One of the world’s leading suppliers of solar PV trackers is targeting sales volumes of approximately 15MW per week of the new battery solution it has paired with its products.

NEXTracker, which according to GTM Research held 30% of the global PV tracker market as of April this year and was sold to Flextronics for US$330 million in 2015, recently launched its partnership with Avalon Battery, a flow battery maker from Oakland, California.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

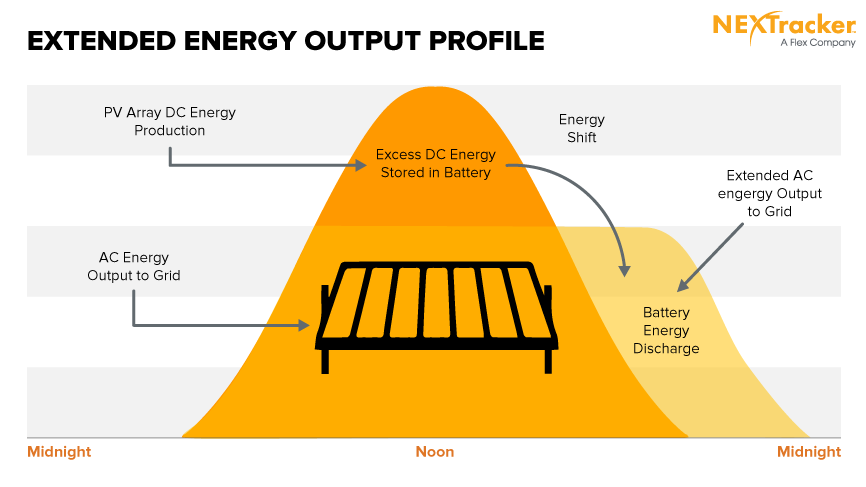

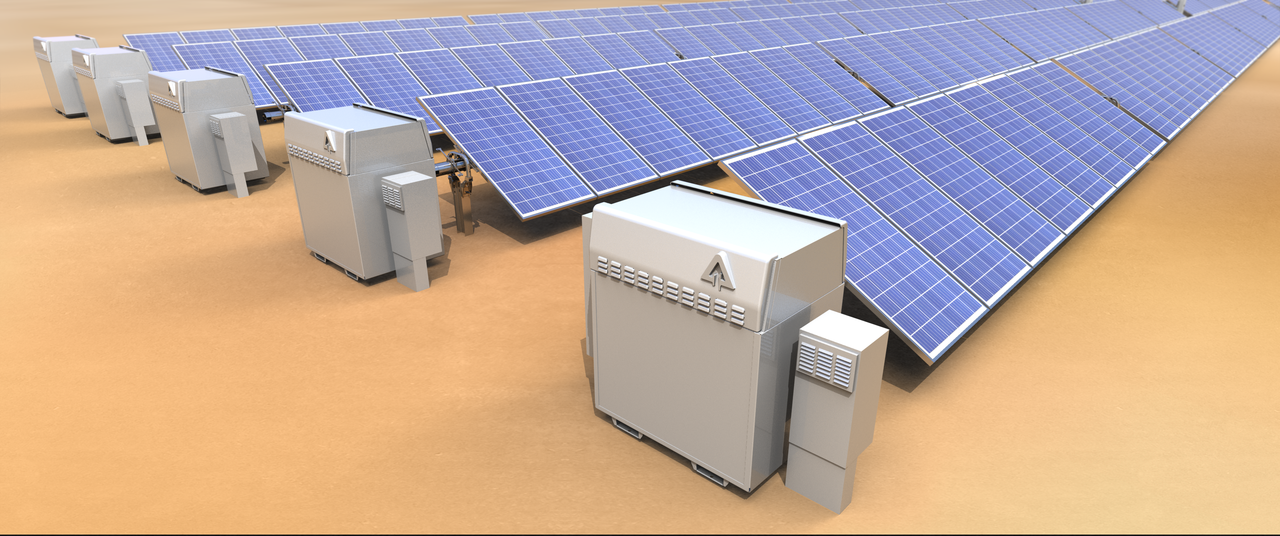

The solution, NX Fusion and NX Fusion Plus, comes pre-wired and pre-assembled, designed to serve as its “own independent renewable energy power plant,” according to the company. The bundles include the NX Horizon tracker, capable of rotating PV modules up to 120 degrees, DC wiring, string inverters, PV modules, UPS, piers and tracker monitoring and control system.

While many other companies are focusing on lithium-ion batteries, NEXTracker was persuaded to go with Avalon Battery’s flow technology after Avalon responded strongly to a novel request for proposal from the tracker specialist. NEXtracker director of sales for the storage solution, Ralph Fallant, told Energy-Storage.News at Intersolar Europe that it was a good fit overall.

“Our CTO Alex Au and one of our consultants, Josh Wiener, they produced an RFP called “decapitate the duck”. They were looking specifically for the best battery technology to be deployed with our type of product, to deal with the duck curve [the lack of overlap between peak solar production and peak energy consumption famously experienced in California],” Fallant said.

“They released a load profile that had two small discharges and one very deep discharge and that was the model people were supposed to compete against.”

As well as being the best entrant in that impromptu competition, the Avalon battery met other criteria that NEXtracker sought.

“What we found was a form factor that fits very well with our product. Our typical row is about 30kW, this is a 25kWh battery and it’ll be paired with a three-port Ideal Power inverter,” Fallant said.

DC-coupling of the solar array makes the system up to 15% more efficient on round-trips before discharge than AC-coupled systems, also allowing more of the traditionally ‘clipped’ energy to be used.

‘Competitive advantage over lithium’

The decision to pick a flow battery over lithium-ion was also due to the longevity of the product. Fallant said that especially when paired directly with PV, NEXTracker had desired a battery system that could last about as long as the PV system in the field – somewhere between 20 and 30 years, as opposed to the expected lifetime of roughly 10 years for many lithium-ion stationary storage systems.

“You can work this battery very hard, it’s especially good for rate arbitrage because you can really load it up all the way and once the PV system tails off during that evening peak time, then you can let all the energy go. You can also do multiple cycles. Typical lithium batteries are looking for about a 70% depth of discharge, any more than that and their lifespan decreases markedly, so we believe we have a competitive advantage over lithium in that fashion. We are seeing LCOE as low as under three cents in California for our solution.”

Fallant claimed that according to his financial modelling, even accounting for lithium-ion prices to fall 50% at each replacement cycle, the NEXTracker offering works out cheaper.

“When you look at the entire cost stack, everything from capacity and maintenance agreements, O&M, installation, based on our forecasts for 2018 prices, the actual lithium cells could be free – and our product’s still cheaper.”

While grid services and other supplementary revenue streams could in future become more lucrative, for now the tracker company’s solution is aimed at what Fallant called the “low-hanging fruit”: demand reduction, rate arbitrage and off-grid applications. There are already projects lined up to use NX Fusion and NX Fusion Plus, but due to non-disclosure agreements, Fallant was not able to give further details.

He emphasised however that the company felt there already exists a “huge market” for those low-hanging fruit applications.

“Based on the amount of tracker we’re selling – we’re shipping 150MW a week right now – I’m looking to, within a year, be shipping our battery with at least 5% to 10% of that if not more,” Fallant said.

“That’s a conservative number.”