A provider of home battery storage systems aggregated via an artificial intelligence (AI) platform has won the first ever fully domestic weekly Firm Frequency Response (FFR) contract with the UK’s transmission network operator, National Grid ESO.

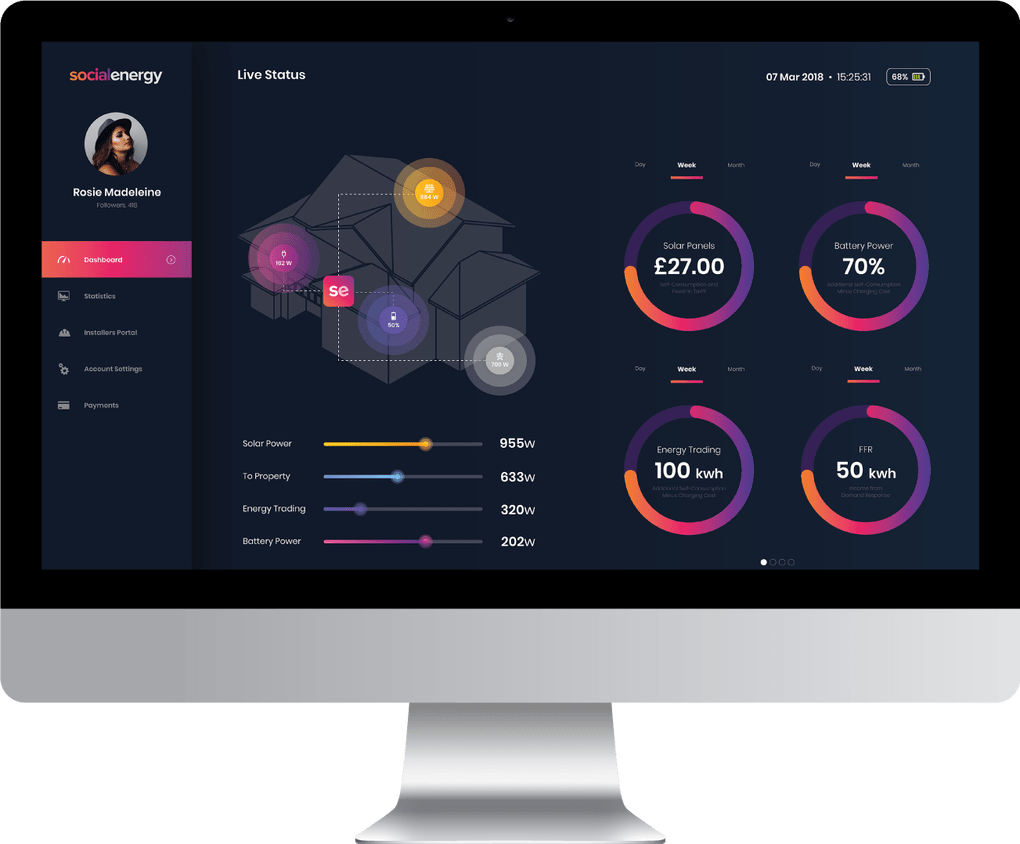

Social Energy will use 80% of its fleet of customer batteries to provide 4MW of FFR capacity throughout the day, helping the operator to balancing demand.

By taking part in frequency response auctions, customers will be able to benefit financially through trading opportunities, taking full advantage of their home storage systems to reduce their energy costs.

Steve Day, chief technology officer at Social Energy, said it was “fantastic” to work with National Grid ESO as part of the weekly trial.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“By expanding our portfolio of grid services to include the frequency response auctions, it enables us to secure greater benefits for our customers, while helping to future proof the electricity system in Britain.”

The need for Frequency Response and other grid services has been thrown into light during the COVID-19 lockdown, with demand hitting record lows and renewable generation surging; National Grid ESO saw its network balancing costs soar by 39% compared to 2019.

David Spencer, New Business manager at National Grid ESO, said it was great to see new approaches to the market and a first contract made up of just domestic customers.

“Managing the frequency of electricity, through matching supply and demand is a key part of our role making sure Great Britain has safe, secure and reliable electricity. FFR is one of the many tools we use to balance the system.

“It’s a great initiative helping us towards achieving our ambition of being able to operate the GB electricity system carbon free by 2025, with the services being used to balance the grid moving away from traditional sources to cleaner, decentralised power.”

Social Energy uses smart technology help reduce customer’s electricity bill, as homeowners can install solar and battery systems and connect them to Social Energy’s tariff. Given a 5.8kWh battery, annual solar generation of 3500kWh and demand of 3800kWH, this export rate of 5.6p/kWh (US$0.074) can help to reduce their electricity bills by £519 (US$689) per year.

This story first appeared on Current±.