Procurement platform Anza Renewables has published its first quarterly US energy storage pricing insights report covering battery cell pricing, AC and DC-integrated systems, list prices and more.

Anza notes that tariffs will continue to shape pricing strategies. The figures in this report, for Q1 2025, show where the market is prior to US president Donald Trump’s 10% universal tariff on Chinese imports. Prices are expected to be significantly impacted by the tariff.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The report showed that pricing decreased slightly from August 2024 to 31 January, 2025. Suppliers are adjusting quotes and deal structures to account for the import tariff. Additionally, Anza says the International Trade Comission’s (ITC’s) preliminary affirmative determination on 31 January, that Chinese active anode material will likely harm the US industry, adds further complexity to the tariff landscape.

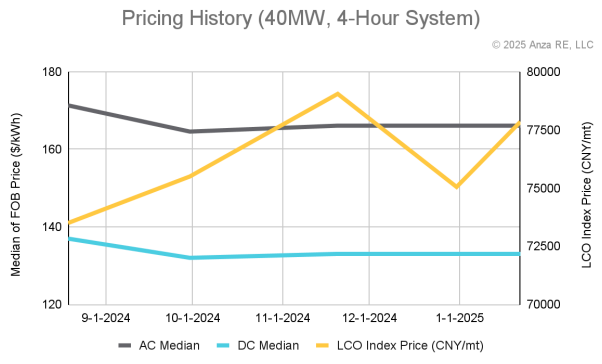

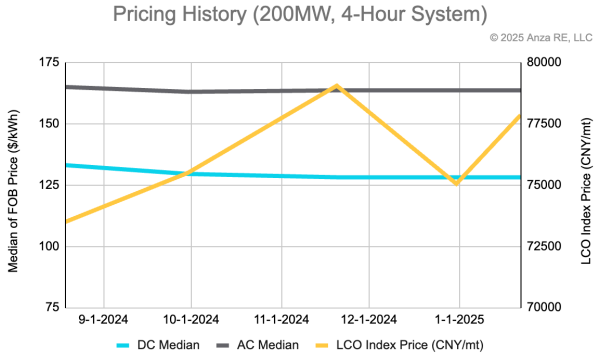

Lithium carbonate prices are levelling, helping to curb cost fluctuations in battery cell pricing. Prices climbed steadily from August through mid-November 2024, but the Lithium Carbonate Index (LCO) entered February at 77,500.

Anza’s report found more manufacturers entering the storage market than ever before, increasing competition and driving greater pricing pressure. These factors helped contribute to list prices being down from prior quarters.

AC-integrated, also known as “all-in-one” systems, are on the rise from system integrators and battery OEMs. Anza also notes a trend in DC-integrated OEM wraps contributing to pricing variability and margin compression in integration services.

US-headquartered energy storage system integrator and digital energy services provider Fluence recently launched a new AC-based modular battery storage platform for delivery in the fourth quarter of this year.

Energy-Storage.news spoke with Ty Daul, CEO of Primergy, about Gemini, a 690MWac/966MWdc solar PV plant paired with a 380MW/1,400MWh DC-coupled battery energy storage system (BESS), which sits just off the Valley of Fire highway through Clark County, Nevada.

Anza also noted the continued expansion of supplier options and volume discounts for larger projects pulling pricing downward for utility-scale projects. Meanwhile, an increase in competition from smaller project suppliers started closing the gap between distributed generation (DG) and utility-scale projects.

The company’s report includes an analysis of a 40MW, 4-hour DG system and a 200MW, 4-hour utility-scale project. The DG system analysis showed “Specifically, median AC pricing has decreased by approximately $4/kWh (about 3.0%), while median DC pricing has declined by roughly $3/kWh (around 2.9%).”

The utility-scale analysis did not show a similar shift. “Here, median AC pricing has dropped by about $1/kWh (approximately 0.8%), and median DC pricing has fallen by roughly $4/kWh (around 3.7%).”

Anza’s report shows that storage supplier pricing has remained largely the same in recent weeks but that the tariffs, which went into effect in early February and the US ITC’s affirmative determination of harm from Chinese imports of anode materials on 31 January, are all but certain to bring change to the industry, in a relatively small amount of time.

In its Q2 2024 quarterly BESS pricing survey, Clean Energy Associates (CEA) also identified increased market competition, noting a trend in the industry toward 20ft containers, along with larger battery cells of 300Ah or more.

The recently published BloombergNEF Energy Storage System Cost Survey 2024, analysing utility-scale batteries on a global level, noted that prices of turnkey energy storage systems fell 40% year-on-year from 2023 to a global average of US$165/kWh. The research firm said this was the highest annual drop since its survey launched in 2017.

BNEF found the US average price for a turnkey BESS to be US$275/kWh, breaking out its research regionally to China, the US, Europe and Rest of the World.

BNEF analyst Isshu Kikuma recently discussed trends and market dynamics impacting the cost of energy storage in 2024 with ESN Premium, noting about tariffs: “What we found is that with the 60% tariff, the cost [of a turnkey energy storage system] increases by 60% compared to 2025, so this is quite a big cost jump if the US actually decided to do so.”

BNEF is anticipating that tariffs will not slow down the growth of US energy storage deployments.