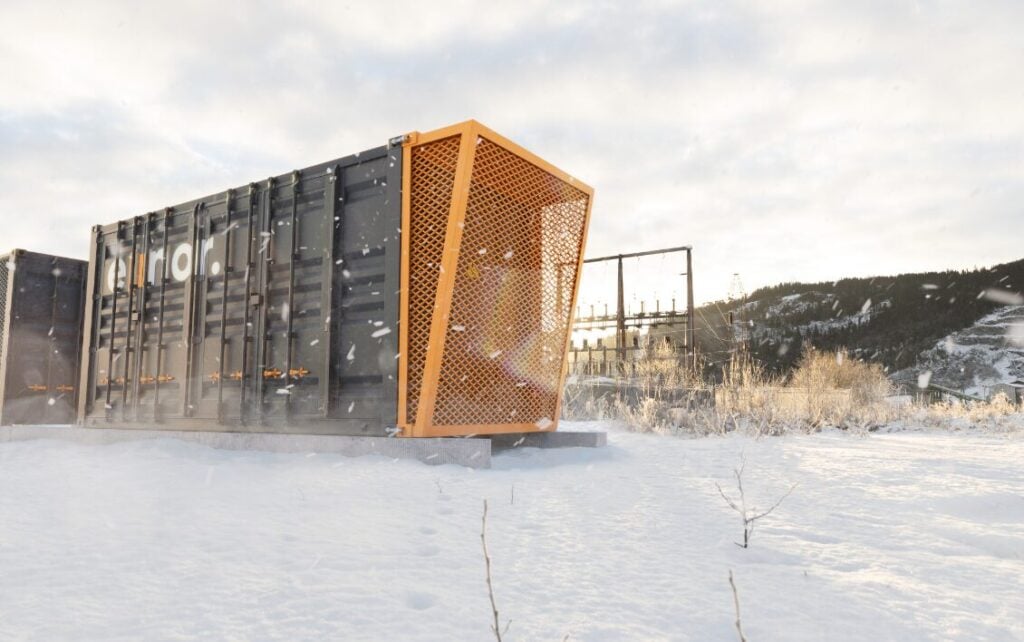

Norway-based startup Elinor Batteries is launching a new product, the Orkan DC Block, which it claims will deliver 30% more energy density than existing products.

“We still observe a somewhat narrow focus on cost per KWh in the industry. Our vision is to help redefine the benchmarks in energy storage by shifting the industry’s focus towards overall project value,” said Arne Fredrik Lanke, CEO of Elinor Batteries.

The firm claims that the battery cell that will go into Orkan already has a cutting-edge energy density compared to other 1C systems and throughout 2026 and 2027 the firm will raise the bar on 2-hour systems, delivering 6.7MWh and 7.2MWh in a 20-foot container battery energy storage system (BESS) product.

Sofi Hildonen, director of business development in Elinor, added: “BESS markets are constantly changing and maturing, and a competitive 1C system is a highly flexible choice that often facilitates most value per MWh installed.”

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Elinor Batteries’ design is built in collaboration with China-based technology provider Morlus Technology and the product will be manufactured in China initially, with plans a few years down the line to bring battery cell and BESS production to Europe. It is planning a 10GWh factory in Norway, with plans to expand to 40GWh.

However, Europe’s battery industry looks to be in a tricky spot at the moment, after the most-funded player Northvolt announced bankruptcy in late 2024. Fellow Norway-founded firm Freyr also struggled to scale up battery cell manufacturing facilities despite huge financial backing, significant blows for Europe’s two leaders in its nascent battery manufacturing sector. The fundamental issue is that batteries from China are so much cheaper, and US batteries have benefited from generous subsidies.

We asked Lanke in an in-person interview at the Energy Storage Summit EU 2025 in London yesterday (18 February) how European manufacturing would become competitive.

Lanke told Energy-Storage.news that as the full-time equivalent (FTE) employees needed per unit of production goes down the cost of labour won’t, he claimed, be a differentiating factor after 2030. He also pointed out Norway’s clean and cheap renewable energy and the site location in central Norway, in Orkland near Trondheim, as a plus.

He also said that getting products to market now, and not only in three or four years’ time, with help from China is key to building a successful business during the interim.

But, he concedes that Europe will need to either start paying a premium for locally-produced products or introduce some kind of government incentives for its battery industry to succeed.

The firm’s partner Morlus Technology is led by Shen Xi, who has 20 years of battery industry experience and was part of the team at Chinese EV giant BYD, which manufactured its first lithium iron phosphate (LFP) batteries for vehicles and also established China’s first gigafactory (10GWh).