Against the backdrop of ever-shifting market conditions, estimating potential energy storage revenues is a complex challenge. Rachel Locquet of Clean Horizon explores the dynamics shaping Europe’s main markets and how investors can make the best decisions for maximising revenues.

This is an extract of a feature article that originally appeared in Vol.42 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries.

Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the 10-year back catalogue is included as part of a subscription to Energy-Storage.news Premium.

The front-of-the-meter (FTM) energy storage industry in Europe is experiencing rapid growth. Projects are

becoming larger and revenue streams are diversifying, with energy storage playing an increasingly critical role in balancing electricity grids.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

New markets are emerging—such as Poland and the Baltic states—where ancillary services have recently opened, creating fresh opportunities for investors and developers. At the same time, some established markets are reaching saturation. In the UK, for example, ancillary service revenues have declined as competition has increased. Similarly, in France, the primary reserve market has become crowded. These shifts are forcing market participants to explore new strategies to optimise returns.

Meanwhile, the increasing penetration of renewable energy is driving greater electricity market volatility. As wind and solar generation fluctuate, energy storage is becoming essential for stabilising supply and capturing price spreads. This trend is unlocking new opportunities in wholesale electricity markets and balancing services.

However, taking advantage of these opportunities is far from straightforward. Estimating potential storage revenues remains a complex challenge. Earnings in real-time electricity markets depend on multiple factors, including market conditions, regulatory frameworks and battery energy storage system (BESS) trading strategies.

Without a deep understanding of these dynamics, investors risk overestimating or underestimating potential revenues, leading to suboptimal investment decisions.

BESS markets in key European countries

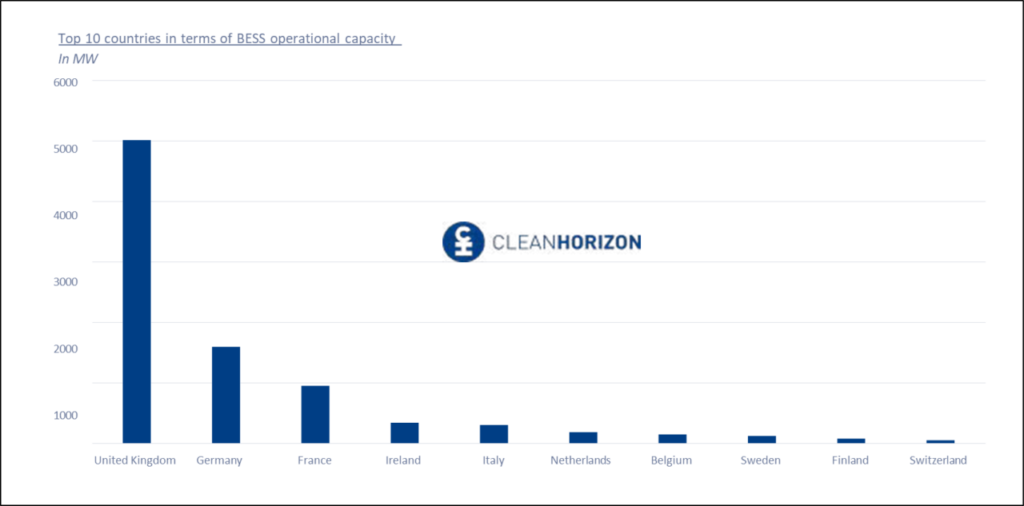

When examining the leading markets for operational energy storage capacity in Europe, the UK stands out as the dominant player by a significant margin. The growth of the UK’s energy storage market has been propelled by targeted auctions held several years ago, which allocated substantial amounts of energy storage capacity. Additionally, the UK has established lucrative ancillary services markets, which have been highly remunerative, attracting large-scale investments in energy storage.

Germany ranks second in Europe, with approximately 1.5GW of installed energy storage capacity. While most of these systems were originally designed to provide primary reserve, a shift has occurred as prices in this market have decreased. As a result, Intraday and secondary reserve markets have become the primary sources of revenue for storage operators.

France follows closely behind with nearly 1GW of energy storage capacity. A significant portion of this capacity is owned by NW Group, while the remaining projects were awarded through the long-term capacity mechanism auction.

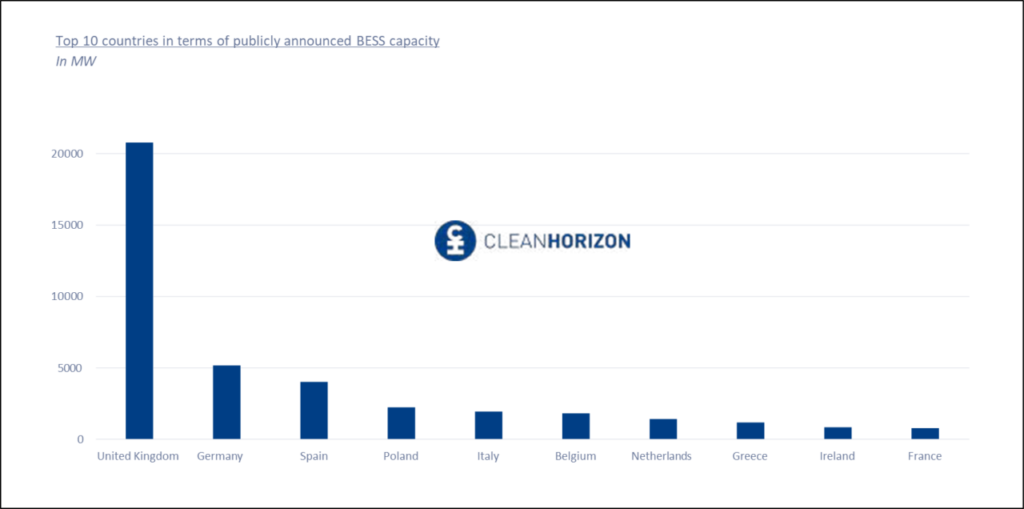

The ranking of the top 10 European countries based on announced energy storage capacities (Figure 2 below) differs significantly from the graph in Figure 1 above. The data presented here is sourced from the Clean Horizon Energy Storage Database (CHESS), which exclusively includes publicly announced projects.

Notably, Spain and Poland feature prominently in the top 10. These countries are becoming hotspots for energy storage developers, thanks to their generous subsidy programmes and substantial market opportunities. Italy has also implemented compelling mechanisms to attract investment, such as the Fast Reserve auction and long-term capacity mechanism auctions.

Similarly, Belgium has emerged as an appealing market, with numerous developers undertaking large-scale projects, particularly to capitalise on high market volatility and ancillary service prices.

What are the key revenue streams for energy storage in Europe?

The main differences between those countries are the revenue opportunities for battery energy storage systems (BESS). Storage assets can get remunerated by providing different types of services to the grid, from shifting consumption to times where the electricity is cheaper to helping the grid ensure frequency stability. Each of those services enable storage assets to generate revenues.

Wholesale markets: intraday, day ahead

The day-ahead market is the primary wholesale electricity market in Europe. Its main purpose is to allow electricity producers, suppliers and traders to buy or sell electricity one day in advance, based on improved forecasts of consumption and production. The market operates on a pay-as-clear auction system, where the last asset selected to meet demand sets the market price for each hourly period. This auction closes at 12:30 PM CET the day before delivery.

Prices on the day-ahead market fluctuate significantly depending on the balance between supply and demand:

• When demand is largely met by low-cost renewable generation, prices tend to decrease and can even become negative during periods of high renewable output and low consumption.

• Conversely, when demand is high and more expensive thermal power plants are required to meet it, prices rise considerably.

For battery energy storage systems, these price fluctuations create an opportunity known as energy arbitrage. Storage assets can charge during periods of low prices—typically around midday when renewable production is abundant—and discharge during high-price periods, often

in the evening when demand peaks and renewable output decreases. The revenue generated from this strategy is essentially the difference between the evening price and midday price, adjusted for the battery’s efficiency. This difference is referred to as the price spread.

Beyond the day-ahead market, BESS can also generate revenues in the Intraday market, which allows trading closer to the actual time of electricity delivery. The Intraday market is divided into two segments:

• Intraday Auctions: Similar in structure to the day-ahead market but held multiple times a day and closing nearer to realtime delivery.

• Intraday Continuous Market: A fundamentally different mechanism, this is a continuous order book where market participants can place buy or sell orders for electricity until as little as 5 minutes before delivery. Trades occur when matching orders are found.

The Intraday Continuous Market was originally introduced to help electricity players minimise imbalances in their portfolios, particularly as renewable production forecasts improve closer to real time. Liquidity in this market tends to increase during periods of high demand, high renewable output, or when imbalance penalties are significant.

For energy storage operators, this market offers additional flexibility to capture price spreads and optimise their revenues beyond the day-ahead auction. In the Intraday Continuous Market, trades can be placed as early as two days before the delivery period and up to five minutes before delivery.

Storage operators typically engage in a dynamic trading strategy by placing successive buy and sell orders at different price levels for the same delivery slot.

Ancillary services

Most European countries within the Continental Europe Synchronous Area (CESA) are interconnected and operate on the same electrical frequency. This synchronisation means that any frequency deviation or electrical instability in one country can quickly affect the entire area. As a result, these countries have developed similar ancillary services markets to maintain grid stability and security.

In contrast, the Nordic countries (such as Sweden, Norway and Finland) form a separate synchronous area, not synchronised with Continental Europe. Their ancillary services markets are therefore designed differently, often reflecting the higher share of renewable energy in their systems and the specific flexibility needs of their grids.

Synchronous areas use ancillary services to maintain their frequency close to its nominal value. Ancillary services used to be provided mainly by flexible power plants such as thermal, hydro and nuclear (in the case of France). In most countries, ancillary services are procured through auctions for delivery timeslots that typically range from one to four hours in reservation markets and from 15 minutes to one hour in energy activation markets.

The primary reserve is the first line of defence against frequency deviations in the power system. It automatically responds within seconds to stabilise frequency across the synchronous area. This service is commonly referred to as the Frequency Containment Reserve (FCR). Storage and other flexible assets providing FCR are typically remunerated through capacity payments. They are paid for making their capacity available to deliver frequency support, usually contracted the day before delivery through daily auctions or tenders. The asset earns revenues whether it is activated or not, simply for being available to respond.

Then, the secondary reserve, known as the Automatic Frequency Restoration Reserve (aFRR), is activated to restore frequency to its nominal value and balance electricity supply and demand at the national level.

The aFRR market structure generally includes two revenue streams:

• A capacity payment for reserving the asset’s flexibility in advance, typically secured in a day-ahead market.

• An energy payment when the asset is activated in real time by the Transmission System Operator (TSO) to deliver energy.

Efforts are underway to harmonise aFRR market operations across Europe. The PICASSO project, led by European TSOs, is standardising the activation of aFRR energy at the European level, allowing cross-border participation and facilitating a more integrated balancing market.

Finally, tertiary reserves are marketed similarly to secondary reserves in most European countries, with the aim of balancing electricity supply and demand. However, this market can prove to be very volatile, namely in countries with high renewable penetrations, such as the Nordics.

Subsidies and capacity mechanisms

In addition to wholesale and ancillary services markets, some European countries have implemented specific mechanisms to support the development of new technologies such as energy storage. These mechanisms aim to ensure security of supply while encouraging the integration of flexible assets that can help balance increasingly renewable-heavy power systems.

One of the most widespread support schemes is the capacity mechanism. This mechanism provides financial incentives to assets that commit to being available during periods of high demand or system stress, regardless of how often they are dispatched. Energy storage systems can participate alongside conventional generation, providing flexibility and reliability to the grid.

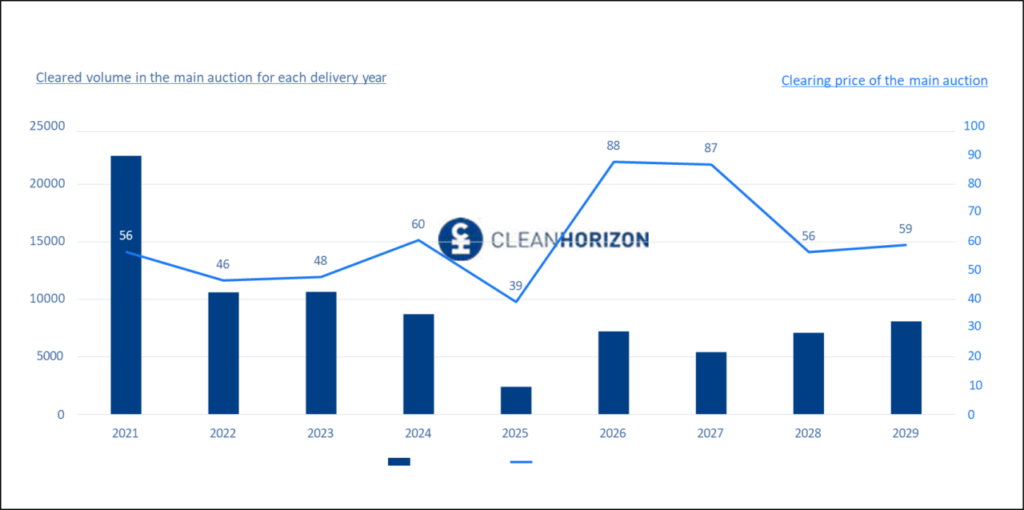

A notable example is Poland, where the capacity market has played a major role in fostering storage development. As of the latest auctions, Poland’s capacity mechanism has awarded contracts to over 2.5GW of battery energy storage systems, expected to be commissioned by 2029. This significant pipeline reflects both the country’s ambition to modernise its grid and the growing recognition of storage as a key enabler of energy transition.

In addition to market revenues, public support schemes are playing a crucial role in accelerating the deployment of energy storage in Europe. A notable example is Spain, which has introduced dedicated funding for storage projects under its Recovery and Resilience Facility.

In October 2023, Spain launched a largescale tender as part of its PERTE (Strategic Project for Economic Recovery and Transformation) framework, specifically targeting 4-hour standalone battery energy storage systems (BESS).

The results of this tender highlight the country’s strong commitment to supporting storage deployment:

• A total of 805MW/3,589MWh of storage capacity was awarded nationwide.

• Of this, more than 690MW/2,820MWh of battery systems were allocated across both mainland Spain and the islands. In mainland Spain alone, 635MW/2,585MWh of projects were selected, corresponding to a total public grant of €128 million.

All awarded projects consist of 4-hour duration BESS, reflecting Spain’s strategy to prioritise longer duration storage to better integrate renewable energy.

Revenue optimisation

As highlighted in the previous section, BESS have the capability to provide a wide range of services across various electricity markets, most of which operate with an hourly or sub-hourly resolution. To fully capture the value of these services, it is essential for BESS operators to optimise their participation across all accessible markets.

This complex task is carried out by specialised entities known as route-tomarket (R2M) providers. The route-to-market provider is responsible for ensuring that a storage asset participates in the most profitable combination of markets while respecting technical and regulatory constraints. This involves making strategic decisions both ahead of delivery (D-1) and in real time.

On the day before delivery (D-1), the R2M must decide how to allocate the asset’s capacity across the following markets:

• Day-ahead wholesale market

• Intraday Auction market and Intraday Continuous trading

• Ancillary services reservation markets (such as FFR, FCR, aFFR, manual Frequency Restoration Reserve (mFRR))

These decisions are based on:

• Expected market prices

• Participation requirements (such as prequalification, state-of-charge limits)

• Anticipated revenues on real-time markets (aFRR energy, mFRR energy, Intraday Continuous)

Once the day-ahead positions are secured, the R2M must manage the asset’s operation in real-time energy markets, ensuring that it fulfils the services it has committed to while also maximising additional trading opportunities on:

• aFRR energy market

• mFRR energy market

• Intraday Continuous Market

The Clean Horizon Storage Index: a benchmark for energy storage revenues

To provide a transparent and standardised benchmark for energy storage revenues across different European markets, Clean Horizon has developed the Storage Index. This index is updated monthly and reflects the annualised revenue potential of a reference storage asset, based on market prices observed during that specific month.

The Storage Index is designed to answer a simple question: if an entire year replicated the same price patterns as those observed in each month, what would be the expected annual revenue of a storage asset?

The Storage Index is calculated using COSMOS, Clean Horizon’s proprietary and sophisticated energy storage simulation tool, which replicates real-world route-to-market behaviour and decisionmaking.

By following a transparent, conservative, and standardised methodology, the Storage Index offers a valuable reference for investors, developers, and policymakers looking to assess and compare the revenue potential of energy storage assets across multiple European countries.

A number of key trends can be observed in those five countries, falling into three main categories:

• Emerging markets such as Poland and Spain, where large volumes of energy storage have been announced and are expected to come online in the coming years, but where the current installed capacity remains marginal.

• Intermediate markets such as Sweden, where the energy storage market is expanding, but the primary reserve markets, particularly FCR, are already nearing saturation.

• Mature markets such as France and Germany, where energy storage is already well established, and key markets like FCR have become saturated, leading to increased competition and declining revenues and where new market opportunities are crucial to sustaining a profitable BESS business case.

Across all these countries, the greatest revenue opportunities typically arise when new markets open. These are key moments for storage operators, as prices tend to be significantly higher due to limited competition and the need for new flexibility providers. Recent examples include the opening of the aFRR capacity auction in France in June 2024 and the launch of ancillary services markets in Poland during the same period.

These events resulted in sharp revenue increases for energy storage assets. Once primary reserve markets saturate—as seen in France and Germany—the profitability of 1-hour BESS decreases. In such mature environments, 2-hour and longer-duration BESS become increasingly attractive, as they allow operators to tap into a wider range of markets, including energy markets and secondary and tertiary reserves.

As markets evolve and saturate, cross-market optimisation becomes essential. In the early stages, as illustrated by Sweden in 2023, the bulk of revenues came exclusively from FCR-D, making market participation straightforward. However, once these markets saturate, it becomes crucial to diversify BESS participation across all available markets to leverage fluctuating price signals— for instance, compensating lower FCR revenues with opportunities in mFRR or energy markets.

This strategy of cross-market optimisation is particularly effective for longer-duration BESS, which offer greater flexibility in cycling and energy dispatch.

Cover image: Zenobe Energy’s grid-forming 200MW Blackhillock BESS project in Scotland, UK. Credit: Zenobe Energy

About the Author

Rachel Locquet is a lead consultant at Clean Horizon, a consultancy which offers both market analysis and technical consultancy on energy storage. Rachel’s role encompasses energy storage training, market analysis, electricity and ancillary services price forecasting, energy storage business model optimisation and commercial due diligence.