Stem Inc has posted close to a 200% increase in revenues in both its fourth quarter and full-year financial results for 2022.

The California-headquartered energy storage system and services company reported Q4 2022 revenue of US$156 million, a 194% jump from Q4 2021’s US$53 million, while full-year revenues for the period ending 31 December went up 186% to US$363 million from US$127 million in 2021.

The company only publicly listed in late 2020, so comparative figures have to be put in perspective, but Stem management has reaffirmed in the results statement its guidance that it can achieve positive EBITDA margins in the second half of this year.

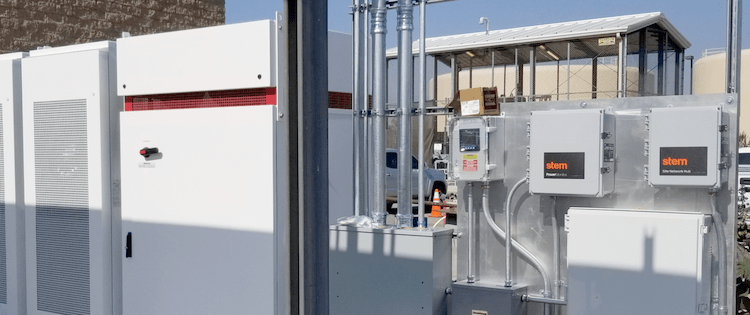

Stem focuses largely on behind-the-meter (BTM) battery storage as a service for commercial and industrial customers, but also has interests in other areas including EV charging and front-of-the-meter (FTM) solar-plus-storage.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

It was however front-of-meter, and specifically hardware sales into that segment, that accounted for the majority of the increase in revenues, while Also Energy, the solar PV monitoring and control platform Stem acquired early last year contributed a significant portion.

At the time of its listing, via a special purpose acquisition company (SPAC) merger, Stem was transparent that it did not expect to achieve profitability ahead of this year. This continues to play out in results, with a US$124 million net loss recorded for 2022 along with adjusted negative EBITDA of US$46 million.

Previously the company had highlighted the high cost of scaling up its operations over the short-term including hiring more staff and opening offices in new territories.

Stem CEO John Carrington said in a conference call to explain earnings that conversely in 2022, the company had “effectively managed expenses”. That included a more prudent hiring policy and increasing employee headcount in cheaper regions to do business in.

Carrington also pointed to the impact of various industry headwinds that have affected companies across the energy storage – and solar – industries. These included supply chain volatility and COVID-related shutdowns in China, interconnection and permitting delays, inflation, and the impact of the ongoing anti-dumping countervailing duties (AD/CVD) investigations into solar component imports into the US.

Lithium carbonate prices appear to be coming down from recent highs, while Stem has locked in sufficient capacity to meet its commitments through Q1 2024 and is “opportunistically adding supply” from the spot market, Carrington said.

“The choppiness in the electric vehicle market, along with some project delays, appears to have released some excess capacity that is coming into the stationary storage market,” the CEO said.

Push into PJM market on the way

In terms of its operating metrics, the company’s bookings for 2021 totalled US$416 million in value, which was easily surpassed with US$1.06 billion bookings in 2022, and its contracted backlog leapt from US$449 million to US$969 million.

In the company’s key markets, California and ISO New England, Stem’s fleets of customer systems were able to respond to increasing calls to provide grid services: California utility Southern California Edison (SCE) called on more than 60MW each day from Stem’s aggregated network of behind-the-meter C&I storage in December and January, and in ISO New England, the fleet generated 76% more revenue than forecast.

Carrington said Athena, Stem’s software platform that drives its so-called ‘intelligent AI-driven’ systems, was able to predict coincident peaks in the ISO New England market with 94% accuracy.

That bodes well for Stem’s prospects in the PJM Interconnection market into which the company is making a major pus, Carrington said. Another market in which Stem is a relatively new entrant is Texas’ ERCOT market, and its first Texas projects, for independent power producer (IPP) REX Holdings, are due to begin wholesale market participation this year.

For 2023, Stem has offered full-year guidance for revenues of between US$550 million and US$650 million, and 15% to 20% non-GAAP gross margin, with 75% of annual revenue expected to be accrued in the latter half of the year.

Adjusted EBITDA loss for the year is set to be between US$5 million and US$35 million, while Stem expects to take between US$1.4 billion and US$1.6 billion bookings for the year.

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 28-29 March 2023 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.