Community batteries are likely to become another tool in a decentralised energy grid, write Lachlan Hensey and Timothy Shue from Australia’s Yarra Energy Foundation.

With the roaring success of residential solar PV and the pressing need for electrification, electricity networks are rapidly evolving. From vehicle-to-grid technology to smart home demand management, customers (and ‘prosumers’) interface with the network in increasingly complex ways.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Community batteries are another tool to manage this increasingly decentralised and bidirectional grid. While it remains unclear what part they will play in Australia’s energy transition, the industry is on a steep and exciting learning curve.

In Australia, the not-for-profit Yarra Energy Foundation’s (YEF) recently released a report on the operations of the Fitzroy North community battery (FN1) over financial year 2023-2024.

This article highlights some of the key insights from our first two years operating FN1.

Overview and context

YEF’s battery is a 120kW/309kWh Pixii PowerShaper originally launched in 2022. It is grid-connected or front-of-meter installation, which charges and discharges directly to the grid. It reduces daytime voltage levels on the surrounding network, enabling more solar export capacity, and offsets peak load on local network infrastructure.

As an emerging technology, barriers include project cost, site availability, market and network integration, product options, and product performance. Many of these are expected to resolve and are reducing as we ride the learning curve.

In Australia, battery energy storage systems (BESS) suitable for residential areas are still new. This means that integration with the LV network, retailers, and the energy market is still maturing. Aesthetics and noise remain common areas of concern for local residents. Community consultation for social licence has shown to be an important step, especially with municipal government stakeholders.

Financial performance of the community battery

The community battery generated revenue of AU$7,393 (US$4,690) in year one and AU$8,423 in year two, predominantly from wholesale energy arbitrage. Favourable network tariffs also contributed about AU$1,000 in both years. Real revenue from energy arbitrage is estimated to be, on average, about 50% of possible revenue using ‘perfect foresight’ – i.e., the theoretically optimal operation of the battery for profit maximisation.

FN1 is a trial project, and YEF have dedicated significant time to monitoring and administration that would not be typical of other projects. As such, operating expenses are difficult to estimate. Further information on operating expenses can be found in the Year One Performance Report. Both the Year One and Year Two reports contain summaries of the financial performance of the respective years for those interested.

Teething issues

Integrating software and configuring hardware settings for the Australian network context was a challenge early on for the community battery.

This resulted in significant downtime during the 2022 energy crisis and significant lost revenue opportunities. The first lesson was peak pricing events such as the energy crisis can significantly overshadow average revenue during ‘normal times’. Therefore, the availability and responsiveness of the system is key to capitalising on such opportunities.

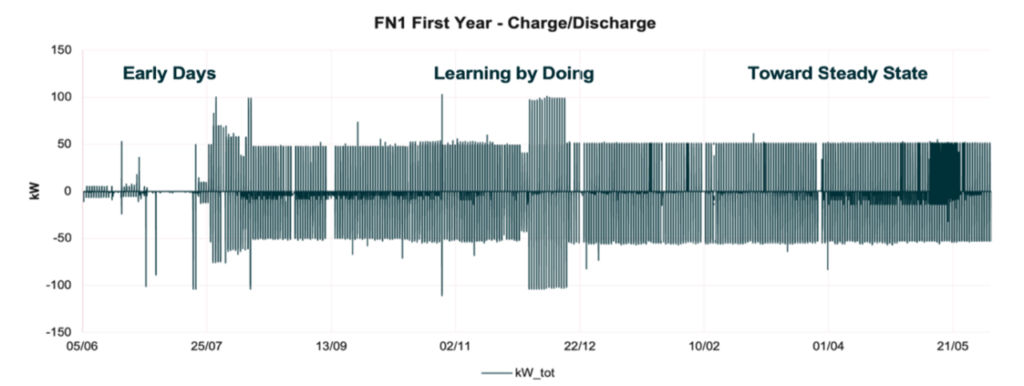

Below shows the first year of community battery FN1’s operation from early downtime to steady state, with each gap indicating some operational issue and its resolution. This journey through year one highlights many teething issues we had to resolve.

Dispatch control

The community battery operates on a rules-based schedule: charge at 50% power capacity between 10am and 3pm when renewable energy is abundant and wholesale energy prices are low, and discharge at 50% between 6pm and 10pm when demand and prices are high.

Initially, YEF intended to dispatch the system using an optimiser that would dispatch the system based on anticipated market prices to maximise revenue. While the software was capable, its effectiveness was limited by the accuracy of data inputs. We relied on the price forecast from the Australian Energy Market Operator, which effectively acts as a market signal, and rarely reflects the eventual settlement price.

Consequently, the outcomes were worse than a rules-based scheduler. This demonstrates the potential for better commercial performance and the value of a more accurate price forecast. This is our second lesson: the performance of an optimiser is contingent on the accuracy of the data inputs – or, garbage in, garbage out.

The third lesson has been to account for the gap between a battery’s theoretical and real-world performance. For instance, BESS manufacturers typically calculate roundtrip efficiency as a function of the efficiency of the inverters and battery modules, which could be over 90%. However, this excludes real-world energy used to power cooling systems, control components and other parasitic losses. The actual roundtrip efficiency might be closer to 80-85%.

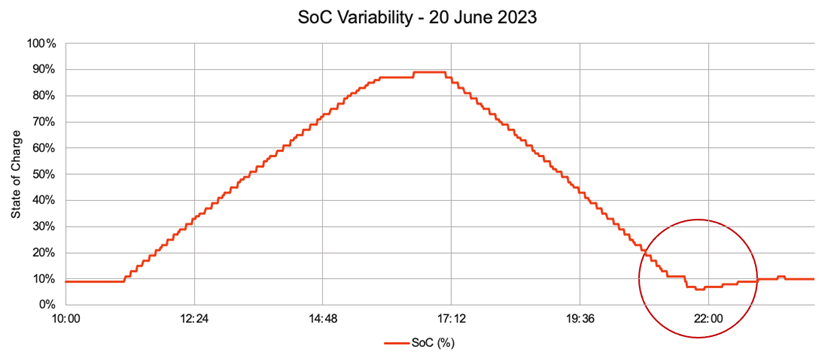

Similarly, the useable capacity of a BESS is generally lower than the capacity stated in a product datasheet and is dependent on the battery chemistry. LiFePo batteries can typically operate stably between 5% and 95% state of charge (SoC), whereas LiNMC batteries like FN1 operate less stably at high and low states of charge.

While we initially intended to operate between 10% and 90% SoC, we experienced volatility in the SoC measurements, which led to unstable charging behaviour. As the BESS calculates SoC differently depending on whether it is charging or discharging, with a 10% SoC limit we noticed the battery would discharge to 8%, only to recharge to 13% before discharging again. We subsequently raised the SoC limit to avoid this ‘ping-pong’ effect.

Additionally, as battery SoC reaches 83% the charging power of the BESS derates to manage increasingly high cell voltage levels. This behaviour is largely inherent to the nature of LiNMC battery cells but was improved from an original threshold of 75% by upgrading the BESS firmware.

As we plan for FN1 to participate in frequency control markets (Frequency Control Ancillary Services; FCAS), we also will need to maintain spare capacity to discharge/charge. In Australia, we must hold about 10 minutes’ of capacity for FCAS to bid into all of the frequency control markets, reducing the capacity for energy arbitrage.

In our second year, we found challenges with stable power due to a ‘traffic jam’ of messages in the RS485 communication system. Essentially, the system would compensate when losing communication with one of the three battery cabinets – for only a fraction of a second – by boosting charging/discharging power, before immediately recalibrating.

This ‘power spikes’ issue barred us from registering for FCAS and required troubleshooting with the BESS manufacturer, Pixii. Resolution of this issue has benefited Pixii systems around the world, not just our community battery FN1.

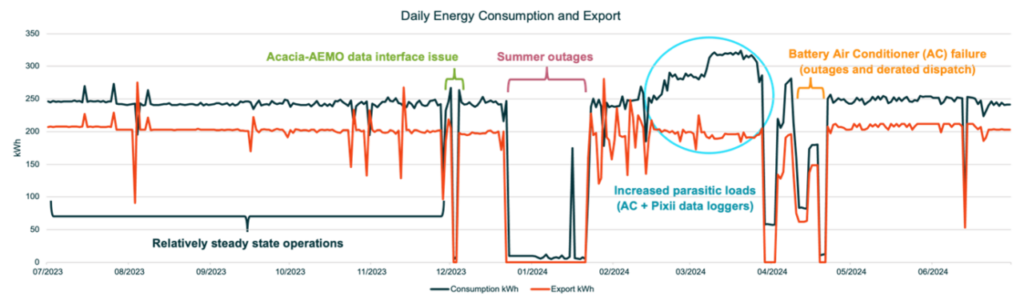

However, troubleshooting led to more parasitic loads from monitoring equipment and reduced revenue (see figure 3). Below shows the periods of stable operation and outages over the course of the second year of operation. The gap between the dark green line (consumption) and the red line (export) represents energy lost through roundtrip inefficiency and parasitic loads.

Parasitic loads

Hence, our fourth key lesson is to minimise energy lost to parasitic loads. While system downtime is an obvious threat to profitability, the cumulative impact of small system inefficiencies is significant. YEF is therefore investigating how to achieve more efficient cooling by recalibrating the settings in line with Melbourne’s variable climate.

After noticing unexpected import charges during the peak demand period, when the battery is scheduled to discharge, we realised that when idle, the battery powered internal loads from the grid. We addressed this by setting the battery to discharge at low power during this 4pm-9pm period, when the network tariff severely disincentivises consumption. This offset the battery’s incidental load on the grid, and drastically reduced network charges.

Conclusion

In broad strokes, we have highlighted four lessons for prospective BESS operators:

- Peak pricing events can make up a disproportionate percentage of annual revenue, and missing these due to downtime is a significant opportunity cost.

- The performance of optimisation software (a.k.a. autobidders) depends on the accuracy of the data inputs – garbage in, garbage out.

- Real-world BESS operation invariably presents curve balls, and performance is unlikely to match the brochure.

- Roundtrip inefficiencies and parasitic loads may appear minor in isolation, but their aggregate impact on energy throughput and profitability is significant.

About the Authors

Lachlan Hensley is energy & storage project lead and Timothy Shue is chief operating officer at Yarra Energy Foundation, a not-for-profit consultancy providing services to accelerate the energy transition. Headquartered in Victoria, Australia, Yarra Energy Foundation supports local communities through its electrification programmes and community & stakeholder engagement activities. It also provides professional services to local governments, state and federal government departments and statutory bodies, network distribution businesses, energy retailers, customer advocacy organisations, and others.