Developer Black Mountain Energy Storage (BMES) has sold 700MW of development-stage projects to UBS Asset Management, its third substantial sale in the Texas ERCOT market in two months.

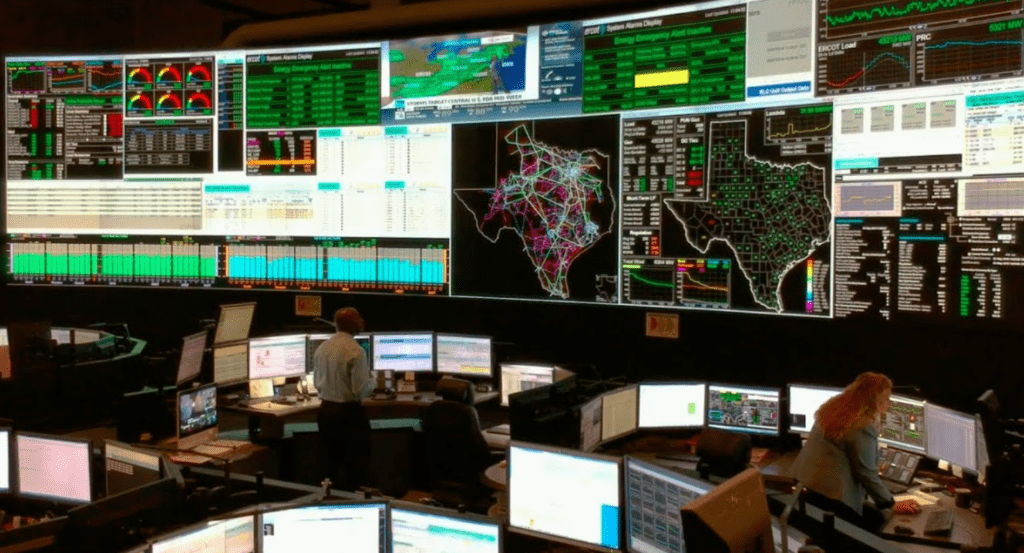

The five standalone battery energy storage system (BESS) projects acquired by UBS Asset Management, part of the Switzerland-based global bank, are expected to come online in 2024. They are located on the Electric Reliability Council of Texas (ERCOT) grid.

UBS said the projects will provide flexibility, responsiveness, and dispatchability to the ERCOT grid once operational.

The main revenue sources for battery energy storage projects in the state are frequency response services regulation reserve service (RRS) and a sub-set within that group called fast frequency response (RRS-FFR), and wholesale energy trading particularly around congested nodes.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“This portfolio is comprised of strategically selected, diversified projects in locations which are well-positioned for the current state of the market, as well as the dynamic growth Texas will experience in the coming years,” said, Ken-Ichi Hino, Portfolio Manager, Energy Storage Infrastructure, UBS Asset Management.

UBS Asset Management was advised on the transaction by Troutman Pepper, Clean Energy Counsel, and Euclid Power.

BMES has now sold 1,200MW of energy storage projects for delivery in ERCOT in 2024 in the last two months, with a total energy capacity of at least 1,700MWh, assuming that UBS’ acquired projects have a discharge of at least one hour.

Last week, BMES sold 400/600MWh of projects to Cypress Creek Renewables with an average duration of 1.5 hours while in June it sold two 100MW/200MWh sites to Recurrent Energy, part of Canadian Solar. In both of those cases the buyers said they would take over project development, entitlement, engineering, procurement, financing and construction and operate the sites once live.

Developers in the ERCOT market are generally moving past one-hour systems as energy trading grows as a revenue stream.