Wind and solar PV generation paired with energy storage are cost-competitive against natural gas-fired power in Ontario and Alberta, according to a new study from Clean Energy Canada.

The clean energy think tank, a programme run at Simon Fraser University in British Columbia, commissioned the report A Renewables Powerhouse from Dunsky Energy + Climate Advisors, published last week.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The report describes fossil fuels as the common denominator in causing or exacerbating two major challenges facing Canada today: climate change and volatile energy pricing. It goes on to argue that wind and solar, cheaper than natural gas in the two provinces, is a common solution.

Dunsky experts analysed the location specific costs of building wind and solar facilities in Ontario and Alberta, as well as the cost of adding energy storage as an enhancement to either type of power plant.

Clean Energy Canada said the study is particularly important because both provinces have so far gone down the route of choosing natural gas as the primary fuel to fill gaps in energy supply and demand. In Ontario’s case, that’s because of decommissioning of an ageing nuclear fleet, in Alberta, it’s to reduce the province’s dependence on coal.

In addition to cost, the low-carbon route is necessary for Canada to meet its climate targets, including net zero emissions from the grid by 2035, while clean energy industries continue to take on greater importance from a standpoint of industrial competitiveness internationally.

Demand for electricity is set to rise on a wave of electrification of everything from buildings and industrial facilities to transport, while decisions made on electricity resource planning today will have ramifications for years to come.

Along with investing in solar PV and wind over gas and other fossil fuels, and incentivising those investments, the report said that supporting “evolving energy storage technologies and other solutions” alongside wind and PV is crucial to removing barriers to adoption of renewables.

Governments and power authorities should also invest into more research on the role of renewables, it recommended, noting that a recently published long-term outlook report from the energy regulator in Alberta used outdated cost assumptions from 2018.

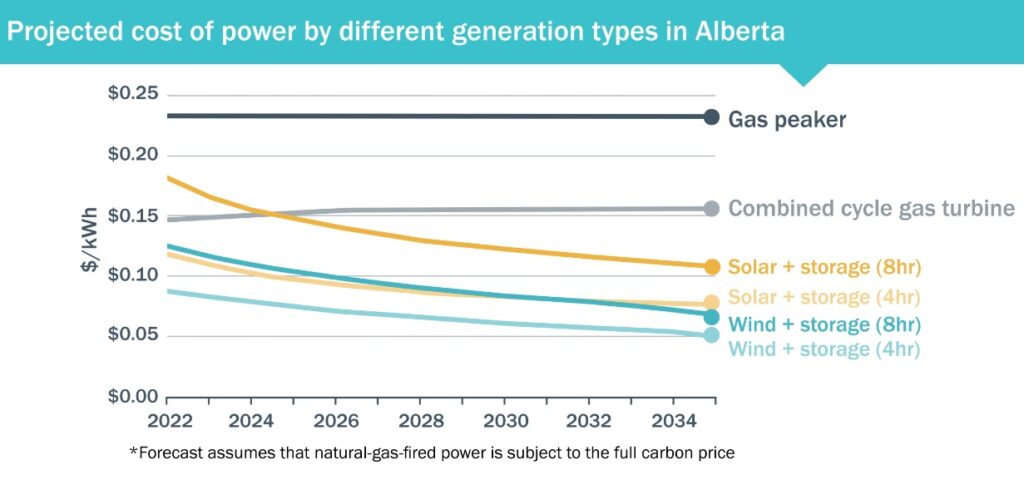

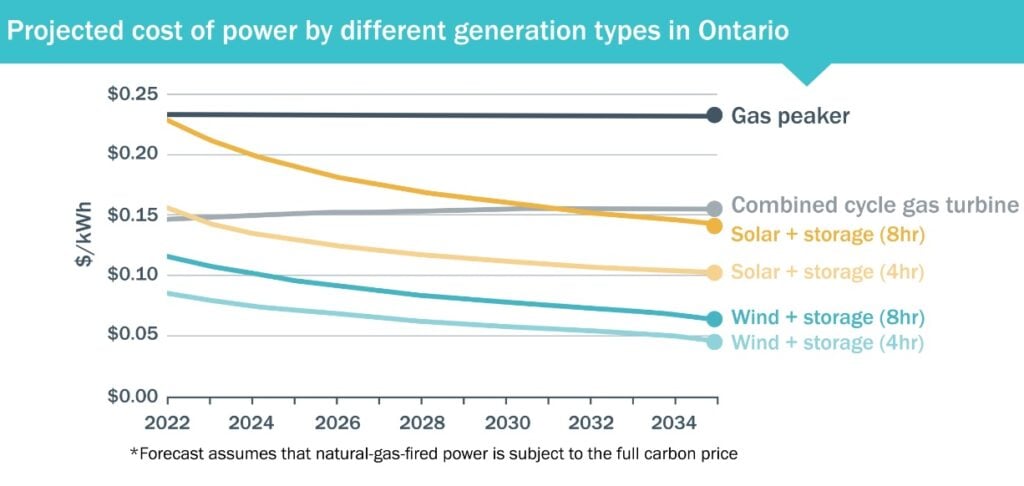

Dunsky used a levelised cost of energy (LCOE) analysis to assess the lifetime costs of different energy technologies in Ontario and Alberta

It compared LCOEs for solar PV and wind versus combined cycle gas turbines (CCGTs), as well as separate LCOE calculations and comparisons for solar PV and wind with energy storage of 4-hour and 8-hour durations, versus gas peakers and CCGTs.

It found that standalone solar and wind facilities were considerably cheaper than CCGTs in both provinces when current carbon prices were factored in. Even without the carbon price, wind came out cheaper than CCGTs in Ontario (although not solar). In Alberta, solar was at about parity with CCGTs without carbon pricing but became cheaper than gas by next year, while wind is already cheaper.

As can be seen in the charts below, renewables-plus-storage are already pretty competitive with gas. A peaker plant is already more expensive in LCOE terms than either solar-plus-storage or wind-plus-storage in both territories.

Images: Clean Energy Canada.

Meanwhile every combination of renewables and storage is already cheaper than both types of gas in Alberta except for solar PV and storage with 8-hour duration, which is projected to beat CCGTs from around mid-2024 onwards.

In Ontario it’s a similar story, although solar and storage does have a more challenging runway to cost parity with CCGT there. Solar with eight hours of storage won’t be cheaper than CCGTs until the early 2030s while the shorter duration energy storage with solar PV should become cheaper during 2023.

In an October report, Energy Storage Canada said the country needs a total of between 8GW and 13GW of energy storage by 2035 to be on track to meet its net zero goals. As of late last year, the country had less than a gigawatt, Justin Rangooni, executive director of the national trade association, blogged for this site after the report’s publication.

Ontario’s government has taken the proactive step of setting a target of up to 2,500MW energy storage procurements, after a recommendation from the province’s Independent Electricity System Operator (IESO) that grid-scale storage should play a key role in helping meet a projected shortfall in electricity supply as demand grows. However, that target sits alongside a 1,500MW natural gas procurement target.

At a national level, the government of Canada has said it intends to introduce a tax credit incentive programme for clean energy technologies, including solar PV, battery storage and hydrogen, partly in response to the US’ Inflation Reduction Act (IRA).

The IRA extended existing clean energy tax incentives and introduced others, most relevantly an investment tax credit (ITC) for standalone energy storage, which will cut the capital cost of investment in energy storage equipment for eligible projects by more than 30%.

To access Clean Energy Canada’s full report, technical report, workbook and more, go here.