While Norway once aimed to be the ‘battery of Europe’ it has since been overtaken other Nordic countries Sweden and Finland for BESS deployments. Research firm LCP Delta’s Jon Ferris explores the region’s energy storage market dynamics in this long-form article.

Europe had yet to install its first grid-scale lithium-ion battery when transmission system operator (TSO) Statnett outlined its ambitions for Norway to become “the battery of Europe” a decade ago.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Since then, nearly 3GW of interconnector capacity has been installed to connect the GB and German markets to Norway’s extensive hydro capacity.

However, across Europe battery capacity exceeds 20 GW, with GB, Germany and Italy leading this growth in capacity. Norway’s battery market remains poorly developed, even compared to its neighbours.

Sweden and Finland lead grid-scale deployments

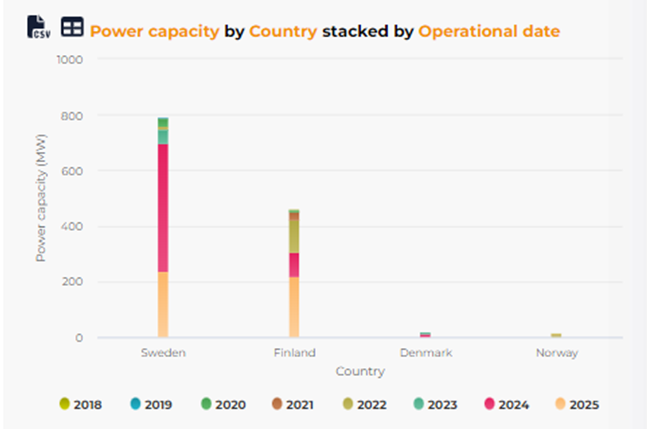

In Finland, the largest battery is currently at Olkiluoto, rapidly developed in contrast to the nuclear plant on the same site. Data from LCPDelta’s StoreTrack shows over 300MW of grid-scale batteries expected to come online over the next two years, while the telecoms operator Elisa plans to install 150MWh of batteries across its sites.

Sweden, however, has both a more developed residential storage sector and a bigger pipeline of grid-scale batteries than the rest of the Nordic countries put together, with around 400MW announced for operations in 2024 alone.

Most BESS projects in the pipeline in Sweden are 1-hour systems, with the business case still very much centred around ancillary service markets.

Cell production is slow to develop

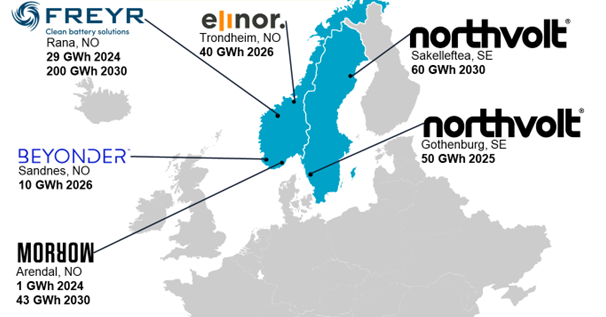

One of the first European-owned gigafactories for battery cell production, Northvolt’s Ett was built in Sweden, and the company is collaborating with Volvo to build the country’s second site. Northvolt also entered into a long-term partnership in 2021 with the developer and optimiser Polarium to offer storage solutions to telecoms networks.

Freyr’s Norwegian gigafactory is delayed pending a response to the USA’s Inflation Reduction Act, while Morrow’s projects will not be operational before 2028.

New markets create opportunities for startups

While Polarium largely focuses on the industrial and residential sectors, Sweden’s grid-scale storage is being driven by Ingrid Capacity, which has announced a pipeline of 400MW capacity for 2024. Other startups driving the country’s storage sector includes Flower Technologies, which recently acquired a 42.5MW battery from OX2, and optimiser Fever which is supporting Conapto’s data centre battery to participate in frequency response markets.

The Finnish start-up scene is also developing, with CapaloAI optimising Exilion’s 6MW battery across multiple markets. With their home country’s electricity market dominated by hydro, Norwegian startups like Enode appear to be taking a wider approach, and Eco-Stor is targeting Germany for its battery pipeline.

Flexibility markets open to consumers

Commercial and industrial participation in energy markets has long been a feature of the Nordic markets, where a collaboration between Sympower and Vattenfall in Sweden enabled Artic Paper to become the first provider of FCR in 2020, and is now providing 60MW in FFR.

Residential customers have not been left out, with Tibber also aggregating to provide FCR since 2020. More recently, 1komma5 launched its Dynamic Pulse tariff and Heartbeat optimisation platform with the aim of delivering zero-cost energy to households from offering pooled batteries to support grid frequency.

Nordic countries have been acknowledged leaders in the electrification of residential heat and transport, with specialist optimisers Kapacity.io managing flexibility from heat pumps in Finland and True Energy EVs in Sweden and Denmark.

Growing needs and high prices for flexibility attract investment

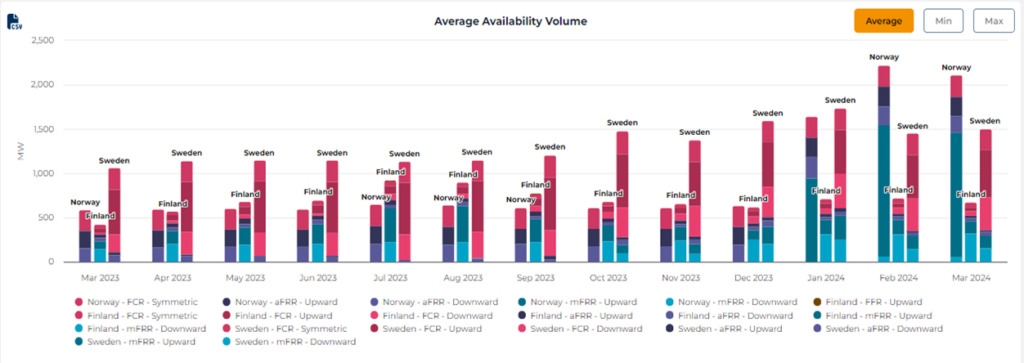

The investments in batteries and residential flexibility have been driven by the increasing need for ancillary services, especially for downward regulation, where Sweden’s TSO Svenska Kraftnat has been struggling to procure its target capacity, and for Fast Frequency Response due to low inertia over the summer months. Lower weekend demand means that generation that historically provided downward regulation is offline, leading to an increased requirement to procure mFRR capacity.

But the high prices that have attracted this investment in batteries and residential flexibility may not be sustainable due to the saturation of markets. Although the need for flexibility grows with renewable generation and rising demand, the capacity of installed batteries is growing at a faster rate.

Meanwhile moves towards sharing reserve capacity between countries, initially within the Nordic balancing model and eventually the pan-European coupled markets, will make more efficient use of flexibility and should reduce balancing costs for system operators and consumers.

Long Duration Energy Storage will be needed

Lithium-ion batteries increasingly dominate the short-term flexibility markets across Europe, and are dealing with market saturation by stacking value across longer duration spot markets. But questions remain around the suitability of batteries to meet the anticipated need for flexibility over weekly or monthly durations.

More suited to seasonal storage, Norway’s hydro capacity seems better placed to compete for opportunities providing long-duration storage, but further market evolution may be required for their ambition to become the battery of Europe to be realised.

What is STOREtrack and FLEXtrack

STOREtrack is Europe’s leading database of storage projects, helping you keep your finger on the pulse of the European energy storage markets. The database tracks the deployment of storage across 28 countries, detailing the companies involved in each project and their role, as well as project technologies, milestones, segments and technical characteristics.

Click here for more information on STOREtrack or here to view the free version.

FLEXtrack is the platform to track and understand accessible value in European flexibility markets, sourcing the data, cleaning it and bringing into an integrated data set, which can then be visualised and downloaded through the web-based interface.

Click here for more information on FLEXtrack or here to view the free version.