A US regional electricity transmission and distribution operator’s plan to install energy storage batteries could enable ‘benefit stacking’as a way of overcoming “crippling challenges” faced by energy storage, according to one energy expert.

Melissa C Lott, who was lead author on an International Energy Agency report on energy storage published last spring, told PV Tech Storage that ‘benefit stacking’ – or combining multiple uses and revenue streams from a collectively managed energy storage system – of the type proposed by Oncor Electric Delivery Company in Texas, is “critical to the value proposition of many storage systems”.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Oncor, which delivers power to more than three million Texas homes and is responsible for around 119,000 miles of transmission wires, put in a request in November to the state’s Public Utilities’ Commission (PUC) to be allowed to install and to own 5,000MW of energy storage, most of which would be distributed or customer-sited.

Oncor commissioned consultancy The Brattle Group to put together a study, “The value of distributed electricity storage in Texas: Proposed policy for enabling grid-integrated storage investments”, evaluating both the potential uses for storage in Texas and how it could be compensated for providing services, or paid for in a manner determined by market forces. The report said wholesale markets and transmission and distribution (T&D) systems alike could benefit from the use of storage but that the economics of doing so are prohibiting deployment.

“…neither merchant investors nor regulated wires companies can independently capture sufficient benefits to justify investing in storage…under the current policy framework in Texas”.

Ravi Manghani, head of energy storage research at analysis firm GTM Research, explained to PV Tech Storage how Oncor was hoping to stabilise its supply and demand of electricity using batteries.

“…when Oncor said that storage can stabilize supply, it means two things – to act as a buffer for generation sources through time-shifting application, and to stabilise the output by providing ramp control as well as firming, thus improving dispatchability of intermittent sources like solar and wind. On demand, storage can function as a load that can be turned on or off as needed. What Oncor's study shows is that storage provides multiple benefits across the whole electricity grid.”

The Brattle Group report for Oncor recommended allowing transmission/distribution service providers (TDSPs) to be allowed to invest in grid-connected storage, with some caveats:

“We propose a policy model that allows the TDSPs to make the investment in electricity storage and recover the associated investment costs through regulated rates as long as: (a) a significant fraction of the value of these storage assets is associated with transmission and distribution system benefits that are not captured through wholesale market participation, and (b) the incremental system-wide benefits are expected to exceed costs by a sufficient margin. In addition, regulations would maintain a clear delineation between the regulated TDSPs and wholesale market participants.”

Melissa C Lott, who says her work "primarily focuses on evaluating the economic and environmental tradeoffs of energy systems" and is a former guest blogger for PV Tech Storage, explained why the “benefit stack” remains a critical piece of the energy storage market puzzle.

“The value of energy storage lies in the services that it can provide to the energy system, meaning that [it] is ‘cheap’ or ‘expensive’ only in relation to the services that it can be paid for supplying. Many storage technologies can provide an array of services to the energy system,” Lott said.

“Benefits stacking is the ability for a system to both operationally and technically supply multiple services and is critical to the value proposition of many storage systems. Without benefits stacking, many energy storage proposals face crippling challenges that hinder and prevent their deployment.”

Oncor is hoping the benefit stack will add up. Image: wikipedia user: BKMD.

As has often been mentioned on this site and elsewhere, the classification of storage systems in the US for the growing number of services it can provide is in its early stages and presents a challenge to policy makers. Chris Edgette of the California Energy Storage Alliance (CESA), offered a succinct explanation in a recent interview with PV Tech Storage’s sister publication, the downstream solar energy technical journal PV Tech Power.

“Storage can be at various times generation, load and it can help transmission and distribution. And those areas of the grid are very siloed in the US system. In some cases there’s a firm regulatory wall. So when you have a resource that can help with all four of those things, you end up with policy and regulatory challenges”.

GTM's Manghani described the Oncor request as “unique” in being the first instance a US regulator has been asked to allow benefit “stacking” from using such systems.

It has also been widely reported that the plan could cost as much as US$5.2 billion to complete. Critics have included one utility company, TXU Energy, which called the scheme “too costly for tax payers”, to which Manghani responded scathingly.

“TXU Energy along with another EFH subsidiary, Luminant have objected Oncor's approach, calling it "too costly" because it obviously it hits their revenue streams as generators and retailers. Also, apart from obvious competing business models at play, what lies at the crux of this disagreement is how much system level benefits can be actually provided by storage.”

Texas could lead the way on storage and its relationship with energy systems if the Oncor plan is approved. Image: Flickr user: The Jamoker.

The Brattle Group report’s economics seemed to show that with adequate stacking of benefits, the argument over cost held less weight. However Manghani admitted that as the system level deployment of storage has yet to be assessed in detail anywhere, the technology involved will still “have to prove itself”.

“In particular,” he said “the analytics and software needed to manage energy storage systems for multiple use cases are not trivial.”

As energy systems face up to the promises and challenges of storage, Melissa C Lott said, the Oncor plan could be a bold step forward for Texas and for energy policy nationwide.

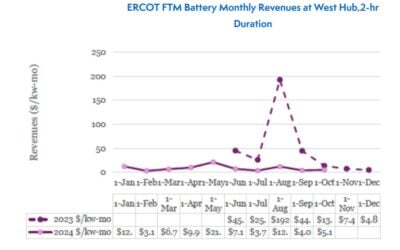

“Oncor's proposal to capture not only transmission and distribution (T&D) benefits but also energy market benefits through auctioning off excess storage capacity would significantly shift the economics of their energy storage proposals, which largely focus on batteries. It's a seemingly elegant solution to the current market challenges that storage faces in the Texas (ERCOT) market and could push the state to the forefront as the country's energy systems continue to evolve."