Despite a 12% year-on-year fall in the capacity of newly submitted planning applications in 2024, there is still a strong interest in the UK energy storage market as a whole.

This article takes a close look into the battery energy storage system (BESS) pipeline, which shows that the future growth pipeline remains robust.

Most of the projects are in the early stages: either announced by developers, included in the TEC register, or have screening/scoping applications submitted. Inclusion in the TEC register is an early stage in a (typically larger) project, and normally comes before a planning application.

The TEC register includes over 156GWh of uncompleted stand-alone battery sites, with an average capacity of 254 MWh. Although 60% have target connection dates beyond 2030, the movement of many projects on this list seems to be slow at the moment, and more projects are still being added every month.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

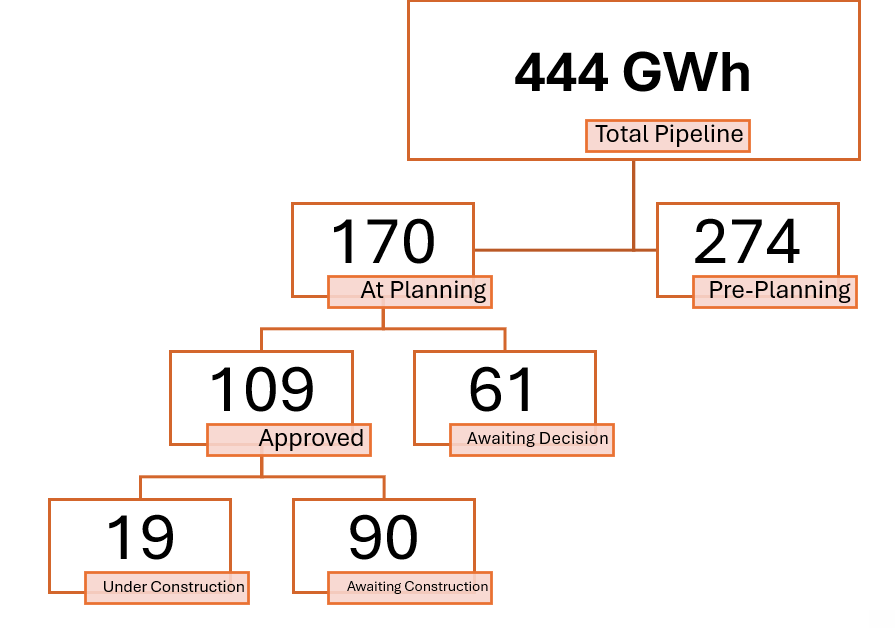

Over 42GWh was added to the overall pipeline from screening and scoping submissions (without corresponding full applications) last year. Most of the pipeline changes so far in 2025 have occurred at this stage also, with over 4GWh submitted in 2025 to-date. Regarding full applications, over 1.6GWh of capacity has been submitted so far in 2025, an increase of 10% compared to the same period last year.

Over 43GWh was approved in 2024, an increase of 35% from 2023 and this year has already seen over 8.9GWh of approvals, including one of the largest consented projects in the UK so far. Although high levels of submitted capacity the previous year did help to increase approval capacity in 2024, the decision times appear to be shortening from the over nine month average decision time for 2023 submissions.

Around 19GWh of projects are currently under construction, accounting for 17% of approved projects. Despite it only being the start of the year, over 140MWh has already been completed and, with over 17GWh of grid connections due to connect in 2025, the build-out this year and in 2026 is looks promising.

With such rapid growth in the energy storage market in recent years, any signs of a slowdown in new applications or build-out should always be viewed with caution.

However, within the UK, numerous sites over 1GWh in size have already been approved and construction has begun on some of these sites that will ultimately become some of the largest BESS projects in Europe.

With the current UK government promoting schemes to help the rollout of energy storage in the coming years, the future of BESS in the UK remains an exciting sector with many opportunities for various stakeholders in the market.

All data and analysis shown in this article comes from our in-house market research at Informa Markets PLC, specifically our UK Pipeline & Completed Assets Database.