The UK will have 50GW-plus of energy storage installed by 2050 in a best case scenario attainment of net zero, according to grid operator National Grid’s Future Energy Scenarios report.

The report’s broader conclusions around the energy sector were covered in detail by Energy-Storage.news’ sister site Current yesterday.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It is published by the National Grid ESO (electricity system operator) each year and outlines four different pathways for the future of energy to 2050, including the energy storage deployments each entails (covering all technologies including batteries, pumped hydro, air-based solutions etc).

Four different Future Energy Scenarios with storage deployments

In the ‘Falling Short’ scenario, which does not achieve Net Zero, the UK will only have around 22GW/60GWh of energy storage.

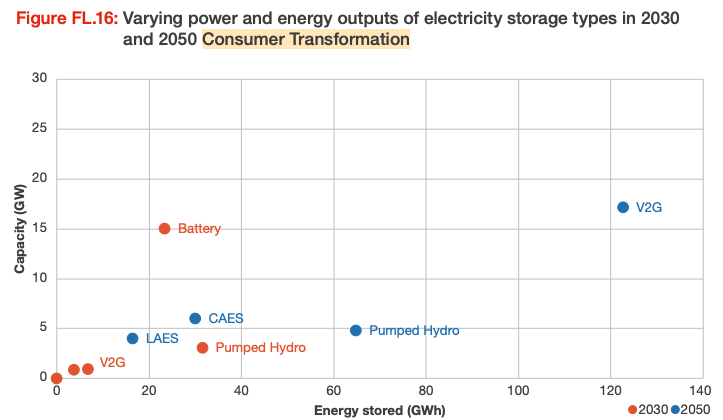

‘System Transformation’ and ‘Consumer Transformation’ both achieve net zero but with the latter involving higher societal changes, like electrified heating, consumers willing to change behaviour, high energy-efficiency and demand side flexibility. The former entails 32GW/115GWh deployed and the latter around 40GW/165GWh deployed, by 2050.

In ‘Leading the Way’, the best-case scenario, the UK will have deployed just over 50GW of energy storage power and just under 200GWh of capacity.

The capacity of different types of storage by 2030/50 under ‘Consumer Transformation’ are illustrated in the report’s graph below.

Roles for storage in providing flexibility

Currently, the vast majority of flexibility provided to the system, totalling nearly 18TWh, is from natural gas. As of the end of 2021, the non-gas assets comprise 25.8GWh of pumped hydro and 1.6GWh of battery storage.

Electricity storage capacity is set to increase in all scenarios to ensure peak demand can be met reliably as an increasing proportion of the UK’s electricity is generated from weather dependent renewables.

The main roles for electrical energy storage in providing flexibility the report spells out are as follows, with the durations required:

- Managing seasonal differences in supply and demand (longer duration storage, i.e. four hours-plus)

- Managing several days of oversupply or undersupply (longer duration storage)

- Balancing daily variations in supply and demand (longer and shorter duration storage)

- Reserve for unplanned outages/forecast error (shorter duration storage)

- Real-time operability (shorter duration storage)

National Grid ESO expects battery storage to make up the largest share of storage power capacity in all scenarios by 2050 to help with shifting demand within the day and managing network constraints as battery costs fall.

But for storage capacity (GWh), pumped hydro is likely to remain the bulk. The report expects this to increase to 65GWh in 2030 and 84GWh in 2050, again under ‘Leading the Way’.

Under ‘Leading the Way’, battery storage capacity will increase to 20GW by 2030 and 35GW by 2050. Later on, the report said that up to 35GW of ‘electricity storage with an average discharge duration of less than 4 hours’ would be needed by 2050, giving an idea of the duration at which it sees non-battery alternatives dominating.

For non-battery technologies, some 11-56TWh of large-scale inter-seasonable storage could be needed by 2050. But, this amount depends on the rollout of green hydrogen, hydrogen storage and other flexibility assets.

One or two-hour average durations for batteries could increase to at least four hours in the coming years due to market-driven factors, the report said.