On 29 October, Sungrow released its Q3 2025 report. Judging from the latest performance, whether in terms of financial data or market capitalisation, Sungrow stands ’in a league of its own’.

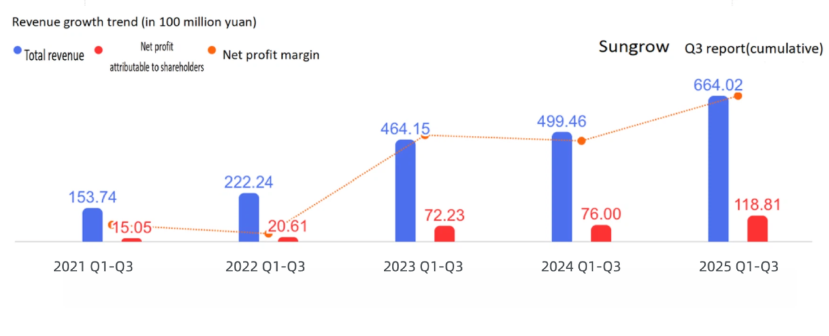

The report shows that in the first three quarters, the company generated RMB66.402 billion (US$9.53 billion) in revenue and RMB11.881 billion in net profit attributable to shareholders, representing year-on-year growth of 32.95% and 56.34% respectively.

The basic earnings per share were RMB5.73, an increase of 56.13% year-on-year. The net operating cash flow surged by more than 11-fold compared to the same period last year, indicating that the company’s performance continues to grow at a robust pace.

Its Q3 2025 standalone performance was equally impressive. During the quarter, the company recorded RMB22.869 billion in operating revenue (up 20.83% year-on-year) and RMB4.147 billion in net profit attributable to shareholders (up 57.04% year-on-year), further strengthening its profitability.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Asked about the key driver behind its performance growth, the company noted in the report that it primarily stemmed from expanded sales volume.

Shift to higher value products drives profitability

The report also notes that Sungrow’s gross profit margin stayed at a high level of around 34% in Q3, up roughly two percentage points from the prior year. This improvement is driven by ongoing optimisation of its product mix—specifically, the shift toward higher-power PV inverters and the integration of energy storage system solutions.

The “technology premium” is particularly pronounced in the energy storage segment. For instance, the company’s grid-forming energy storage technology—used in mega-projects like Saudi Arabia’s NEOM and the UK’s Mendy—commands a 10-15% premium.

As of the market close on October 29, Sungrow’s market capitalisation hit RMB396.9 billion (US$55.9 billion), securing its top spot in the market cap rankings for listed Chinese PV firms.

At the Q3 earnings call, Sungrow disclosed that its energy storage revenue for the first three quarters of the year reached approximately RMB28.8 billion, representing a 105% year-on-year increase.

In terms of shipments, the company’s global energy storage product shipments reached 29GWh in the January-September period. Specifically, it shipped 19.5GWh in H1 of the year and 9.5GWh in Q3.

That is already higher than its entire energy storage shipments for 2024, of 28GWh.

Sungrow stated that it expects full-year 2025 shipments to reach 40-50GWh, with Q4 shipments proceeding per the remaining project schedule. Regional distribution adheres to a project-based model, with shipments adjusted dynamically to meet customer demand.

International shipments grow, regional drivers

In terms of regional distribution for energy storage shipments, the share of overseas markets has risen significantly. Domestically, shipments totaled less than 5GWh in the first three quarters. Internationally, shipments reached approximately 9GWh to the Americas, over 5GWh to Europe, 3-4GWh to the Asia-Pacific region, and around 5GWh to the Middle East.

Sungrow anticipates that starting in H2 of this year, Eastern European countries such as Romania will see the launch of large-scale project tenders, with commercial and industrial (C&I) energy storage registering explosive growth (approximately 4-5GWh this year).

In the Americas—including the US and Chile—AI development has driven robust growth in new power load demand. The Middle East and Africa markets continue to surge as large projects are rolled out sequentially and supported by follow-up projects, while the Asia-Pacific market (India, Australia) is also expanding rapidly.

In these markets, Sungrow has achieved significant results. In the European market, it has partnered with BBOLT to deploy a 100MWh energy storage system in the Benelux region, teamed up with Insyte to build an integrated solar-storage-charging station in Spain, and collaborated with Schouten Energy to establish a heavy-duty truck charging and storage demonstration site in the Netherlands.

The US market is also one of Sungrow’s key markets. In recent years, revenue from US operations has accounted for between 15% and 20% of Sungrow’s total revenue.

Regarding the uncertainty of impending US tariff hikes (which could exceed 80% for energy storage products), Sungrow told investors it will “closely monitor policy implementation and proactively formulate responses.” The company has already built a diversified supply chain and rolled out an overseas localisation strategy. Meanwhile, the company’s deployment in other global markets is steadily advancing to ensure robust growth in core markets.

AI data centres key, dedicated subsidiary planned

Furthermore, during the earnings call, Sungrow clearly stated: “The company will seize the rapid development opportunities in AIDC (Artificial Intelligence Data Center), and leverage its power electronics expertise to launch a subsidiary dedicated to AIDC power supply solutions. The company also possesses the capability for R&D, production, sales, and service of new energy vehicle electronic controls and power supply systems.”

This marks Sungrow’s official entry into the AIDC power supply segment—a key direction for the integration of new energy and computing power over the next five years. AI data centers demand exceptional reliability and energy efficiency from power equipment, and Sungrow has inherent strengths in HVDC (High-Voltage Direct Current), energy management, and energy storage coupling technologies.