Energy-Storage.news Premium speaks with Noon Energy co-founder and CEO Chris Graves about the company’s approach to long-duration energy storage.

In January, Noon Energy launched its first operational demonstration project. The company describes its battery technology as ‘ultra-long-duration’ and ‘multi-day’ energy storage.

It asserts that its system can fill long-lasting gaps in renewable energy supply, reducing reliance on traditional ‘baseload’ energy from coal, gas, and other thermal generation.

The company’s battery functions similarly to a flow battery, which stores energy in liquid electrolyte tanks separate from the power stack. The Noon fuel cell battery likewise enables decoupling of power and energy.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Noon Energy’s battery consists of three main parts: a power block that uses reversible solid oxide fuel cell technology to convert electricity into stored energy; a charge tank that transforms electricity into a carbon-based storage medium while releasing oxygen into the air; and a discharge tank that takes in oxygen from the air to convert stored energy back into electricity.

Noon claims that this process is clean and efficient, utilising readily available materials.

“In our case, we have a significantly higher energy density—up to 50 times greater than a typical flow battery and even surpassing pumped hydro water storage. That’s the main distinction in the concept. We are utilising existing industry technology that already produces solid oxide fuel cells for natural gas power generation. In our application, the same technology is used in a reversible manner: it charges in one mode and discharges in fuel cell mode, which is how we operate,” Graves explains.

Noon Energy’s cells

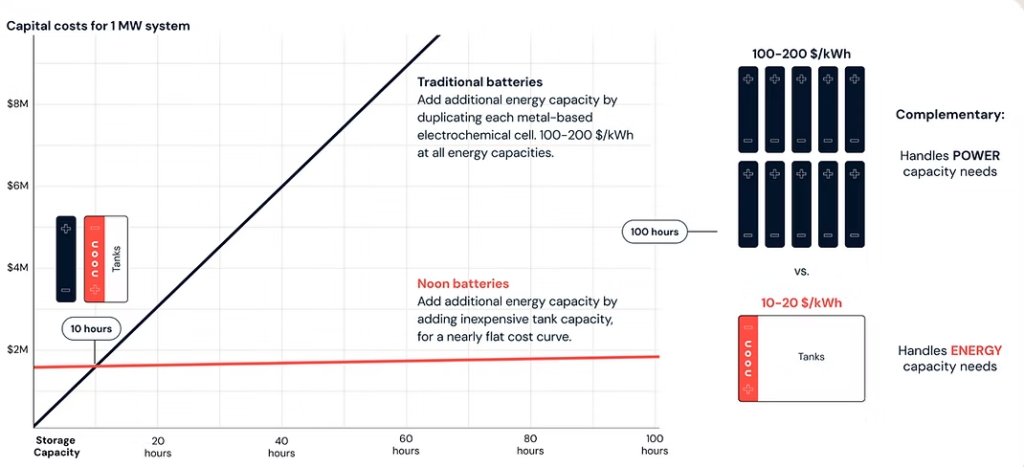

Graves further explains about Noon Energy’s cells, “(The design) means that you can add energy capacity by just adding the tank capacity. That’s very inexpensive compared to duplicating the entire cells, for example, for a regular type of lithium-ion (Li-ion) battery.”

This helps to account for the company’s claims that the system can scale while keeping costs “nearly flat”.

Graves highlights the chart above, explaining, “With lithium-ion, you duplicate the cells. I mentioned the energy stored in the electrodes—you’re using 10 cells instead of just one. That’s when you need to increase energy capacity, including power capacity, resulting in the correct proportions. However, the graph’s slope differs because of what you’re duplicating to boost energy capacity.”

He continues, “The complementarity of these two means we’re not competing directly with lithium-ion batteries for the same uses, unlike many other technologies. It’s highly complementary—excellent at managing peak power and quick response times—while we can cover most of the energy capacity.”

Market applications

The development of Noon Energy’s technology aligns with a global surge in demand for reliable, long-duration energy storage (LDES). Graves highlights strong interest from hyperscale data centres fueled by the AI boom, where “they want a lot of power, and of course, a lot of that is natural gas. Turbine prices are increasing. There are long lead times.”

Beyond data centres, Noon has pinpointed four primary market segments: hyperscale and industrial load expansion; commercial and industrial (C&I) behind-the-meter (BTM) customers paying high electricity rates; microgrids and island situations dependent on costly diesel generation, and utility-scale grid projects.

“We also have commercial, industrial behind-the-meter customers quite interested if they’re paying high rates, whether that’s just the base electricity rates, or adding in some demand charges and maybe replacing a backup generator as well. So, we can offer a solution that saves money for them,” Graves explains.

Compared to current LDES solutions, Noon’s technology has a unique size advantage. Graves describes Noon’s system as “ultra-compact, 100 times smaller, and deployable anywhere,” unlike pumped hydro energy storage (PHES), which is geographically limited to certain areas.

The comparison with flow batteries shows a significantly larger performance gap. Graves explains, “Our energy density is 20 to 50 times higher than a typical flow battery.” This means more applications can fit within smaller footprints that wouldn’t accommodate other technologies. Additionally, the increased energy density impacts costs since shipping, delivering, and installing more units naturally raises expenses.

Leveraging proven technology

Instead of creating entirely new technology, Noon has based its development on established systems. “We are leveraging that solid oxide fuel cell technology as the core tech. So that does have a lot of operational history. I think a couple of gigawatts or so are out there doing the fuel cell natural gas power generation application,” Graves states by way of reassuring concerns about the operational track record.

Noon’s go-to-market approach emphasises forming strategic partnerships instead of directly competing with established companies. “We’re partnering with project developers because we don’t want to handle everything ourselves, as many solar and solar-plus-storage developers are already managing the concrete work and interconnection,” Graves explains.

Graves articulates an ambitious vision for the technology’s role in the global energy transition: “In the big picture, I do think that, especially solar power, would be the dominant electricity supply in the world, and that would include data centre applications. We would help that continue by being able to make it fully reliable and firm, which is the big issue, right?”

With demonstration projects underway and commercial systems in development, Noon Energy represents itself as a potentially transformative approach to solving the intermittency challenge that has limited renewable energy’s grid penetration.

The Energy Storage Summit USA will be held from 24-25 March 2026, in Dallas, TX. It features keynote speeches and panel discussions on topics like FEOC challenges, power demand forecasting, and managing the BESS supply chain. ESN Premium subscribers can get an exclusive discount. For complete information, visit the Energy Storage Summit USA website.