The question of where the cells in a BESS are from ties in to safety, performance, design and, increasingly, potential tariffs.

This article dives into cell production and supplier relations between manufacturers and system integrators, using data and analysis from our Market Research team.

These manufacturers, although also selling own-branded systems, strongly rely on battery and cell shipments for energy storage revenue, with multi-GWh deals spanning several years being common.

While this ensures a steady supply of cells, rising trade tensions and general market uncertainty have increased the urgency of having multiple cell suppliers.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Some companies are reducing the third-party supply risk even further by starting cell manufacturing, such as Canadian Solar with production set to begin in 2025.

Cell-to-system dynamics of BESS industry

Very often system integrators and BESS manufacturers do not reveal which lithium-ion OEM supplied the cell in their product, even to potential customers during early-stage discussions.

The infographic above is based only on publicly announced supply deals, so is by no means exhaustive (it only covers grid-scale BESS, so Panasonic and Tesla’s co-operation is not included).

Sunwoda is a major lithium-ion OEM, for example, which likely works with many system integrators but has rarely if ever publicly announced a BESS supply deal.

Part of this lack of transparency may be justified by a maturation of the industry meaning that the origin of the lithium-ion cells in the BESS is not particularly significant, with quality and safety parameters now far more developed and encoded than they were, say, five years ago. Integration, assembly, software and services are now the main areas where BESS providers differentiate themselves.

As shown in the infographic, many lithium-ion OEMs have their own in-house BESS solutions using their cells while also supplying BESS manufacturers and integrators.

This means an element of competing with their customers, who could either buy directly from, say CATL, or buy from a system integrator using CATL cells (or BESS).

We’ve put this to numerous lithium-ion OEMs in the past, who in response have been relatively sanguine on this risk, saying the market is big enough that this competition isn’t a problem.

Another trend that is increasingly affecting which cells BESS companies will buy is an increase in form factor. For the past few years, virtually all grid-scale BESS products used 280/314Ah cells, while the past year has seen cells twice or even over three times that size come to market. Hithium last week announced a 1,175Ah cell.

China still dominant

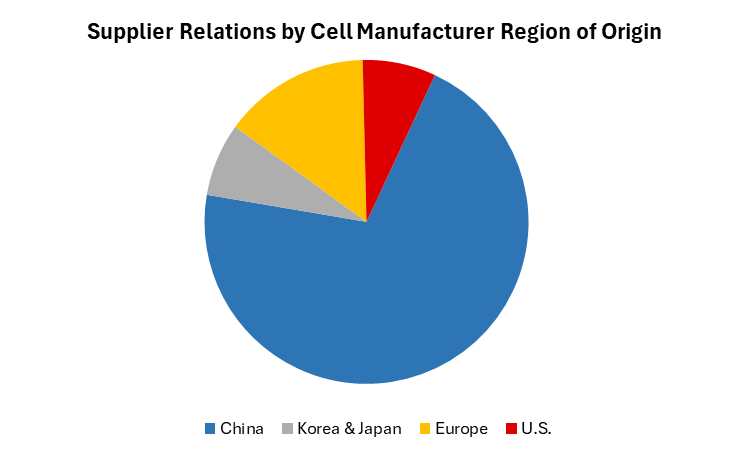

China still remains dominant in cell manufacturing, with nearly all system integrators included in the Battery StorageTech Bankability Ratings report acquiring cells from the region. CATL, the largest lithium-ion manufacturer in the world, has had publicly released supplier deals with over 10 different integrators included in the aforementioned report.

Figure 1: From 18 top ESS integrators, the majority of cells in the systems come from Chinese companies.

Even with Korean and American battery manufacturers, it is common for ESS cells to be manufactured in China as well given the lower cost of production; a business decision taken recently by Kore Power for example.

However, the new tariffs have brought an emphasis on US manufacturing; while companies with established plans for US sites should be benefiting, instead, tariffs have led to market uncertainty and halted plans for both ESS projects and cell manufacturing facilities. Both Kore Power and Freyr (now T1 Energy) have cancelled gigafactory plans in the US earlier this year.

Some companies are faring better with shifting more of their supply chain to the region, such as Fluence, which said systems with US-manufactured cells will be available this year from its supplier AESC and is rapidly expanding domestic manufacturing of other components.

Gotion High-Tech is also committing to U.S. manufacturing with the company’s first ESS packs produced in California in 2024 and plans for a cell production site in Illinois in addition to a materials plant for a fully American supply chain.

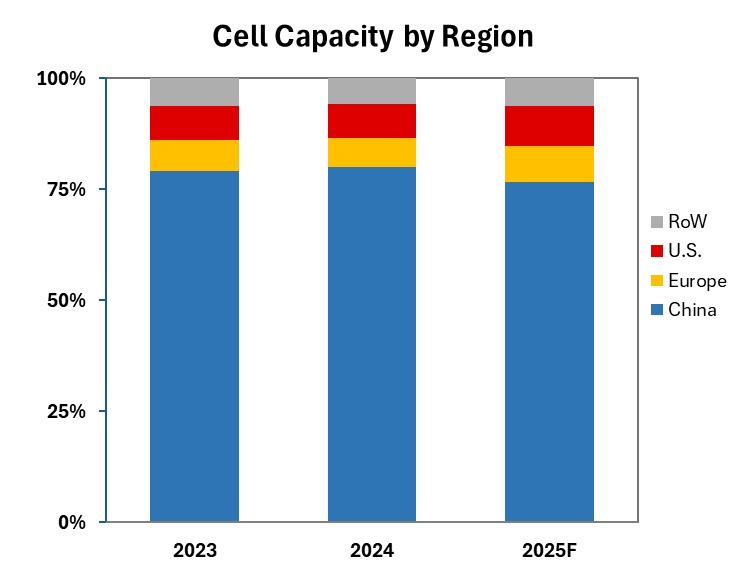

In general, there will be a gradual move out of China for cell manufacturing for both EV and ESS.

Figure 2: Total capacity for cells (including for energy storage) is forecast to become more global from 2025 onwards.

The cell production capacity is still heavily weighted towards that for electric vehicles and overseas expansion is aided by joint ventures with major automotive companies.

However, it still shows suppliers pushing for overseas production capabilities and potentially trying to mitigate the effects of tariffs. Southeast Asia, which had previously been the prime spot for relocation of manufacturing for the solar industry, has been seeing increased interest with EVE Energy’s Malaysia factory already started production and Sunwoda planning a cell plant in Thailand.

Energy storage is also seeing a similar trend, with CALB’s Portugal factory set to include the production of ESS batteries. LG Energy Solution is incorporating ESS battery production in its plants, notably in Poland and Michigan. With the strong investments in Korean manufacturers like LG Energy Solution and Samsung SDI into US factories and integrators seeking a more diverse supply chain, there’s strong potential for these companies to gain an edge over their Chinese competitors.

Conclusion

The supply chain for energy storage systems remains more complicated than just securing cells, and the dynamics between manufacturer and integrator equally so. With the cell manufacturing landscape remaining extremely concentrated within the top five and increased competition, integrators are looking to any further benefits the supplier could offer, whether that be through pricing or increased collaboration.

American battery manufacturing is still a difficult landscape with the AD/CVD on anodes in addition to the reliance on imports and long timeframe to establish a manufacturing base. American-made batteries are likely to continue to be more expensive to produce and that extra cost falls on the customer, imports will still have a strong place in the market.

To learn more about the Battery StorageTech Bankability Ratings Report, or to arrange a free demo, please contact our team at the link here.