We catch up John Diklev, founder and CEO of Sweden-based optimisation and virtual power plant (VPP) software company Flower, to discuss the Swedish market and beyond and his idea of ‘long-term optimisation’.

Diklev founded Flower (a shortening of ‘flexible power’) in 2020 with the plan to develop a hardware-agnostic platform that could manage different types of flexibility assets, meaning anything that produces, consumes or stores energy.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The firm started with electric vehicle (EV) chargepoints and quickly grew to 1,000 chargepoints, which it got pre-qualified for Sweden’s ancillary services market. Today, the portfolio comprises chargepoints, solar, wind, hydro and data centres but the bulk is large-scale battery energy storage systems (BESS), accounting for 95% of its trading activity.

“We realised in mid-2021 that it was with our trading algorithms was where we could create the most value and that’s how we really started growing in the battery space,” Diklev says.

He says there are around 10 competitors that can optimise batteries but that Flower manages half of the roughly 50MW of batteries that are pre-qualified for ancillary services in Sweden, a success which he says is down to its emphasis on optimising revenues.

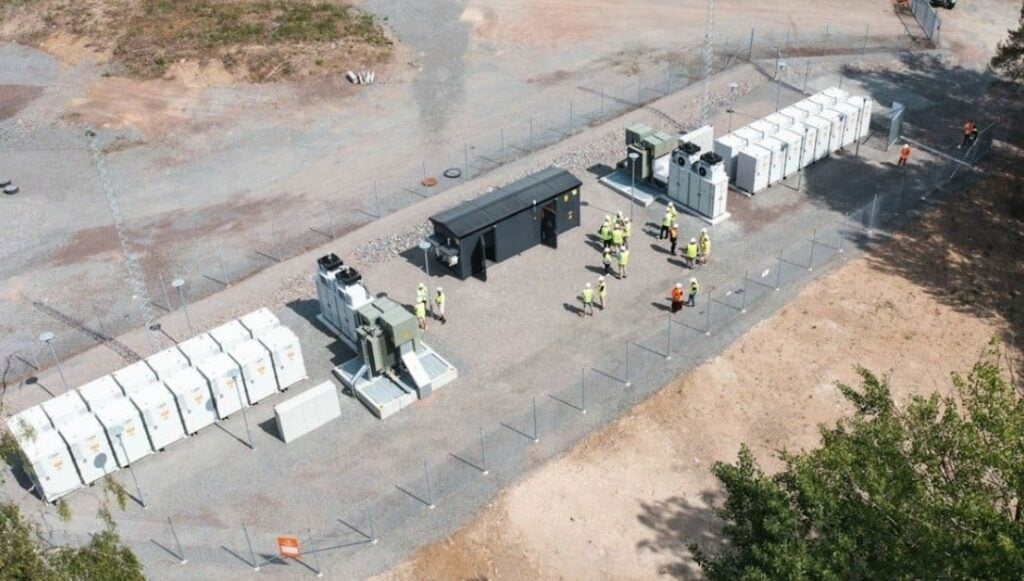

Notable projects include a 10MW BESS owned by distribution network operator (DNO) Ellevio and a 5MW one owned by another DNO Nybro Energi, both one-hour systems.

Sweden’s large-scale BESS market

Diklev says the market kicked off with “exceptional” prices in the ancillary services market in early 2021, of €70-80 per MW per hour, as well as an energy reservoirs pilot programme by Sweden’s transmission system operator (TSO) that allowed continuous trading in energy markets with shorter activation periods.

Exactly why prices increased is still a bit unclear but one suggestion is that hydropower operators re-evaluated the wear and tear on their assets from supplying fast-reacting ancillary services and so priced their services higher.

Hydropower is still the driving factor setting the prices but Sweden’s battery buildout may mean batteries start to displace it at some point in the next 12-36 months according to forecasts based on publicly announced megawatts.

Diklev: “The Nordic markets are waking up. If you look at our pipeline of projects it will grow by six to eight times in 2023, and market growth could be even higher. There are a lot of batteries being built, a lot of investment, and the question is when will this fairly limited market saturate and what is operators’ transition plan from that?”

Commercial model and long-term view

“We’ve been pretty open-minded on this, as it’s important to understand the type of investor behind the asset, what their financial structure is and how we can be a good partner to that. But typically it’s been a revenue-share model,” Diklev says.

This is also the case in the UK market where nearly most BESS projects are optimised by a third party.

Diklev believes the firm can create the most value through entering into long-term financial trading on top of more short-term trading strategies, which necessitates long-term partnerships with asset owners. He expects a shift in Nordic market battery revenues from ancillary services to wholesale trading as is starting to happen in the UK.

“We would argue that the largest long-term value drivers for flexibility will be supporting the grid by deferring capex, alleviating short-term constraints and managing volatility of renewables in financial trading by being able to utilise portfolio assets to be able to handle long-term risk.”

“So, we want to find partners who are willing to own assets with the same long-term vision as us who is willing to give us, say, a five or 10 year contract as an optimiser. Because without that long-term contract it’s hard for us to then into a similarly long-term contract providing flexibility services using our portfolio of assets.”

“It’s a bit of a chicken-and-egg scenario because how do you prove long-term profitability without having done it already, since the market is so new? That’s where we might be open to owning some quantity of batteries long-term in order to prove the business model, but only if it necessitates it.”

Expanding beyond Sweden and long-term plans

The firm is already live in Denmark and the next markets on its horizon are Belgium, Austria, Germany and the Netherlands. Expansion abroad will be primarily through managing utility-scale BESS, though its first foray in Denmark has been using EV chargepoints to provide demand response services.

The firm finished 2023 with just under SEK100 million in annual revenue (€9 million/US$10 million), 20 times more than 2022’s SEK5 million, and has so far raised around SEK120 million SEK in investment. DNO Ellevio owns just under 20% of Flower.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.