Stem's storage system combines big data and predictive analytics to reduce bills and load on the grid. Credit: Stem

US energy storage provider Stem has increased its funding pool with the addition of US$100 million in new project financing from investment firm Starwood Energy.

The injection takes its total third-party financing to US$350 million. Other funds in its latest round of private financing comes from Generate Capital and Clean Feet Investors.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

California-based Stem installs and manages energy storage systems at commercial and industrial facilities as storage-as-a-service solutions on a subscription basis, with no upfront costs for hardware or installation.

By combining big data and predictive analytics, it claims its storage systems automatically reduce energy usage during peak times, lower electricity bills by up to 20%, and provide customers with a revenue stream for helping to balance the grid.

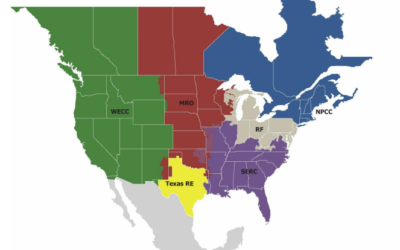

It has 75MWh of projects so far deployed, or else under contract, across 480 sites in the US. Its customers include Safeway, Wells Fargo, and Adobe. Stem provides grid services to Southern California Edison, Hawaiian Electric, and the California Independent System Operator.

John Carrington, chief executive at Stem, said: “This financing vehicle gives our customers access to capital and allows them to achieve the benefits of intelligent energy storage without making a major investment.”

Madison Grose, vice chairman, general counsel and senior managing director at Starwood Energy, said: “Distributed energy resources such as those provided by Stem will be part of the foundation of the future electric grid.”

Meanwhile, Stem was among 10 companies to win a tender for demand-response services from New York energy firm Consolidated Edison, according to Bloomberg.

Stem confirmed an additional US$15 million of Series C funding in May, from Mithril Capital Management, bringing its total since it was established in 2010 to more than US$110 million. Other prominent investors include European utility RWE and Japanese trading company Mitsui & Co.

Energy storage capacity additions will double worldwide to 2.9GWh this year, up from 1.4GWh in 2015, according to a recent report from analyst firm IHS Markit.

Meanwhile, US-based GTM Research said in July the business case for commercial commercial energy storage adds up in seven US states, at present, with the number expected to jump to 19 by 2021 as storage costs fall.