of capital. The first is transferability, whereby project owners can sell tax credits associated with their projects to outside parties rather than setting up traditional tax equity partnerships. The second is direct pay, whereby non-tax paying entities can monetise tax credits with a direct payment from the government.

Transferability will be used particularly for 45X manufacturing production tax credits while project developers still prefer to use traditional tax equity to monetise the ITC. Investment banking firm Foss & Company explained the reasons for this yesterday (Premium access).

The IRA and its tax credits and other subsidies is the US government’s ‘carrot’ for supporting its domestic clean energy industry, while the ‘stick’ is increased tariffs on clean energy technologies imported from China.

See the Final Rule filing from the Treasury on 45X, in full here. For a summary of its significance for solar manufacturing, see our sister site PV Tech’s coverage from yesterday here.