Activity in the UK battery energy storage system (BESS) market continues to grow substantially year-on-year despite numerous headwinds, as detailed in this H1 recap from our Market Research colleagues.

The first half of 2025 saw a 78% jump in project completions, a 25% increase in projects submitted for planning approval and a 49% jump in projects being approved.

Clean Power 2030 goals loom over industry

The UK energy storage market continues to see strong interest from both existing and new players. There is a robust pipeline of 68GWh of BESS submitted into planning still awaiting decisions and over 130GWh of approved projects. With Clean Power 2030 goals looming over the industry, it’s useful to take stock of the market at this juncture.

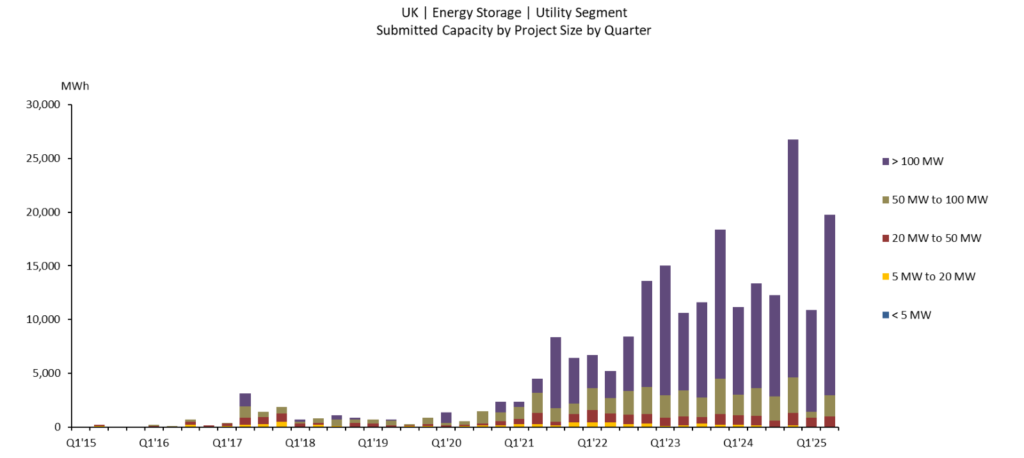

Submissions remained strong in the first half of the year despite the slight dip in the first quarter. There was a 25% increase in submitted capacity compared to H1 2024, mainly due to the second quarter of 2025 having the second-highest quarterly submitted capacity seen to date. This was only beaten by Q4 2024, which saw a spike due to the submission deadline in December for projects to be considered for a gate 2 connection under the new grid reforms.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

There was no significant difference between the number of projects in H1 2024 and 2025, but project sizes have generally increased over the years. 2025 continues this trend with the average capacity of submitted projects being 300MWh compared to the 230MWh average of 2024.

41% of submitted projects were over 100MW compared to 22% in the same time period last year. Multiple developers have put forward projects over 1GWh, such as Fidra Energy’s 2.4GWh BESS in Lincolnshire and NatPower’s 2GWh Brant Energy Storage also in Lincolnshire.

It comes as no surprise that the English region with the highest capacity submitted so far is the East Midlands with over 6.7GWh. When looking at just the number of projects however, it is the West Midlands with the most number of applications.

Pre-application submissions have also been going strong, building the UK pipeline up for years to come with over 47GWh in screening and scoping applications (without a corresponding full application) in just the first half of the year. This has been boosted by the increase in LDES (long-duration energy storage) submissions in light of the new cap and floor scheme.

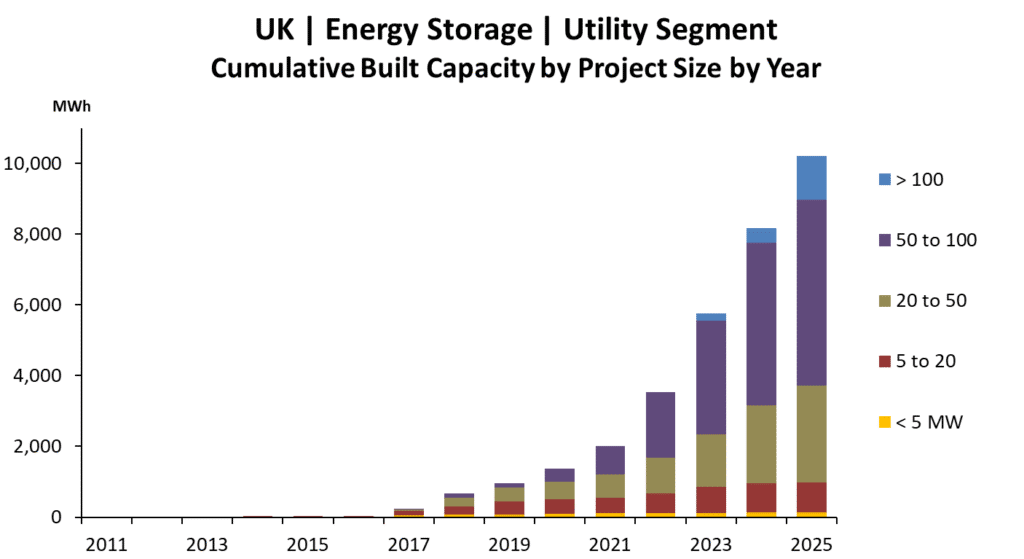

Fig 2: 2025 completed capacity is already 78% of the capacity completed for the full year of 2024

In addition to the steady stream of submissions, build out has been going strong with over 1.9GWh completed in the first half of 2025 so far, a 78% increase from capacity built in H1 2024. The average size of completed sites has again increased to 92MWh from 63MWh in the year prior.

Around two-thirds of the completed capacity is from stand-alone sites, and the rest are primarily co-located with solar. The region in England with the most capacity built out so far this year is the South-East with over eight completed projects.

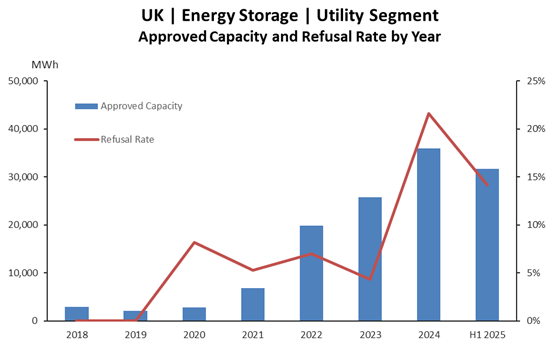

Fig 3: The 2025 refusal rate is nearly double that in 2022

The number of approvals shot up compared to H1 2024, growing 49%. Even only looking at the first half of 2025, the approvals have already reached 87% of the approved capacity seen in full year 2024.

Over 31GWh have been granted approval in the first half of the year, bringing the cumulative capacity of approved and not yet completed sites to over 130GWh; 71% of this has come from approvals made since the start of 2023. The regions with the most approved capacity in H1 2025 were the East Midlands, and Yorkshire and the Humber, with over 5GWh each.

2024 saw a spike in rejection rates, presumably as more sites were being submitted and publicly announced. This has since fallen to around 14% so far in 2025, still higher than the five-year average. Most of the refusals (70%) occurred in the second quarter of the year. The region with the largest number of refusals was the South East with a rejection rate of 40%.

Overall, battery storage in the UK is seeing sustained growth and shows a promising future. Over 70GWh of approved projects are due to be connected to just the transmission network by the end of 2030, well over the Clean Power 2030 goal. However, a large number of these projects remain in a state of stasis and development timelines, particularly in the build-out, need to show faster movement in order to bring the CP30 plan to fruition.

All data and analysis shown in this article comes from our in-house market research at Informa Markets PLC, specifically our UK Pipeline & Completed Assets Database.

ESN Premium subscribers can track the Database’ data on a monthly basis with our regular deployment roundups, the latest of which is here.