In the past few months Spain has announced a 2.5GW energy storage target by 2030 and Portugal is hosting a solar tender with a significant add-on option for storage, but tentative regulatory and market design steps will have to be taken to create viable long-term opportunities in each country.

That’s the summarised view of consultancy and market analysis firm Clean Horizon’s experts, who spoke with Energy-Storage.news on the role batteries and other storage can play in the Iberian Peninsula’s energy transition in the present and future.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Clean Horizon energy storage analyst Tanguy Poirot and head of market analysis Corentin Baschet share their views on what each country’s moves represent and what more is still needed. We’ll be taking a bit of a deeper dive in the coming days in our news coverage, but for today’s blog, here’s a more general overview.

Portugal: Safeguarded auction offers 15-year visibility on revenues

Portugal’s 700MW solar PV capacity auction was delayed from Spring this year, not due to any problems with the auction itself, but rather predictably the COVID-19 pandemic meant that, as energy state secretary João Galamba told our sister site PV Tech, it made more sense to “pause for the general situation to calm down”.

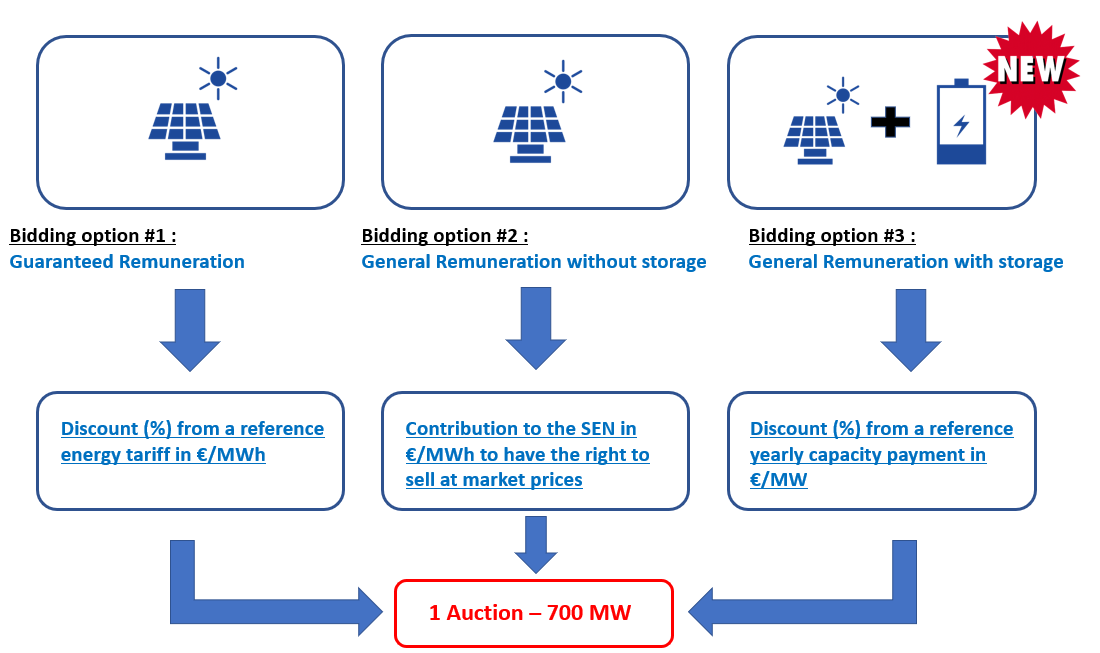

Finally then kicking off in early June with applications being accepted until the end of July, the auction includes three options, as represented in the diagram below courtesy of Clean Horizon. Solar-plus-storage systems can participate, but will be remunerated on a fixed payment basis and will therefore not be able to take advantage of volatility and price spikes when stress events happen.

As Tanguy Poirot explains, it’s about allowing solar-plus-storage plants to participate in a competitive way with standalone solar.

“[The] remuneration scheme is about paying a kind of capacity payment for the solar-plus-storage plants. So every installed megawatt gets a fixed payment, on a yearly basis, in exchange for basically protecting the national Portuguese system against price spikes.

“So in case of stress events, when the price on the wholesale market reaches a certain threshold – called the strike price – the solar-plus-storage plant has to pay back the difference between this strike price and the actual wholesale market price which is above.”

The idea is to protect the system against stress events and market prices which are too high, but this does make the competitiveness of energy storage in the auction against standalone solar a complicated prospect, Poirot says.

Reference payment prices given for the auction are around €33,000 (US$37,430) per MW per year, including both solar and storage components. As Poirot’s colleague Corentin Baschet points out, this is about 1.5x the level of payments in the UK Capacity Market, and it is generally considered that revenues need to be about 6x higher than that “to make a battery storage business work”.

Tanguy Poirot says that developers will need to be able to stack revenues from multiple streams in order to make their business case add up, especially from the ancillary services market and revenues from any other available sources to be competitive, because that payment alone is “not likely to be super-interesting”.

Nonetheless, Clean Horizon has seen “a lot of developers who are interested,” and it should be possible to attain revenues in other markets, notably in secondary reserve rather than primary reserve. What’s also interesting about the auction’s capacity payment mechanism is that it offers 15-year contracts, which “at least… gives some visibility for developers on future revenues,” Tanguy Poirot says.

Spain: Impressive 2.5GW target, path to get there is not yet clear

“Spain has announced really interesting targets at least, in the National Energy and Climate Plan: which is basically a document that every country in Europe has published in order to meet the strategy towards a decarbonised power system,” Tanguy Poirot says.

“Spain is the only country in Europe so far which has announced a defined target for storage excluding pumped hydro, so only batteries and hydrogen, or thermal storage and Spain has announced a target of 2.5GW of storage which must be deployed by 2030.”

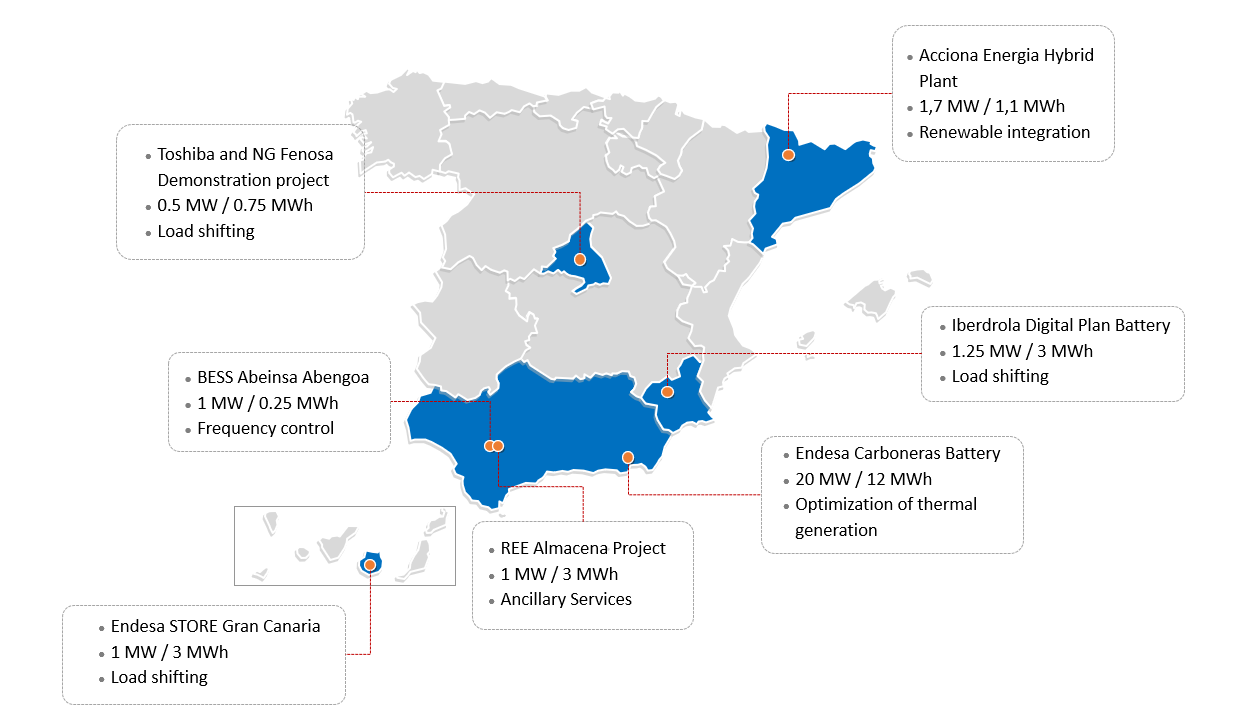

While this “pretty huge” target is impressive, it’s also “pretty much impossible” to get there with current market conditions, because the design of the electricity market today is not attractive enough to invite masses of storage, either large-scale or distributed. The map below of existing battery energy storage systems in Spain – again courtesy of Clean Horizon – demonstrates just how early stage the market is.

That said, this was also the case until very recently in solar PV, where despite its obvious potential Spain lagged behind much of Europe. Having caught up, the solar market in Spain is racing forwards. The government has recognised this gap in the energy storage space between what’s there and what it’s hoping for and recently opened up a consultation process, to which Clean Horizon made a submission loaded with recommendations.

Based partly on what’s worked well in other countries that have deployed storage such as the UK, the main recommendation, Corentin Baschet says, is to “keep the organisation of existing transmission system operator (TSO) markets, but open them to storage”. This can take “quite a lot of time,” so the country should move forwards as soon as possible to allow the targets to be reached, the analyst says.

“In the UK, the Balancing Mechanism has been in discussion for storage since the enhanced frequency response (EFR) tender [in 2016], or around 2017, when we understood there wouldn’t be any more EFR tenders. It only opened up really fairly for it to be accessible to storage recently, so that it’s not a nightmare for storage to be able to play in it”.

“So it takes some time and we recommend opening these services to storage so that storage can participate – just create a level playing field. That’s true for ancillary services, plus the Capacity Market, which is a good way to decarbonise,” Baschet says.

As with Portugal, the secondary reserve market has attractive revenues open but the the participation rules are “not really favourable to storage,” Tanguy Poirot adds, but a project currently underway across Europe’s transmission network providers, called the Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation (PICASSO), looks set to open that up in the coming years.

We’ll look in a bit more detail at the reserve markets of each of Portugal and Spain when we next revisit this in our news coverage, as well as the potential prospect of commercial power purchase agreements (PPAs) for solar-plus-storage of the type increasingly seen in the US and more specific details on Clean Horizon’s response to the Spanish government consultation.

While the 2.5GW target seems ambitious if not impossible to reach with today’s market design, the Clean Horizon experts say that they do “witness a will from the Spanish government to promote storage” and to reach the target, and expect the country to implement regulatory changes in the coming years.

As Baschet says, Clean Horizon would never recommend subsidies or other mechanisms to support storage for the sake of supporting storage, the technology’s deployment has to answer both a need and an opportunity from the market, but, taking the example of secondary reserve markets, even with “quite minor regulatory changes,” market-based opportunities can make Spain – and Portugal – much more attractive for energy storage developers.

Cover Image: What is thought to have been Spain’s first distribution grid connected energy storage plant, a 3MWh system which enables up to five hours of backup to local networks, only went online in late 2019 through i-DE, the electricity distribution arm of Spanish utility company Iberdrola in Murcia. Image: Iberdrola.